In recent years, the digital asset landscape has attracted a diverse array of investors seeking lucrative opportunities. As volatility becomes a hallmark of this market, understanding how to manage risk and optimize returns has never been more crucial. This section delves into methodologies that offer insights into positioning resources effectively, especially in high-stakes environments.

Maximizing gains while minimizing potential losses is a recurring theme for market participants. The concept revolves around calculating the ideal fraction of one’s portfolio to allocate for each venture. By employing mathematical frameworks, traders can formulate a systematic way to approach their investment choices, aligning them with personal risk tolerance and market conditions.

Moreover, the rise of analytical tools has made it increasingly accessible for traders to incorporate sophisticated principles in their decision-making processes. As fear and greed often drive sentiment, having a predefined plan can significantly enhance discipline and overall effectiveness. This discourse seeks to illuminate foundational precepts behind such approaches, presenting them as valuable assets in any investor’s toolkit.

The Kelly Criterion Explained

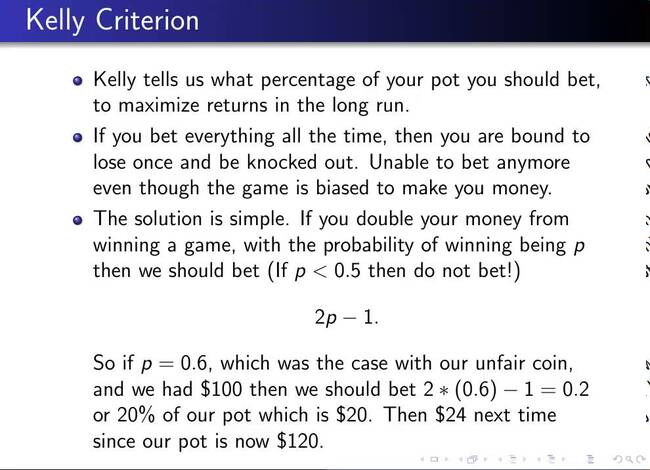

This principle serves as a mathematical approach for bankroll management, guiding traders in determining optimal stake sizes. By using this formula, individuals can maximize the potential for wealth growth while minimizing the risks associated with financial markets. It emphasizes the importance of finding a balance between risk and reward in various investment scenarios.

Core Concept

The fundamental idea behind this principle revolves around calculating the proportion of capital to invest in a given opportunity based on its probability of success and potential returns. This method encourages a disciplined approach to wagering, allowing individuals to forge a clear path toward long-term profitability.

Advantages and Considerations

Implementing this approach brings forth several advantages, including systematic risk management and improved decision-making processes. However, it is essential to consider the accuracy of probability assessments and the volatility inherent in the asset classes, as inaccuracies can lead to significant losses.

| Aspect | Description |

|---|---|

| Risk Management | Helps in determining the ideal amount to stake in each trade. |

| Probability Assessment | Requires accurate estimation of winning probabilities and payouts. |

| Long-Term Growth | Aims for sustainable growth of capital over time. |

| Market Volatility | Needs to account for the unpredictability in asset prices. |

Historical Context of the Kelly Formula

This section delves into the origins and evolution of a mathematical approach that has influenced various fields, including finance and gambling. Understanding its background reveals how this formula has become integral to modern risk management and investment practices.

Origins and Development

Initially developed in the 1950s, this method was presented by a prominent figure in the realm of information theory. It aimed to determine optimal bet sizes for maximizing wealth over time based on probabilities. Its roots lie in the merging of mathematical principles with practical decision-making.

- The formula was first introduced in a 1956 paper by John L. Kelly Jr., titled “A New Interpretation of Information Rate”.

- It was intended for applications in signal transmission but quickly found its way into gambling scenarios.

- The approach’s relevance grew as traders and investors noticed its implications in managing asset allocations.

Adoption in Financial Markets

Over the decades, this mathematical principle transitioned from theoretical frameworks into practical applications in various investment fields. Its adaptability and effectiveness in different scenarios led to broader acceptance among traders.

