In the ever-evolving landscape of virtual currencies, individuals are faced with a myriad of options for managing their investments. Navigating through diverse solutions can be daunting, yet understanding the nuances of different services can significantly enhance one’s experience. Evaluating the offerings of top contenders in this sphere leads to insights that go beyond mere functionality.

When it comes to envisioning a seamless user experience, features can vary widely. Each contender has crafted its own environment tailored to distinct audiences–some prioritize simplicity while others cater to seasoned enthusiasts seeking advanced tools. By delving into these offerings, one can better grasp how their preferences align with available choices.

Moreover, considerations such as security measures, ease of access, and fee structures play pivotal roles in determining one’s satisfaction and success. Scrutinizing these elements empowers users to make informed decisions, ensuring a productive and rewarding journey in the realm of digital assets.

Overview of Coinbase and Robinhood

This section aims to provide a comparative insight into two prominent services available for digital assets exchange. Each option offers unique features, benefits, and potential drawbacks that cater to various types of users. Understanding the nuances associated with these services can significantly influence the decision-making process for individuals looking to engage in the dynamic world of virtual currencies.

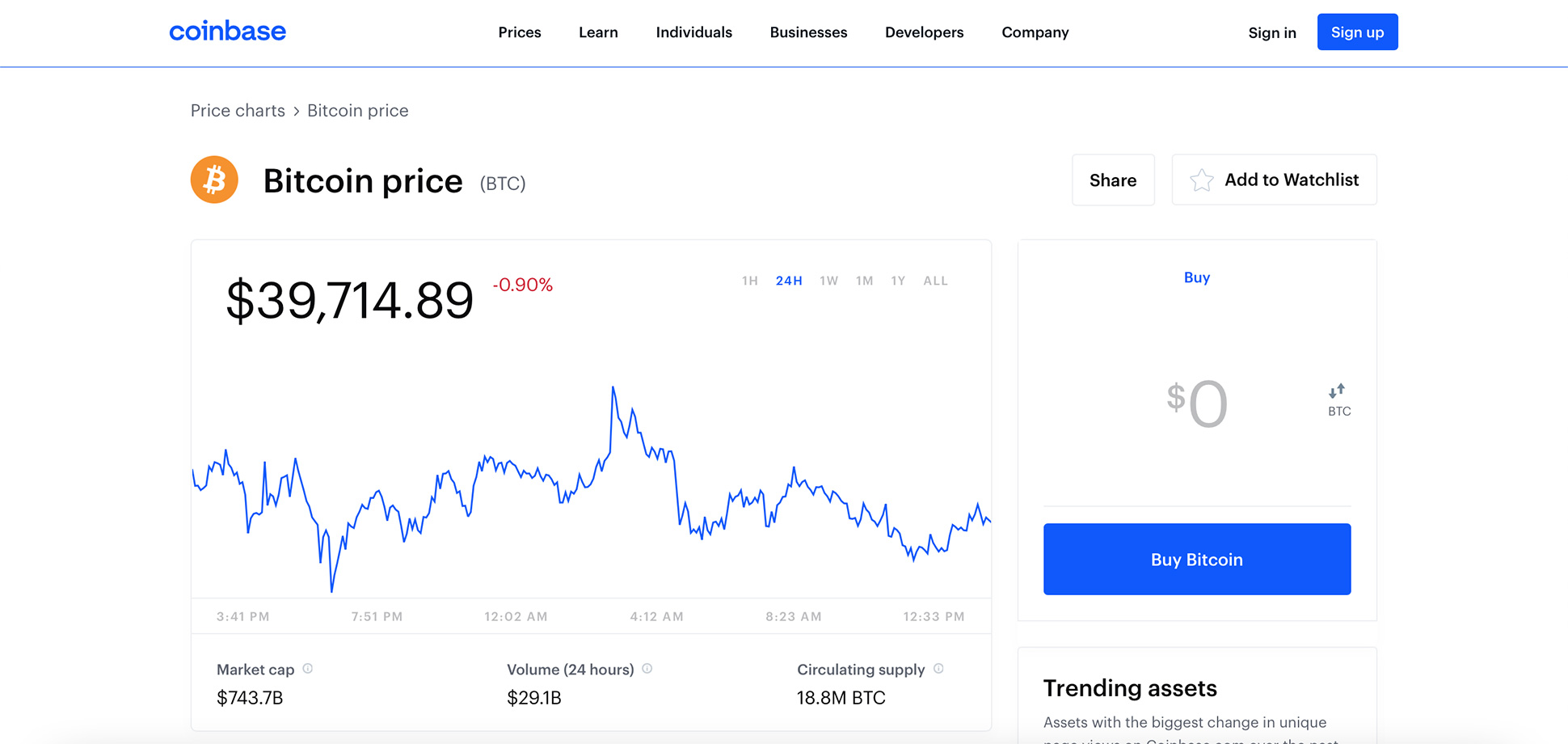

The first service is well-known for its user-friendly interface, robust security measures, and extensive selection of virtual currencies. It appeals to both newcomers and experienced enthusiasts who value comprehensive market data and analytical tools. Furthermore, it is designed to facilitate the buying, selling, and management of assets in an accessible manner.

The second service, in contrast, markets itself as a convenient solution for those seeking alternative financial options combined with a straightforward entry into digital asset acquisition. It emphasizes a simplified experience and may be more appealing to casual investors who prioritize ease of use over extensive trading functionalities. However, this approach may come with certain limitations that users should consider.

