With the surge of interest in digital currency such as Bitcoin, Ethereum and others, many individuals are seeking to invest in these burgeoning assets. However, potential investors might face some restrictions, one of the most fundamental of which is the age prerequisite for buying these digital currencies. Therefore, this article proposes to examine the age criteria related to purchasing cryptocurrencies worldwide.

Cryptocurrencies have heartily challenged traditional financial systems, promising potential investment returns that greatly surpass conventional methods. However, as a comparatively novel field, it is governed by a set of rules and regulations that many may find overwhelming or confusing, especially for younger aspiring investors. Among these rules, the age restriction seems to play quite a prevalent role.

We will specifically pay attention to the legalities and regulations that revolve around the minimum age for buying cryptocurrencies. In some cases, the rules concerning cryptocurrency investments can be more strict than conventional investment vehicles, adding an extra layer of complexity to the subject. Despite the intricate legal framework surrounding cryptocurrencies, understanding these requirements is crucial for potential investors.

A Closer Look at Age Requirements for Buying Digital Currencies

As digital currencies continue to ascend in popularity, the need for understanding the legalities associated with their purchase, such as the required age, becomes more critical. The age restriction varies across different jurisdictions and platforms, offering these currencies. Factors like geographical location, the type of digital currency, and the specific platform guidelines can influence this.

It’s also essential to consider that these age-related policies are in place to advocate for safe and responsible decentralised currency dealings. They exist to protect young individuals from potential financial perils associated with these highly volatile digital assets.

Dissecting the Age Restrictions in Various Jurisdiction

In most jurisdictions, the minimum age for buying digital currencies is typically pegged at 18 years, mirroring the general age of contractual capacity. This age is considered an international norm, although there are variations. For instance, in countries like South Korea, the minimum age is 19 years. In contrast, Japan currently does not have a clearly defined age limit.

By and large, these age thresholds are based on a variety of factors including local laws and market dynamics. Hence, it is critical for potential buyers to familiarize themselves with the specific rules regulating digital currency transactions in their respective jurisdictions.

Beyond the age, legalities also impose restrictions based on other factors. These may include investment caps, compulsory ID verifications, and necessary digital wallets with robust security measures.

- In the United States, for instance, buyers need to be at least 18 years old and most platforms require consumers to undergo an ID verification process.

- In the European Union, different platforms have different age restrictions. Generally, individuals need to be older than 18 years, but some platforms permit younger individuals given parental consent.

Understanding the age limit to buy digital currencies goes beyond knowing the right age. It involves knowing what the digital currency market entails, what the specific laws in your jurisdiction are, and what protections are available for purchasers. This knowledge puts you in a stronger position, enabling informed and confident participation in the digital currency market.

Understanding Cryptocurrency and its Operations

Cryptocurrency, a type of digital or virtual currency, is becoming increasingly popular globally. Unlike traditional currencies, cryptocurrency doesn’t have a physical form and is not controlled by a central bank or government. Instead, it relies on encryption techniques to regulate the creation of new units and verify the transfer of assets.

One of the main advantages of cryptocurrency is its potential for anonymity. Because transactions are recorded on a public ledger called a blockchain, they are trackable but not necessarily connected to real-world identities. In fact, users can have one or multiple cryptocurrency wallets without divulging their true identities.

An Overview of How Cryptocurrency Functions

The working of a cryptocurrency groundwork is quite complicated yet genius. It is primarily based on the technology known as the blockchain. The blockchain is essentially a distributed public ledger where each and every transaction made with the use of a particular cryptocurrency is recorded.

Validating transactions, or “mining,” as it is often called, is a crucial aspect of the cryptocurrency infrastructure. Mining involves solving complex mathematical problems to add new transactions to the blockchain. Miners are usually rewarded with a certain amount of the cryptocurrency they are mining.

- Decentralization: Cryptocurrencies operate on a decentralized network of computers. This means there’s no central authority, such as a government or financial institution, controlling the currency or transactions. Rather, everyone who participates in mining (validating transactions), helps to maintain and update the blockchain.

- Security: The cryptographic nature of cryptocurrency transactions makes them secure and safe from fraud or tampering. Moreover, the decentralization feature reduces the risk of a single point of failure that could compromise the entire system.