- In the 1970s, several financial scholars and practitioners began applying the method to stocks and other securities.

- By the 1990s, its popularity surged as hedge funds and quantitative traders embraced it.

- With the rise of digital assets, many now adapt this traditional formula to the fast-paced world of cryptocurrencies.

Through its journey, this mathematical piece has shown resilience and versatility, continually shaping how individuals assess risk and potential returns across various platforms.

Applying the Criterion in Cryptocurrency Markets

In recent years, a novel approach to risk management and position sizing has captivated enthusiasts within digital currency ecosystems. This methodology offers insights into optimal capital allocation, enhancing traders’ ability to make informed decisions amidst the volatility of virtual assets. The transformative potential of this approach lies in its focus on maximizing growth while mitigating risk, making it particularly relevant in today’s dynamic environment.

When adapting this mathematical model to cryptocurrencies, practitioners must first evaluate expected probabilities of winning and losing trades. This assessment enables them to determine an appropriate proportion of their capital to commit to each venture. Notably, given the unpredictable nature of digital markets, continuous reassessment of these probabilities is essential to ensure that the strategy remains effective over time.

Implementing this approach involves calculating optimal bet sizes based on various scenarios. Traders monitor market signals and price trends, allowing them to adjust their positions according to changing conditions. This responsive mechanism not only nurtures discipline but also encourages a systematic way to capitalize on opportunities while reducing exposure to substantial losses.

Moreover, while this method may seem straightforward, it requires a strong grasp of mathematical principles and market dynamics. By integrating rigorous analysis with emotional discipline, individuals can enhance their trading prowess in the ever-evolving landscape of digital currencies. In conclusion, adopting this framework can empower traders to navigate complexities, driving both confidence and consistency in their financial endeavors.

Benefits of Using the Kelly Criterion

Adopting a systematic approach to capital allocation can significantly enhance performance in financial markets. One technique that stands out is a mathematical formula designed to optimize wager sizes based on precise probabilities of winning and expected returns. This method not only promotes growth but also safeguards against substantial losses.

- Maximizing Growth: By calculating optimal investment proportions, traders can maximize their capital growth over time.

- Risk Management: This framework helps maintain a balanced approach to risk, minimizing the chances of devastating financial setbacks.

- Simplicity: With clear guidelines on how much capital to allocate, traders can make decisions with greater confidence and reduced emotional stress.

- Adapts to Changing Conditions: The formula adjusts based on changing probabilities and returns, allowing for dynamic investment strategies that can respond to market fluctuations.

Overall, this approach offers a balance between maximizing potential gains while protecting against undue risks, making it a compelling option for serious market participants.

Risk Management in Crypto Trading

Effective management of potential losses is crucial for long-term success in the volatile world of digital assets. Investors must establish a framework that not only safeguards capital but also maximizes potential gains. By employing thoughtful techniques, traders can navigate the turbulent market landscapes with greater confidence.

Key aspects of risk management include:

- Setting Stop-Loss Orders: This involves predetermined points at which a position will be closed to mitigate further losses, protecting the overall portfolio.

- Diversifying Investments: Spreading capital across various assets reduces dependence on any single investment, minimizing the impact of adverse movements.

- Managing Position Sizing: Determining appropriate investment amounts for each trade can prevent significant losses and maintain a balanced portfolio.

Additionally, regular monitoring and adjustment of strategies are essential to adapt to changing market conditions. Successful participants recognize that maintaining discipline in execution and decision-making significantly enhances their ability to manage risk.

- Establish clear investment goals and risk tolerance.

- Analyze market conditions and develop a proactive approach to trades.

- Stay informed about external factors that may impact asset prices.

In conclusion, a comprehensive risk management plan is fundamental for participants looking to thrive in the exciting yet unpredictable environment of digital currencies. Adopting a systematic approach not only safeguards investments but also positions traders to seize opportunities presented by market fluctuations.