Both services have carved out distinct niches in the ever-evolving landscape of virtual assets, and the choice ultimately depends on individual preferences and investment strategies. By examining their core attributes, users can make more informed decisions that align with their financial goals.

Unique Features of Each Platform

When comparing various services for digital asset exchange, it is essential to highlight the distinctive attributes that set them apart. Each option offers a unique set of functionalities and user experiences designed to cater to different audiences, ensuring that users find tools and features that suit their individual needs.

Innovative Characteristics

One service may pride itself on its user-friendly interface and educational resources, while the other focuses on providing advanced trading features and lower fees. Exploring these innovative characteristics can guide users in making informed decisions based on their priorities.

Comparison of Distinct Features

| Feature | Service A | Service B |

|---|---|---|

| User Interface | Intuitive and simple navigation | Advanced tools for experienced investors |

| Educational Resources | Comprehensive guides and tutorials | Limited, but useful for quick insights |

| Transaction Fees | Higher fees on small trades | Competitive pricing with fewer costs |

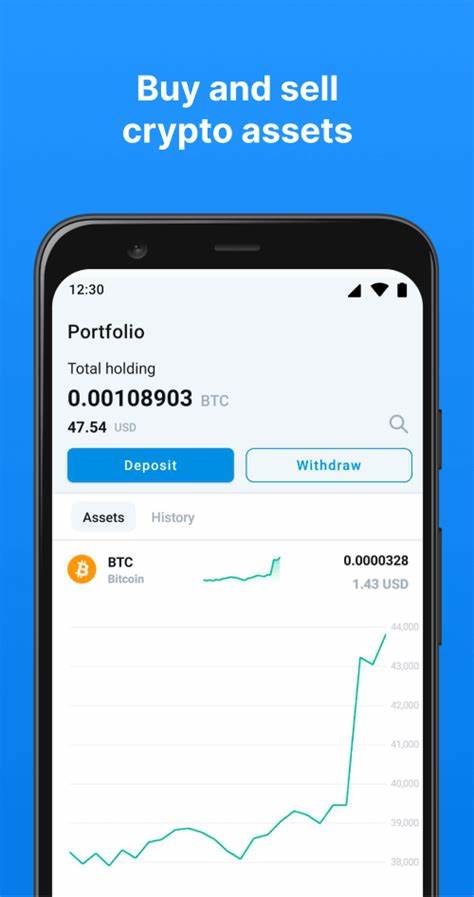

| Mobile Access | Fully optimized mobile application | Responsive mobile site for seamless access |

| Security Features | Two-factor authentication and insurance | Robust encryption and monitoring |

Understanding these distinctive features allows users to choose the service that aligns with their investment strategies and trading habits, ensuring a more tailored experience.

Fee Structures Explained for Traders

Navigating the world of digital asset exchanges can be challenging, especially when it comes to understanding the various costs associated with executing transactions. These financial liabilities can significantly impact overall returns and trading strategies. Hence, comprehending the fee framework of each service is essential for any participant in the market.

Types of Fees to Consider

- Transaction Fees: These are the charges incurred each time a purchase or sale is executed. They can vary based on the asset type and the size of the trade.