In conclusion, the essence of cryptocurrencies is innovation and disruption, redefining the way we understand and interact with money. However, it’s also important to be aware of the potential risks associated with investing in cryptocurrencies, such as price volatility and regulatory uncertainty.

Understanding the Age Limitations on Crypto Transactions Around the Globe

When it comes to transactions in the digital currency market, age plays a significant role. Rules and regulations vary from one country to another, with some jurisdictions placing a minimum age requirement on crypto purchases. It’s important for anyone considering investing in this growing digital economy to know these restrictions in their resident countries.

While cryptocurrencies offer an unparalleled level of decentralization and freedom, their purchases are still subject to rules and regulations in many nations. Some governments see these digital currencies as a risk to financial stability and thus impose age constraints to prevent the unsupervised involvement of minors.

The General Stand on Minimum Age for Crypto Acquisition

For most countries, the age of majority is usually the starting point for anyone intending to buy cryptocurrencies. This age limit, generally 18 years, often corresponds with the legal age of entering into contracts. It is, however, important to note that this age limit is not universal. Some countries could have a higher limit depending on their respective laws on financial transactions.

- In the United States, as in most places, the law stipulates that you must be at least 18 to execute binding contracts. Consequently, cryptocurrency exchanges tend to apply the same age limit for account holders.

- In Japan, the country famous for its advanced stance on cryptocurrencies, adjusted its laws in 2020, lowering the age of adulthood from 20 to 18, hence legalizing crypto purchases for 18-year-olds.

- In South Korea, one of the hottest spots for cryptocurrency trade, the situation is a little different. Under Korean law, you have to be 19 years old to make independent financial decisions, including cryptocurrency purchases.

The above examples are a snapshot of the global landscape regarding age requirements for cryptocurrency purchases. Please consult the local laws in your respective jurisdiction for the most relevant and accurate information.

Understanding the Legal Purchasing Age for Digital Currencies in the United States

The laws in the United States concerning the buying and selling of cryptocurrencies are continually evolving. Despite this, no specific age limit has been universally determined for purchasing such assets. The age restriction often depends on various factors such as the platform being used, the state laws, and the type of cryptocurrency.

In general, it is typically assumed that an individual must be 18 years old to conduct significant financial transactions. This is seen as the age of majority–an individual’s transition into adulthood, making them legally capable of managing their own actions and decisions, including those related to finance.

Role of Crypto Exchanges in Buying and Selling Cryptocurrency

The critical role in determining the eligibility of an individual to buy cryptocurrency in the United States is often played by cryptocurrency exchanges. This is because these platforms have the right to set their own user policies, which can include age restrictions. Most reputable platforms impose an age limit of 18 years. Some exchanges do allow younger users to open an account with parental permission, but this the exception rather than the rule.

It’s essential for potential users, regardless of age, to know that possession of cryptocurrency also carries responsibilities. This includes being able to understand and manage the potential risks, the privacy issues, and the tax implications.

- Age restrictions can vary from one state to another

- Even within a single state, different exchanges could have different age restrictions

- Severe consequences can occur from illegal activities related to cryptocurrencies, including legal repercussions and financial losses

The age of cryptocurrency holders is a factor that various regulatory bodies in the United States take into account when developing policies. As with other financial transactions, the aim is to protect young and inexperienced investors from potential risks and scams. Therefore, while age is not the sole determiner in assessing an individual’s capacity to buy and handle cryptocurrencies, it does play a significant role in the United States.

Meet the Age Prerequisite for Cryptocurrency Acquisition in Europe

In Europe, the market for virtual currencies like Bitcoin, Ethereum, and others is developing rapidly. The trend for buying and trading cryptocurrencies is skyrocketing, not only among seasoned investors but also among the younger population. Thus, understanding the age prerequisite for entering this digital world of currencies becomes crucial.

The concern of how old a person should be to venture into the world of virtual currencies often arises. In Europe, the answer relies significantly on the policies set by different exchanges and platforms that facilitate the buying and selling of these digital currencies.

Standard Age Bars in Europe

Typically, the lower age limit implemented by most cryptocurrency exchanges across Europe is 18 years. This is primarily because 18 is the age of legal majority in most European countries, marking the transition to full legal status as an adult capable of making financial and other significant decisions independently. However, there are certain exchanges which may allow transactions for users aged below 18, but these instances are significantly less common.

