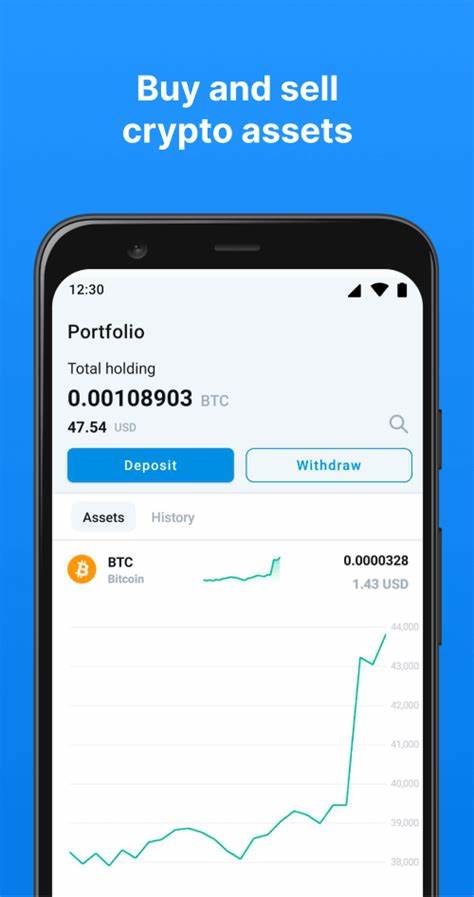

In today’s rapidly evolving financial landscape, the significance of securing digital wealth cannot be overstated. With the increasing popularity of online platforms for trading and managing virtual currencies, individuals are seeking reliable methods to ensure their holdings remain safe from unforeseen circumstances. This need for assurance has led to the emergence of various protective measures designed to provide peace of mind for users navigating this dynamic environment.

As participants engage with innovative solutions for enhancing their financial portfolios, understanding the mechanisms that can mitigate potential losses becomes paramount. The concept of enhanced security features provides a promising avenue for those looking to minimize risks associated with unexpected disruptions or malicious activities. Adopting these protective strategies can help bolster confidence among traders and holders alike.

As the landscape continues to shift with new technologies and regulatory frameworks, discerning users recognize the importance of diligent preparation and proactive measures. By being informed about the available options to fortify one’s assets, individuals can navigate the complexities of this vibrant market with greater assurance. Ultimately, the pursuit of lasting security for digital wealth represents a critical step toward achieving financial resilience in an uncertain future.

Understanding Crypto Exchange Account Insurance

In the ever-evolving world of digital assets, ensuring the safety of funds held on various platforms has become paramount. Users are increasingly aware of the need for additional layers of security against unforeseen events such as hacks, system failures, or fraudulent activities. This growing concern has led to the emergence of protective measures designed to provide a safety net for those engaging in virtual currency trading.

Such protective policies serve to mitigate potential losses that individuals may encounter when utilizing platforms for their digital transactions. They offer a reassuring backup plan that addresses the vulnerabilities inherent in the digital ecosystem. By opting for these safeguarding strategies, traders can enjoy a greater sense of stability while navigating the complex landscape of asset management.

It is essential for participants in this market to familiarize themselves with how these safety mechanisms function, what they cover, and their limitations. Understanding the nuances of these protective strategies helps users make informed choices, ultimately enhancing their trading experience and reducing anxiety associated with the risk of loss. As the market matures, the significance of these safeguards continues to grow, making it an important consideration for anyone involved in digital asset trading.

Importance of Insurance for Your Crypto Assets

In a digital landscape where virtual currencies are gaining prominence, safeguarding these digital holdings has become increasingly vital. Just as traditional assets often carry some form of security, the realm of online currencies demands similar protective measures to mitigate potential risks. The unpredictable nature of the market means that unforeseen events can lead to significant financial setbacks.

Having a reliable protective layer allows individuals to navigate the uncertainties of the blockchain sphere with greater confidence. While the allure of high returns can be tempting, the underlying vulnerabilities cannot be overlooked. Many users find solace in knowing their resources are covered against hacking, operational failures, or other unforeseen losses.

Furthermore, ensuring peace of mind enables investors to make informed decisions without the constant worry of possible downturns or security breaches. The incorporation of a safety net not only bolsters confidence but also encourages a more stable and prosperous interaction with the ever-evolving world of digital assets.

How Crypto Exchange Insurance Works

The concept behind protection mechanisms for digital currency platforms involves various financial safeguards designed to mitigate risks associated with potential losses. These structures can provide a safety net against unforeseen incidents, ensuring users feel more secure during transactions and investments in the fast-evolving world of virtual assets.

Understanding the Mechanism

Typically, these options operate by pooling resources from participating users and companies, allowing for compensation in the event of loss due to circumstances like hacks, insolvency, or operational mistakes. Here are some key features of this framework:

- Risk Assessment: Companies assess potential threats to determine the coverage and premium rates.