- Withdrawal Fees: When transferring assets off the service, traders may encounter fees. These costs can differ based on the withdrawal method.

- Deposit Fees: Some exchanges impose fees for adding funds. This can include bank transfers or credit/debit card payments.

- Subscription Fees: Certain services may offer premium features for a monthly or yearly fee, which can enhance the user experience.

Comparative Cost Analysis

Understanding the implications of each fee type is crucial. Here are factors to keep in mind when evaluating costs:

- Examine transaction costs as a percentage of your total trade amount to gauge their weight.

- Consider how frequent withdrawal activities may accumulate into substantial cumulative costs.

- Review deposit methods; while some may have no fees, others could impose significant charges.

- Analyze whether premium services justify their costs based on your trading frequency and needs.

In summary, being well-informed about fee structures enables traders to make smarter choices and optimize their overall experience in the digital asset market.

User Experience and Interface Comparison

This section delves into the design and functionality of two leading services in the digital currency sphere. A user-friendly interface and seamless experience can significantly impact how individuals engage with their assets. Therefore, assessing these features is crucial for potential users.

Both services offer distinct approaches in terms of usability and design aesthetics:

- Layout: One service employs a straightforward layout, making it easy for beginners to navigate. The other opts for a more dynamic interface, catering to experienced traders.

- Accessibility: Features such as mobile applications and web accessibility vary, impacting the way users interact with their accounts on-the-go.

- Customization: Options for personalizing the dashboard and notifications can enhance user engagement and satisfaction across different experience levels.

In terms of support documentation and resources, both services provide valuable educational materials. However, the clarity and organization of these resources can differ:

- One service may offer comprehensive guides and tutorials, promoting a better understanding of functionalities.

- The other might focus on quick tips and simplified FAQs, appealing to users seeking rapid answers.

Ultimately, the choice between these two digital currency services will depend on the individual’s preferences regarding interface design and the overall user experience. Whether one prioritizes simplicity or advanced features, understanding these elements plays a vital role in making an informed decision.

Security Measures and Risks Involved

When engaging in the exchange of digital assets, it is crucial to understand the protective strategies in place as well as the potential hazards associated with such activities. Ensuring the safety of investments requires awareness of how platforms safeguard user information and funds while also considering the various threats that can compromise security.

Protective Strategies

Various entities implement a range of security measures to shield users from unauthorized access and potential losses. Commonly employed tactics include:

- Two-Factor Authentication (2FA): This adds an extra layer of protection by requiring users to verify their identity through a secondary method.

- Cold Storage: A significant portion of funds is stored offline, which minimizes exposure to cyber attacks.

- Encryption: Robust encryption techniques are employed to secure sensitive data transmitted over the internet.

- Regular Security Audits: Frequent evaluations of security protocols ensure any vulnerabilities are addressed promptly.

Potential Hazards

Despite extensive security measures, participants must remain vigilant about several risks inherent in the digital asset space:

- Phishing Attacks: Fraudsters may attempt to trick users into providing their login credentials through deceptive websites or emails.

- Market Volatility: Sudden changes in market conditions can lead to significant financial losses.

- Regulatory Changes: Shifts in legal frameworks can affect the accessibility and legitimacy of various services.

- Technical Failures: Issues such as server outages or bugs can impede access to accounts and hinder trading activities.

Being informed about both the protective measures and the inherent risks is essential for anyone looking to navigate the landscape of digital asset exchanges securely and effectively.

Customer Support and Community Engagement

The quality of assistance provided to users and the level of interaction within the community are vital aspects that can significantly influence the overall experience of individuals engaged in digital asset exchanges. Understanding how support services operate and how users can connect with each other is essential for making informed decisions.

Support Services

Responsive and knowledgeable support can make a substantial difference, especially during periods of high market volatility or technical issues. Timely assistance through various channels such as live chat, email, and phone support ensures that users feel secure and valued. Moreover, comprehensive educational resources, including tutorials and FAQs, empower users to solve problems independently and enhance their trading strategies.

Community Interaction

Engagement within the user community fosters a sense of belonging and enables the sharing of insights, tips, and experiences. Active forums and social media groups facilitate discussions and allow users to connect with experienced traders. Notably, a vibrant community can serve as a valuable source of real-time information, helping individuals navigate the ever-evolving landscape of digital assets more effectively.

