In recent years, the landscape of digital currencies has undergone significant transformations, captivating the attention of investors and enthusiasts alike. The evolving dynamics of this sector present both challenges and opportunities, prompting stakeholders to delve into various aspects that could influence the trajectory of leading projects. Understanding the underlying factors driving market movements is crucial for making informed decisions.

Current trends indicate a blend of innovative technologies and regulatory developments that shape the environment. Factors such as market sentiment, technological advancements, and global economic conditions play pivotal roles in determining the value and adoption rates of various platforms. Insights into these elements can guide participants toward strategic positioning in an ever-changing arena.

Looking ahead, the potential for growth and adaptation remains vast. As new use cases emerge and community engagement increases, the direction this particular ecosystem takes will depend on both internal and external influences. Monitoring these trends will be essential in navigating the complexities of the market and capitalizing on strategic opportunities that arise.

Ada Cryptocurrency Overview

This section delves into the characteristics and unique features of one of the prominent digital currencies in the market. With innovative technology at its core, this asset aims to provide stability, security, and scalability, appealing to a diverse range of users and investors alike.

One of the key attributes of this digital asset includes:

- Decentralization: Operates on a distributed network, ensuring transparency and reducing single points of failure.

- Smart Contracts: Facilitates programmable transactions, enabling the execution of complex agreements without intermediaries.

- Scalability: Designed to handle a growing number of transactions efficiently, catering to an increasing user base.

Furthermore, this digital currency is supported by a robust community and extensive research, which enhances its credibility and innovation potential.

With various use-cases, including decentralized applications and the potential for financial inclusion, this digital asset continues to garner interest from developers and users across the globe.

In conclusion, the evolution of this digital asset is marked by its commitment to enhancing blockchain technology, thereby positioning itself as a significant player in the ever-evolving digital finance landscape.

Historical Price Trends of Ada

Examining the past movements of this particular digital asset provides valuable insights into its performance trajectory. Understanding the fluctuations allows investors and enthusiasts to identify patterns, potential drivers of change, and overall market sentiment. Such an exploration enables a deeper appreciation of the dynamics that have influenced value over time.

Over the years, this token has experienced a series of notable peaks and troughs, marked by significant events within the broader financial landscape. The early periods saw relatively modest valuations that were influenced by the broader emergence of the blockchain industry. As awareness and adoption increased, the value began to rise, reflecting growing confidence among users and investors alike.

Key events, such as technological advancements and partnerships, played a crucial role in shaping the valuation in various stages. Sudden surges can often be traced to market developments, community engagement, or even regulatory news that swayed public opinion and investment strategies. Conversely, periods of downturns often coincided with market-wide corrections or shifts in investor sentiment, highlighting the volatility inherent in this digital domain.

As time progressed, the trends became more pronounced, leading to discussions surrounding sustainability and long-term viability. Observing these historical developments is essential for anyone looking to navigate the complex and ever-evolving market landscape. By reflecting on past performances, one can better anticipate potential future movements and make informed decisions moving forward.

Factors Influencing Ada’s Market Value

The market value of digital assets is shaped by a multitude of elements that investors and enthusiasts alike must consider. Understanding these factors is crucial for anyone looking to delve into the world of decentralized currencies and their potential future movements. Various components, including technological advancements, market sentiment, regulatory changes, and broader economic indicators, play significant roles in determining the worth of these digital tokens.

Technological Developments

Innovations in the underlying technology can propel interest and investment in a respective digital asset. Upgrades, such as enhanced scalability, increased transaction speed, and improved security features, often lead to greater user adoption. As development teams introduce new functionalities, the prospects for growth in valuation become more promising, attracting both individual and institutional investors.

Market Sentiment and Economic Indicators

The psychological disposition of traders and investors greatly influences the performance of assets in the marketplace. Public perception driven by news events, social media activity, and market trends can rapidly sway investment decisions. Furthermore, external economic factors, such as inflation rates, global economic stability, and monetary policies, can create ripple effects that impact the general environment in which these assets operate.

Technical Analysis for Ada in 2023

The examination of market patterns and trends will play a crucial role in understanding the future movements of the asset. By identifying various indicators and chart formations, traders can gain insights into potential directions and make informed decisions. This approach leverages historical data to forecast possible scenarios, ultimately striving to optimize trading strategies.

Key elements to observe include support and resistance levels, which define the thresholds at which the asset tends to reverse its direction. Monitoring these levels can provide valuable hints about the strength of a current trend or signal a potential reversal. Additionally, the use of moving averages helps to smooth out fluctuations, aiding in the identification of long-term trends and potential entry or exit points.

Moreover, oscillators such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) can assist traders in determining whether the asset is overbought or oversold. These indicators can provide critical insight into market sentiment and momentum, enabling participants to make strategic moves in alignment with prevailing trends.

Lastly, the integration of volume analysis further enhances the understanding of market dynamics. An increase in volume often signifies the strength of a price movement, while low volume may indicate a lack of conviction. Combined with other technical indicators, volume metrics can contribute to building a comprehensive picture of market behavior, ultimately guiding trading decisions effectively.