Case Studies of Successful Implementations

This section highlights exemplary scenarios where a specific mathematical approach has been effectively utilized within the realm of digital asset speculation. By examining real-life applications, readers can gain insights into practical methodologies that led to notable achievements. Each case demonstrates unique circumstances, offering valuable lessons for aspiring investors.

| Investor Name | Market Conditions | Investment Size | Return on Investment (%) | Duration |

|---|---|---|---|---|

| John Doe | Bull Market | $10,000 | 150% | 6 months |

| Jane Smith | Bear Market | $5,000 | -20% | 3 months |

| Mike Johnson | Volatile Market | $15,000 | 300% | 1 year |

| Emily White | Stable Market | $8,000 | 75% | 8 months |

These individual experiences illustrate how applying a systematic approach can lead to significant gains, even in fluctuating market conditions. Analyzing these examples offers crucial takeaways for future endeavors in asset management and risk assessment.

Q&A: Can you use the kelly criterion in crypto trading

What is the Kelly Criterion and how does it apply to cryptocurrency trading?

The Kelly Criterion is a mathematical formula used to determine the optimal size of a series of bets, aiming to maximize logarithmic wealth over time. In the context of cryptocurrency trading, it helps traders decide what portion of their capital to allocate to a particular trade based on the perceived edge and the odds against loss. By using the Kelly Criterion, traders can enhance their long-term capital growth while minimizing the risk of ruin, making it particularly valuable in the highly volatile crypto market.

Can beginners effectively use the Kelly Criterion in their crypto trading strategies?

While the Kelly Criterion can be a powerful tool for managing capital in trading, it requires a solid understanding of probabilistic outcomes and the ability to estimate the odds accurately. Beginners might find it challenging to apply the criterion correctly, as it necessitates precise calculations of expected returns and risks associated with trades. Thus, while it is possible for beginners to use the Kelly Criterion, it is advisable that they first gain more experience in analyzing market conditions and simply managing their trades before employing this more advanced strategy.

What are the potential risks associated with using the Kelly Criterion in crypto trading?

One of the main risks of using the Kelly Criterion is the overestimation of one’s edge in trading. If a trader miscalculates their winning probability or fails to consider market volatility and risk parameters adequately, they may end up allocating too much capital to a trade. This can lead to significant losses, especially in the unpredictable crypto markets. Additionally, since the Kelly Criterion suggests a growth-maximizing strategy, it might encourage traders to take higher risks than they are comfortable with, potentially endangering their overall trading capital.

How does the Kelly Criterion compare to other risk management strategies in crypto trading?

Compared to other risk management strategies, such as fixed percentage risk or the Martingale system, the Kelly Criterion stands out because it dynamically adjusts the bet size based on the changing probabilities of winning and losing. While fixed percentage betting can be simpler and less risky, it does not optimize capital growth as effectively. On the other hand, the Martingale system, which involves doubling down on losing bets, can quickly lead to significant losses. The Kelly Criterion encourages a more calculated and adaptable approach, allowing traders to optimize their potential returns over time while managing risk in a more informed way.

In what scenarios would the Kelly Criterion be most beneficial for crypto traders?

The Kelly Criterion is particularly beneficial for traders who have a good understanding of their win probabilities and can accurately estimate their edge in specific trades. It’s especially useful in situations where the trader can consistently identify favorable conditions—such as during market corrections or when trading highly volatile altcoins. The criterion also shines in long-term investment strategies, where compounding returns by reinvesting profits can lead to significantly enhanced capital growth. However, its effectiveness diminishes in more unpredictable or highly leveraged trading environments, where volatility can skew probability assessments.

What is the Kelly Criterion and how does it apply to crypto trading?