Country-Specific Regulations

It is paramount to mention that despite a general age limit, the eligibility to buy cryptocurrency also depends on specific national regulations. For instance, countries like France have proposed a law to lower the age restriction to as low as 16 for certain financial activities, whereas in some countries, the age of majority is set higher than 18.

Policies Per Exchange

Another crucial element to keep in mind is the rules established by individual exchanges. Each trading platform lays down its criteria for users, including age limits, account verification process, and the amount of cryptocurrency that can be bought or traded in one transaction. Some platforms may require users to undergo an extensive verification process and adhere to stringent rules. It is advisable to thoroughly review an exchange’s terms and conditions before proceeding with any transaction.

- Follow the Law: It is of utmost importance to abide by the legal age requirement in your area. Violating the rules can lead to serious repercussions.

- Know-Your-Customer (KYC): Always adhere to the KYC procedures. This will not just validate your age but also ensure the safety of your transactions.

- Choose a Reliable Platform: Ensure the authenticity of the chosen platform. It is safer to go with recognized and accountable exchanges.

In conclusion, while the ‘golden age’ to dive into cryptocurrency trading usually starts at 18 in Europe, it’s essential to explore the specific regulations laid down by your country as well as individual platforms. Interestingly, emerging demands might pave the way for more inclusive regulations, potentially lowering the age criteria.

An Overview of Registration Prerequisites for Digital Currency Trading Platforms

The world of digital currencies is an enigmatic yet exciting place where fortunes could be made or lost. Consequently, it is essential that anyone who wishes to venture into this world knows the registration requirements for trading platforms dealing with such currencies. In most jurisdictions, the process involves several compulsory procedures designed to ensure a safe and secure trading experience for all stakeholders.

While different trading platforms may have varying rules, most of them generally preserve a standard set of requirements. Such requirements are in place due to both ethical reasons and to ensure compliance with global standards set forth by financial and regulatory bodies. These criteria ensure that the platform remains transparent, secure, and promotes financial inclusivity.

A Detail Guide to Getting Started With Digital Asset Trading Platforms

Before you can start trading on most digital currency platforms, you will need to meet a certain age restriction. In most cases, this means you must be at least 18 years of age, but some platforms may set their minimum age requirement higher, depending on the jurisdiction and the type of financial services being offered.

- Identity Verification: The first stage of creating your trading profile involves providing a government-issued ID card to center against identity theft and fraud. This could be a driver’s license, passport, or any other legal document that can verify you are who you claim to be.

- Proof of Residence: You’ll likely need to provide also proof of your residence. This usually involves submitting utility bills or a bank statement that clearly shows your current residential address.

- Contact Information: Contact details like a functional email address and phone number are also equally important. These would be used for communication and account verification purposes.

After these steps have been successfully completed, the potential digital currency trader is usually required to agree to the platform’s terms and conditions to finalize the registration. Although these procedures might initially seem rigorous, they are critical towards ensuring a safe trading environment.

Every digital currency trading platform you interact with should protect your personal information and be transparent about its procedures. It’s an absolute necessity in maintaining the trust of its user base. Therefore, before investing in digital currencies through a specific platform, ensure you thoroughly understand their specific registration procedures and age requirements.

FAQ: Buy Cryptocurrency

What is the difference between a crypto wallet and a custodial account?

A crypto wallet allows users to store and manage their cryptocurrency securely, often providing control over private keys, while a custodial account is held by a third party, like an exchange, that holds the crypto assets on behalf of the user.