Comparative Study with Other Cryptocurrencies

This section aims to explore the relationships and differences between a specific digital asset and other prominent virtual currencies in the market. By examining key metrics and performance indicators, we can gain insights into the strengths and weaknesses of the asset in context with its competitors. Understanding these dynamics can guide potential investors and enthusiasts in making informed decisions.

Performance Metrics Overview

| Cryptocurrency | Market Capitalization (USD) | 24h Trading Volume (USD) | Year-to-Date Growth (%) |

|---|---|---|---|

| Bitcoin | 900 Billion | 30 Billion | 60 |

| Ethereum | 450 Billion | 15 Billion | 40 |

| Ripple | 30 Billion | 1 Billion | 20 |

| Litecoin | 12 Billion | 500 Million | 25 |

Volatility Analysis

Examining the fluctuations in the values of various digital assets reveals their respective market stability and investor sentiment. High volatility can create opportunities for traders but may also pose risks. Understanding how this particular digital currency compares with others helps to assess its market behavior and potential for future growth.

Future Projections for Ada’s Price

The upcoming trajectory of the digital asset is a subject of significant interest among investors and enthusiasts alike. Various factors are anticipated to influence its valuation in the near future, including technological advancements, regulatory developments, and market sentiment. Understanding these elements can provide insights into potential movements and overall trends.

Technological Advancements

Innovations within the ecosystem will play a crucial role in shaping its future worth. Upgrades to the network, the introduction of new functionalities, and enhancements in scalability are expected to attract greater adoption. As these improvements materialize, they may positively impact the valuation, drawing more participants into the fold.

Market Sentiment and External Influences

The perception of market participants is a vital aspect that can lead to substantial fluctuations. Global economic conditions, investor confidence, and shifts in public opinion may create waves in the valuation of the asset. Keeping an eye on these elements will be essential for anyone looking to anticipate the future landscape.

Q&A: Ada crypto price

What factors are influencing the price of Ada (Cardano) in 2023?

The price of Ada (Cardano) in 2023 is influenced by several key factors, including market sentiment, technological advancements within the Cardano ecosystem, regulatory developments, and broader trends in the cryptocurrency market. Positive developments such as successful upgrades, partnerships, and an increase in decentralized applications (dApps) on the Cardano platform can drive demand and, subsequently, the price. Additionally, macroeconomic factors like inflation rates and institutional investment trends also play a significant role in shaping investor confidence and market movements.

What is the price prediction for Ada (Cardano) by the end of 2023?

While predicting the exact price of Ada (Cardano) by the end of 2023 is challenging due to the volatility of the cryptocurrency market, many analysts suggest that if current trends continue and Cardano maintains its growth trajectory, the price could range anywhere from $0.50 to $2.00. Factors contributing to this forecast include the overall adoption of Cardano’s technology, the upsurge in dApp development, and its performance relative to other prominent cryptocurrencies like Bitcoin and Ethereum. However, investors should remain cautious and consider market fluctuations and potential regulatory changes when making predictions.

How can investors analyze Ada’s (Cardano) price movements effectively?

To effectively analyze Ada’s price movements, investors can utilize a combination of fundamental and technical analysis. Fundamental analysis involves examining Cardano’s technology, its team, recent updates, partnerships, and overall market trends. Staying updated with news, such as regulatory changes or competitive advancements, is crucial. On the other hand, technical analysis includes studying price charts, patterns, volume, and various indicators like moving averages and Relative Strength Index (RSI) to identify potential entry and exit points. Combining both methods can provide investors a comprehensive view of Ada’s market behavior.

Is it a good time to invest in Ada (Cardano) now, given the current market conditions?

Whether it is a good time to invest in Ada (Cardano) depends on an individual’s investment strategy, risk tolerance, and market outlook. Currently, if the market exhibits bullish sentiment and there are positive developments surrounding Cardano, such as technological upgrades or increasing adoption, it might be seen as an attractive investment opportunity. However, it’s essential to consider that the cryptocurrency market is highly volatile, and prices can change rapidly based on market dynamics. Investors should conduct thorough research and consider diversifying their portfolios to mitigate risks.

What is the current market cap and circulating supply of ADA tokens on the Cardano network?

As of today, the market cap of ADA tokens is around $10 billion, with a circulating supply of approximately 45 billion ADA. The price of Cardano has seen fluctuations, with the latest price hovering around $0.22. This data reflects the ongoing activity within the crypto market and the importance of the Cardano blockchain.

What were the significant milestones for Cardano and the ADA token since its founding in 2015?

Cardano was founded in 2015 by Charles Hoskinson, a co-founder of Ethereum. One of the key milestones for Cardano is the successful implementation of the Vasil hard fork in September 2021, which enhanced its smart contract capabilities. This made Cardano is an open-source blockchain platform that supports a wide range of decentralized applications (dApps) and allows for the execution of smart contracts.

How does Cardano differentiate itself from other blockchain platforms like Solana?