Q&A: Coinbase vs robinhood

What are the main differences between Coinbase and Robinhood for crypto trading?

Coinbase is primarily a cryptocurrency exchange, allowing users to buy, sell, and store a wide variety of cryptocurrencies securely. It offers features like advanced trading tools, a wallet service, and educational resources about crypto. Robinhood, on the other hand, is a commission-free trading platform that includes stocks, options, and cryptocurrencies, but it does not provide a dedicated cryptocurrency wallet. Users can trade cryptocurrencies on Robinhood but may not have the same level of security or ownership of their assets compared to using Coinbase. In summary, if you want a full-fledged crypto experience, Coinbase might be the better choice, while Robinhood is more suitable for those interested in a more straightforward investment approach without trading fees.

Is Coinbase or Robinhood safer for crypto trading?

When it comes to safety, both platforms offer a degree of security, but they have notable differences. Coinbase is known for its robust security measures, including two-factor authentication, cold storage for the majority of user funds, and insurance against breaches. However, rewards and risks should be considered, as users do not have access to a private key with Coinbase, meaning they do not technically own their crypto. Robinhood provides a seamless experience but lacks the same level of security features that dedicated exchanges like Coinbase have for crypto assets. Since Robinhood does not allow users to withdraw cryptocurrencies, this may be a drawback for those concerned about long-term security. Overall, while Coinbase may offer superior security features, both platforms come with risks and benefits that users should assess based on their trading habits and security preferences.

Which platform has lower fees for cryptocurrency trading, Coinbase or Robinhood?

When it comes to fees, Robinhood is often touted as more affordable since it offers commission-free trading for both stocks and cryptocurrencies. However, it’s important to note that Robinhood generates revenue through spreads, meaning that users might experience higher costs when executing trades. In contrast, Coinbase has a more complex fee structure that includes a percentage fee along with a spread, which can vary based on the user’s payment method and location. Users might find that while Robinhood has lower upfront trading costs, the overall cost of purchasing cryptocurrencies could be similar or even higher depending on market conditions. For those focused solely on fees, it’s essential to analyze trade size, frequency, and personal preferences while considering the overall value each platform offers beyond just the fees.

Can I transfer my cryptocurrencies between Coinbase and Robinhood?

Transferring cryptocurrencies between Coinbase and Robinhood is not straightforward due to the different structures and functionalities of the two platforms. Coinbase allows users to withdraw their cryptocurrencies to an external wallet, enabling them to transfer assets anywhere that supports the specific cryptocurrency. In contrast, Robinhood does not currently allow users to transfer cryptocurrencies to and from its platform; users can only buy, sell, and hold assets within the Robinhood app. Consequently, if you’re looking for a platform that provides flexibility and control over your crypto assets, Coinbase would be the preferable option. However, if you plan to keep your investments on the platform for trading without transferring them, Robinhood’s ease of use may be attractive until its transfer feature is available.

What are the differences between Robinhood and Coinbase, and how do they compare in cryptocurrency investing?

Robinhood and Coinbase are two of the most popular platforms for cryptocurrency investing. Robinhood offers a more simplified experience with limited cryptocurrencies, while Coinbase is a full-service crypto exchange with a wider range of cryptocurrencies and advanced trading features, making it the better choice for those looking for a comprehensive crypto platform.

How does Robinhood offer cryptocurrency trading compared to Coinbase, and what are the key features of each?

Robinhood offers cryptocurrency trading with a focus on ease of use and commission-free trades. In contrast, Coinbase offers a more robust platform like Coinbase Pro with advanced trading options and a wider selection of cryptocurrencies, making it suitable for more experienced investors.

Is Coinbase or Robinhood the right choice for someone looking to buy and sell bitcoin?

Choosing between Robinhood and Coinbase for buying and selling bitcoin depends on your investment needs. Coinbase is the better choice for those who want access to a wider range of cryptocurrencies and advanced features like margin trading, while Robinhood might be the better option for beginners seeking a simple, no-fee experience.

What are the pros and cons of using Robinhood for cryptocurrency investing compared to Coinbase?

Robinhood offers cryptocurrency trading with no fees and an easy-to-use interface, but it has a limited selection of cryptocurrencies. Coinbase, on the other hand, offers a full-service crypto exchange with a wider range of cryptocurrencies and more advanced trading features, but it charges fees for transactions.