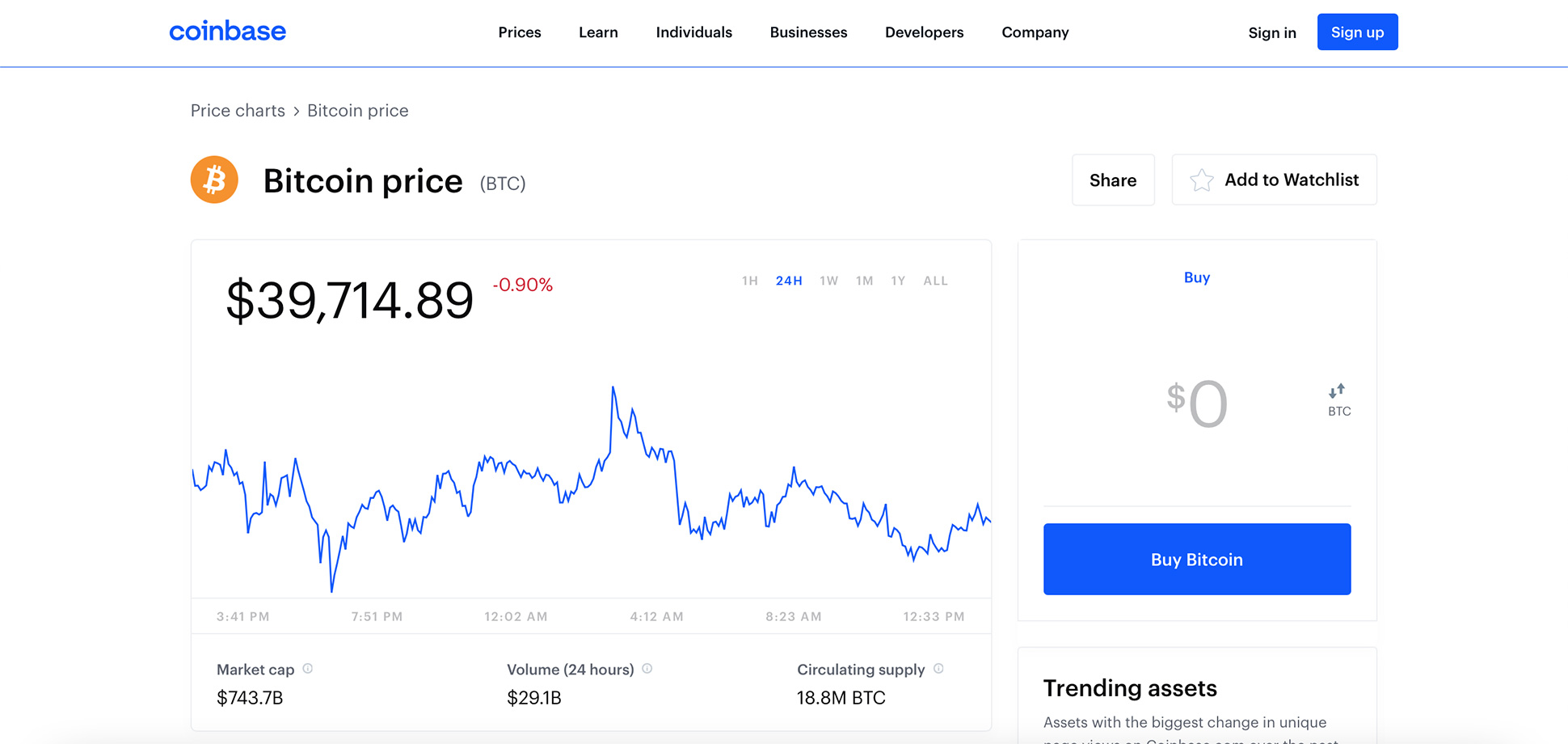

Is it possible to invest in cryptocurrency using a debit card on platforms like Coinbase?

Yes, platforms like Coinbase allow users to purchase cryptocurrency using a debit card, as well as other payment methods.

How does blockchain technology benefit the crypto world, especially when one wants to buy or sell bitcoin?

Blockchain technology ensures transparency, security, and immutability. When you want to buy or sell bitcoin, blockchain records these transactions in a way that they cannot be altered, ensuring trust in the system.

Can individuals under the age of 18 create an account on crypto platforms to trade bitcoin?

Most crypto platforms require users to be over the age of 18 to create an account. However, parents can buy cryptocurrency as a gift for their children or oversee an account created for them.

How does one decide whether to buy or sell in the crypto market, especially popular cryptocurrency like bitcoin and ethereum?

Making a decision to buy or sell in the crypto market involves analyzing market trends, understanding the fundamentals of the cryptocurrency, and often seeking investment advice. Although bitcoin and ethereum are popular, it’s essential to conduct thorough research or consult with financial experts.