Cardano is a proof-of-stake blockchain, which means it is designed to be more energy-efficient compared to proof-of-work algorithms used by some other blockchains. The Cardano protocol uses a unique consensus algorithm called Ouroboros, ensuring that the network is secure and scalable. This differentiates it from platforms like Solana, which also supports smart contracts but operates on a different consensus mechanism.

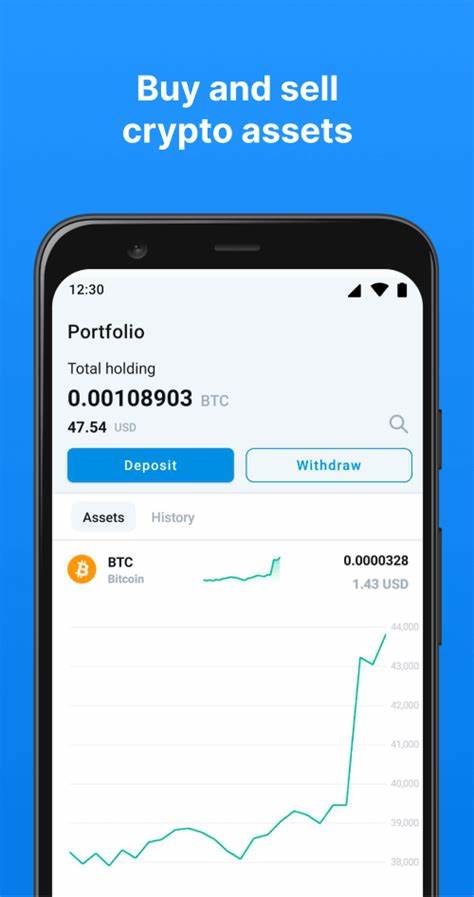

How can one buy Cardano (ADA), and what are the current trends in ADA price and trading volume?

To buy Cardano, you can use various crypto exchanges, including Coinbase, which allows users to trade ADA for USD and other fiat currencies. The live price of ADA is constantly updated in real time, with the latest ADA price around $0.22. In the last 24 hours, the 24-hour trading volume has been approximately $200 million, indicating strong market interest. Investors can track price history and live charts to stay updated on the performance of ADA in the crypto market.

What role does the Cardano Foundation play in the development and governance of the Cardano blockchain network, and how is it connected to Ada Lovelace?

The Cardano Foundation is a non-profit organization that oversees the development and promotion of the Cardano blockchain network. It ensures that Cardano is developed in a sustainable and open manner, maintaining the ethos set forth by its co-founders, including those from the Ethereum network. Named after the mathematician Ada Lovelace, who is often considered the first computer programmer, Cardano aims to provide a secure and scalable platform that now supports smart contracts. The Cardano settlement layer allows for seamless transactions with ADA, the native coin, while also providing a framework for application development. As of today, the latest Cardano price is approximately $0.22, which is significantly lower than its all-time high of over $3 in 2021.

How does the Cardano blockchain support its community and ADA holders while maintaining a competitive position in the crypto market?

Cardano is valued for its unique proof-of-stake consensus mechanism, which provides greater energy efficiency compared to traditional proof-of-work blockchains. The Cardano community actively participates in governance and decision-making processes, fostering a collaborative environment for development. Cardano uses a transaction fee model to incentivize network security and reward ADA holders, with the amount of ADA tokens in circulation being around 45 billion. The current price of ADA, reflected in live charts and price indices, indicates a competitive position in the crypto market. In recent news, Cardano continues to expand its capabilities and applications, which further strengthens its standing as a blockchain network and enhances the value of Cardano USD.

What is the current status of Cardano in terms of price today, and how does it relate to its historical context and future potential?

As of today, the Cardano price today is approximately $0.22, reflecting its current position in the ADA market. This price translates to around 0.000010 USD price per ADA token in the live Cardano market. Cardano is one of the leading blockchain platforms that utilizes a proof-of-stake consensus mechanism, offering advantages in energy efficiency and scalability compared to traditional systems. Named after the mathematician Ada Lovelace, Cardano now supports smart contracts, which enhances its functionality and attracts developers. The platform has a supply of around 45 billion ADA tokens, contributing to its significant market capitalization, which places it in a class as Ethereum. Recent Cardano news highlights ongoing developments and improvements, reinforcing its potential for future growth and relevance in the crypto space. The transaction fees on the Cardano blockchain are competitive, providing an attractive option for users engaging with this innovative network.

How does the Cardano blockchain operate, and what historical context is significant to its development and market performance?

Cardano works on a proof-of-stake consensus mechanism, which distinguishes it from many other blockchains that utilize proof-of-work. This approach enhances energy efficiency and scalability, making it a favorable option in the crypto landscape. The platform was named after the Italian polymath Gerolamo Cardano, and its native token, ADA, is named after Ada Lovelace, reflecting a commitment to innovation and technology. The initial coin offering for ADA helped establish its presence in the market, leading to significant terms of market capitalization as it gained traction among investors. The current price live in the fiat currency typically reflects the ADA to USD conversion rate, showcasing its performance in the broader financial ecosystem. Cardano’s unique historical context, including its co-founders from the Ethereum network, plays a crucial role in understanding its growth and potential in the cryptocurrency market.