How does the selection of cryptocurrencies on Robinhood compare to that on Coinbase?

Robinhood offers a more limited selection of cryptocurrencies compared to Coinbase. While Robinhood still provides access to popular crypto options like bitcoin and ethereum, Coinbase offers a wider range of cryptocurrencies, making it a better choice for those looking to invest in a broader array of digital assets.

Why might someone choose to use Coinbase Pro instead of Robinhood for their crypto trading?

Someone might choose to use Coinbase Pro instead of Robinhood for crypto trading because Coinbase Pro offers advanced trading features, lower fees for high-volume trades, and access to a wider range of cryptocurrencies, making it more suitable for experienced traders.

How does margin trading differ between Coinbase and Robinhood, and which platform is better suited for it?

Coinbase offers margin trading through its advanced platform, allowing users to trade with leverage on a wider range of cryptocurrencies. Robinhood, however, may not offer the same level of margin trading options, making Coinbase the better choice for those interested in leveraged trading.

What should be considered when choosing between Robinhood and Coinbase for cryptocurrency investing?

When choosing between Robinhood and Coinbase for cryptocurrency investing, consider the range of cryptocurrencies offered, the availability of advanced trading features, and the fee structure. Robinhood might be better for beginners, while Coinbase offers more options and tools for experienced investors.

How do the customer support options of Robinhood and Coinbase compare for crypto investors?

For crypto investors, Coinbase offers more comprehensive customer support options, including access to Coinbase One, which provides dedicated customer service. Robinhood offers support through its platform, but Coinbase’s support might be more robust, especially for complex issues.

Why might someone prefer using Robinhood over Coinbase for buying and selling cryptocurrencies?

Someone might prefer using Robinhood over Coinbase for buying and selling cryptocurrencies because of Robinhood’s commission-free trading and user-friendly interface. However, this comes with trade-offs, such as a more limited selection of cryptocurrencies and fewer advanced trading features.

What are the advantages of Coinbase’s wider range of cryptocurrencies compared to Robinhood?

The advantages of Coinbase’s wider range of cryptocurrencies compared to Robinhood include access to a more diverse portfolio of digital assets, the ability to trade newer or less common cryptocurrencies, and the option to use advanced trading features like those found on Coinbase Pro.

How do the fees and costs associated with trading on Robinhood compare to those on Coinbase?

Robinhood offers commission-free trading, which can be appealing to beginners. However, Coinbase charges fees on transactions, especially when using its basic platform. Coinbase Pro offers lower fees for high-volume trades, which can be more cost-effective for active traders.

What are the main differences between the Coinbase Wallet and an account with Robinhood Crypto?

The main differences between the Coinbase Wallet and an account with Robinhood Crypto are the level of control and security over your assets. Coinbase Wallet allows users to hold their own private keys, providing greater control and security, while Robinhood Crypto is custodial, meaning Robinhood holds the assets on behalf of the user.

Why might the pros and cons of Robinhood and Coinbase influence a new investor’s decision on where to start trading cryptocurrencies?

The pros and cons of Robinhood and Coinbase can significantly influence a new investor’s decision on where to start trading cryptocurrencies. Robinhood offers a simple, no-fee trading experience that is appealing to beginners, while Coinbase provides a more comprehensive platform with a wider range of cryptocurrencies and features that may better suit those looking for more advanced trading options.

How do Coinbase and Robinhood compare in terms of cryptocurrency trading, and which platform has the edge?

Coinbase and Robinhood are two popular platforms for cryptocurrency trading, but they serve different needs. Coinbase focuses on offering a more comprehensive crypto experience with advanced features like Coinbase Advanced, making it suitable for serious crypto traders. In contrast, Robinhood offers users a simple and cost-effective way to trade stocks and crypto with minimal fees. However, Coinbase has the edge for those looking for more robust crypto trading options.

What are the pros and cons of using Robinhood or Coinbase for buying bitcoin, and how do their services differ?

Robinhood and Coinbase are safe platforms for buying bitcoin, but they differ in their approach. Robinhood offers a user-friendly interface with no account management fees, making it accessible to beginners. Coinbase also offers users a more detailed trading experience with features like Coinbase Advanced, which provides more tools for active traders. While Robinhood does offer lower fees, Coinbase is one of the more comprehensive options in the U.S. for those who want to dive deeper into cryptocurrency trading.