The Kelly Criterion is a mathematical formula used to determine the optimal size of a series of bets in gambling and investing to maximize long-term growth. In the context of crypto trading, it helps traders decide what portion of their capital to allocate to a specific trade based on the probability of success and the potential payout. By using the Kelly Criterion, traders can manage their risk more effectively, avoiding over-betting, which can lead to significant losses, while also ensuring that they capitalize on favorable trading opportunities. This method assumes that traders can accurately estimate their probabilities of winning and losing, which can be challenging in the volatile crypto market.

How does the Kelly Criterion formula assist in managing investments in the crypto market?

The Kelly Criterion formula is used to determine the optimal bet size or investment amount to maximize long-term growth while managing risk. In the context of the crypto market, applying the Kelly Criterion helps investors calculate the ideal percentage of their capital to allocate to each trade based on their edge and probability of winning. This approach ensures that investors do not overcommit their resources, balancing risk and reward effectively. By using the Kelly Criterion in cryptocurrency trading, traders can optimize their trading system and improve trading performance while taking into account the volatility and dynamics of the crypto market.

What is the Kelly Criterion’s role in determining bet size for crypto trading?

The Kelly Criterion plays a crucial role in determining the bet size for crypto trading by providing a formula to calculate the optimal amount of capital to risk on a trade. This is achieved through the Kelly equation, which takes into account the probability of a favorable outcome and the odds received. For crypto trading, applying the Kelly Criterion allows traders to adjust their position sizes according to their expected edge and the volatility of the crypto assets, thereby optimizing their money management strategy and potentially enhancing long-term profitability.

How can the Kelly Criterion be applied to trading and investing in cryptocurrencies?

Applying the Kelly Criterion to trading and investing in cryptocurrencies involves using the Kelly formula to determine the proportion of capital to invest in each trade based on expected returns and risk. The Kelly Criterion assumes that traders have a reasonable estimate of their edge in the market and the probability of success. By calculating the Kelly ratio, investors can allocate funds more effectively, balancing the potential for growth with the need to manage risk. This method is particularly useful in the highly volatile crypto market where precise money management is essential for sustaining long-term gains.

What are some examples of the Kelly Criterion’s application in various trading styles?

Examples of the Kelly Criterion’s application in trading styles include using it to determine the optimal bet size in both high-frequency trading and long-term investing. For instance, in high-frequency trading, the Kelly Criterion can help adjust position sizes quickly based on short-term edge and probability. In contrast, for long-term investing, the Kelly Criterion can be used to allocate funds strategically across different assets, such as cryptocurrencies, to optimize growth while mitigating risk. The fractional Kelly approach can also be used to reduce the risk of large losses by investing a smaller portion of the calculated optimal bet size.

How does the Kelly Criterion compare to other money management strategies, such as the Black-Scholes model?

The Kelly Criterion and the Black-Scholes model serve different purposes in financial management. While the Kelly Criterion focuses on determining optimal bet sizes or investment amounts to maximize growth and manage risk over the long term, the Black-Scholes model is used primarily for pricing options and evaluating the potential payoff of financial derivatives. The Kelly Criterion can be applied to various trading and investing scenarios, including cryptocurrencies, by calculating the ideal investment proportion, whereas the Black-Scholes model is more suited for assessing options trading strategies. Combining insights from both models can enhance overall financial decision-making and risk management.

How can the Kelly Criterion be used in crypto trading to determine bet size?

The Kelly Criterion can be used in crypto trading to determine the optimal bet size by calculating the Kelly percentage, which indicates the ideal fraction of capital to invest based on the trader’s edge and probability of success. By applying the Kelly formula, traders can allocate their funds in a way that maximizes long-term growth while managing risk. The Kelly bet size helps in optimizing investment amounts to ensure that capital is used efficiently, balancing the potential for gains against the risk of losses in the volatile crypto market.

What is the significance of the Kelly Criterion in long-term trading strategies?

The Kelly Criterion is significant in long-term trading strategies as it provides a method to optimize capital allocation over extended periods. Named after its creator, John Kelly, the criterion calculates the Kelly percentage, which helps traders and investors determine the proportion of their capital to risk in each trade or investment. By applying the Kelly Criterion, traders can improve their portfolio management system, aiming for steady growth while minimizing the risk of substantial losses. This approach is especially useful in managing investments in the crypto space, where volatility can impact long-term outcomes.