Are there alternative ways for individuals under 18 to buy crypto under 18 since many crypto exchanges require users to be of age?

Yes, while individuals under 18 cannot buy crypto directly from most exchanges, they can receive cryptocurrency as a gift, use Bitcoin ATMs with cash (though availability might vary), or have a guardian purchase on their behalf.

What’s the difference between bitcoin and other cryptocurrencies in terms of crypto investing?

Bitcoin is the first cryptocurrency and remains the most well-known and valuable. Investing in bitcoin might be viewed as less risky compared to newer, less established cryptocurrencies. However, other cryptocurrencies may offer innovative features or benefits that Bitcoin does not.

If someone is interested in investing in cryptocurrency, is it better to buy stocks in crypto companies or to purchase crypto directly?

Both options have their merits. Buying stocks in crypto companies means investing in the company’s success, not directly in cryptocurrency. On the other hand, purchasing crypto directly allows one to benefit directly from its appreciation. Investment goals, risk tolerance, and market research should guide this decision.

How do bitcoin ATMs function in the crypto world, especially for those who want to buy BTC without a cryptocurrency account?

Bitcoin ATMs allow individuals to buy BTC using cash or a credit card or debit card. They essentially serve as a physical access point to the digital cryptocurrency market for those who might not have a cryptocurrency account or prefer a more tangible transaction method.

Although Bitcoin and Ethereum are popular crypto assets, what are some other options for those new to crypto investing?

There are many crypto assets available for investment, including Ripple (XRP), Litecoin (LTC), Cardano (ADA), and Polkadot (DOT). It’s crucial to research and understand each cryptocurrency’s fundamentals and potential before investing.

Why do people choose to invest in crypto instead of traditional assets?

Investing in crypto can offer high potential returns and a chance to diversify one’s portfolio. Moreover, cryptocurrency is a digital representation of value, which can provide unique advantages such as decentralized control and global access.

If I want to invest in Bitcoin or Ethereum, do I need a crypto account?

Yes, to invest in Bitcoin or Ethereum, one typically requires a crypto account on a reputable exchange or platform, allowing you to buy, store, and trade crypto.

Are there platforms that offer crypto for kids, or is it only reserved for adults?

While most platforms require users to reach the age of 18, some platforms or services cater specifically to younger audiences, allowing parents or guardians to oversee crypto for kids, helping them learn about digital assets.

I’ve heard a lot about Ethereum and Bitcoin. Which is the best crypto to start with for a beginner who wants to invest?

Both Bitcoin and Ethereum have their unique advantages. Bitcoin is often viewed as digital gold and a store of value, while Ethereum offers smart contract functionality. A beginner’s choice between Bitcoin or Ethereum should be based on their investment goals and risk tolerance.

Is it necessary to have a significant amount of money to start a crypto investment account?

No, it’s possible to buy small amounts of crypto, making it accessible for various budgets. Some platforms even allow purchases of fractional parts of popular cryptocurrencies like Bitcoin.

After I turn 18, how can I buy and sell Bitcoin using my own funds?

Once you turn 18, you can create a crypto account on a trusted exchange, link your bank account or card, and start trading crypto. Platforms often provide a user-friendly interface to buy and sell Bitcoin and other cryptocurrencies.

What is the primary advantage of using a bitcoin ATM over other ways to buy cryptocurrency?

A Bitcoin ATM offers a tangible, immediate method to purchase Bitcoin using cash or card, making it suitable for those who prefer face-to-face transactions or lack access to online banking.

Can I store cryptocurrency in my regular bank account?

No, cryptocurrency is a digital asset that requires a digital wallet or a crypto account on an exchange to store. Traditional bank accounts are not equipped to hold cryptocurrencies.

Is it safe to trade crypto without using a well-known exchange?

Trading crypto without a reputable exchange can be risky. It’s essential to use trustworthy platforms or services, as scams and fraudulent activities are prevalent in the crypto space.

Are there any benefits for long-term crypto investors when it comes to fluctuating market prices?

Long-term crypto investors often adopt a strategy called “HODLing,” where they hold onto their assets despite market fluctuations, believing in the future value and potential of their investment. This approach can mitigate short-term volatility and potentially yield significant returns over time.