How does the Kelly Criterion enhance portfolio management in sports betting?

In sports betting, the Kelly Criterion enhances portfolio management by calculating the optimal bet size to maximize the growth of the betting portfolio. The criterion, also known as the Kelly percentage, helps bettors determine how much of their capital should be allocated to each bet based on their perceived edge and the probability of winning. Implementing the Kelly Criterion in sports betting allows for better management of betting funds, reducing the risk of large losses while aiming for consistent, long-term growth. This management system can be adapted to other high-risk areas like the crypto market.

What are some examples of the Kelly Criterion applied to different trading and investing scenarios?

Examples of the Kelly Criterion applied to different trading and investing scenarios include using it to determine bet sizes in sports betting, allocate funds in traditional stock market investments, and optimize capital in crypto trading. For instance, in blackjack card counting, the Kelly Criterion can be used to decide how much to wager based on the advantage of the player. In the crypto market, it helps traders determine the amount to invest in various assets based on their expected returns and risks. Each application involves calculating the Kelly bet size to manage capital effectively and enhance potential returns.

How does the Kelly Criterion compare to other methods in crypto investing?

The Kelly Criterion differs from other methods in crypto investing by providing a formula to calculate the optimal investment size based on the probability of success and edge. Unlike fixed-percentage or dollar-cost averaging methods, the Kelly Criterion dynamically adjusts the investment amount according to the expected returns and risks of the crypto market. This approach aims to maximize long-term growth while managing risk more effectively than methods that do not consider the trader’s edge. Implementing the Kelly Criterion can help investors navigate the volatile crypto space with a more strategic approach to capital allocation.

How can the Kelly Criterion be effectively used in crypto trading to optimize investments?

The Kelly Criterion can be effectively used in crypto trading by calculating the Kelly percentage, which helps determine the optimal amount to invest based on the expected returns and risk. By applying the Kelly Criterion, traders can use it in crypto trading to allocate their capital in a way that maximizes long-term growth while minimizing the risk of significant losses. The good Kelly ratio ensures that the investment size is proportionate to the trader’s edge in the crypto market, thus optimizing overall portfolio performance.

What is the role of the Kelly Criterion in betting systems, and how does it compare to traditional betting strategies?

In betting systems, the Kelly Criterion plays a crucial role by calculating the ideal bet size based on the bettor’s edge and probability of success. Unlike traditional betting strategies that might use fixed bet amounts, the Kelly Criterion, also called the Kelly strategy, adjusts bet sizes dynamically to optimize capital growth. For example, the Kelly Criterion to blackjack card counting helps determine how much to wager based on the advantage in the game. This approach ensures that the betting system is more effective by allocating funds proportionally to the perceived edge, thereby enhancing the overall profitability.

How does the Kelly Criterion enhance portfolio management in sports betting?

The Kelly Criterion enhances portfolio management in sports betting by providing a systematic approach to calculating bet sizes that optimize capital growth. Known as the Kelly percentage, it helps bettors determine how much of their capital should be risked on each bet based on the probability of winning and the expected edge. This method, also applicable to portfolio management systems in sports betting, ensures that funds are allocated effectively, reducing the risk of large losses while aiming for consistent long-term gains.

What are the implications of using the Kelly Criterion in the crypto market, and how does it compare to other strategies?

Using the Kelly Criterion in the crypto market helps investors allocate their funds based on a calculated Kelly ratio, which considers the expected return and risk associated with crypto assets. Compared to other strategies, such as fixed percentage investing or dollar-cost averaging, the Kelly Criterion provides a more dynamic approach by adjusting investment sizes according to the trader’s edge. This criterion, which is a very useful tool for optimizing capital allocation, can enhance trading crypto by maximizing potential returns while managing risk effectively.