- Coverage Limits: Policies often specify a maximum amount that can be claimed for losses.

- Compensation Structure: Users typically receive payouts that reflect their contributions or the loss suffered, based on set criteria.

Types of Protection Offered

Diverse options are available to users, focusing on different aspects of risk management:

- Digital Asset Theft: Coverage against unauthorized access leading to loss of assets.

- System Failures: Compensation for losses resulting from operational breakdowns.

- Regulatory Issues: Financial protection in case of legal challenges or penalties.

Overall, these protection schemes aim to enhance confidence among participants by providing an assurance that their holdings are safeguarded against potential threats in a landscape known for its volatility and uncertainty.

Key Benefits of Secure Account Coverage

Investors can enjoy a range of advantages when they opt for comprehensive coverage for their online asset management platforms. Such safeguards not only enhance peace of mind but also create a more robust environment for digital financial activities. Understanding these benefits is crucial for anyone looking to engage in this modern economic landscape.

1. Enhanced Trust and Confidence

When individuals know their digital assets are safeguarded, they tend to engage in transactions with greater assurance. Secure coverage fosters trust in the system, encouraging users to explore more opportunities within the trading environment. This increased confidence can lead to more active participation and positive experiences.

2. Financial Reimbursement in Case of Loss

In the unfortunate event of a breach or cyber incident, having a protective mechanism means users can receive financial compensation for lost assets. This feature greatly reduces the risks associated with volatile markets and unexpected threats, allowing traders to rebound swiftly without debilitating losses.

Comparing Different Insurance Providers

When evaluating various options for safeguarding digital assets, it’s essential to consider the offerings provided by different companies. Each organization may have unique features, coverage limits, and costs associated with their protective solutions. An informed analysis can help individuals make choices that align with their financial strategies and risk tolerance.

Key Factors to Consider

Several criteria should guide your comparison process. These include the extent of coverage, premium rates, reputation of the provider, and customer support services. Understanding how these elements interact can aid in selecting the most suitable option for your needs.

Comparison Table of Insurance Offerings

| Provider | Coverage Limit | Premium Rate | Customer Support | Reputation |

|---|---|---|---|---|

| InsureX | $1,000,000 | $100/month | 24/7 Support | High |

| SafeAssets | $500,000 | $75/month | Business Hours | Medium |

| SecureFunds | $2,000,000 | $150/month | 24/7 Support | High |

| ProtectWealth | $750,000 | $90/month | Business Hours | Low |

By carefully analyzing these details, individuals can choose a provider whose policies meet their specific requirements and ensure their assets are shielded effectively.

Steps to Insure Your Crypto Holdings

Securing digital assets is a fundamental aspect for individuals venturing into the world of virtual currencies. A proactive approach can significantly reduce potential risks associated with market fluctuations and unforeseen events. Below are essential measures to ensure the safety of your holdings.

Choose a Reputable Provider

Identifying a trustworthy company that offers coverage for digital assets is paramount. Conduct thorough research to find a provider known for reliability and strong reviews. Verify their credentials and the terms of coverage to ensure clarity about what is included.

Diversify Risk Management Strategies

Implementing multiple strategies to manage risk can enhance overall safety. Consider utilizing hardware wallets for offline storage, employing multi-signature solutions, or leveraging smart contracts. These approaches, combined with insurance, create a robust framework for safeguarding assets against loss or theft.

Always stay informed about the latest developments in the industry and adjust your strategies accordingly. Staying proactive ensures that you are prepared for any challenges that may arise.

Future Trends in Cryptocurrency Insurance

The rapidly evolving landscape of digital assets necessitates innovative protective measures to address emerging risks. As the cryptocurrency market matures, the demand for coverage options is expected to grow, paving the way for novel approaches in safeguarding virtual holdings against potential threats.

Enhanced Coverage Options

Insurance providers are likely to introduce more comprehensive policies tailored to the unique challenges of the crypto sector. These may include:

- Protection against cyber-attacks targeting wallets and exchanges

- Fidelity coverage for custodians and third-party platforms

- Compensation for lost private keys or access failures

Integration of Technology

Technological advancements will play a crucial role in shaping future insurance products. Some expected developments include:

- Utilization of blockchain for transparent and efficient claims processing

- Application of smart contracts to automate policy enforcement and payouts

- Use of artificial intelligence to assess risk factors more accurately

The convergence of these factors is likely to create a more robust framework for managing risks associated with digital assets, ultimately fostering greater confidence among investors in this dynamic market.

Q&A: Crypto exchange account insurance

What is crypto exchange account insurance and how does it work?

Crypto exchange account insurance is a form of coverage that protects users’ digital assets held on a cryptocurrency exchange from various risks, such as hacking, fraud, or operational failures. This insurance usually comes from third-party insurance companies that assess the exchange’s security measures. If a covered incident occurs, policyholders can file a claim to recover some or all of their lost assets. It’s crucial to read the specific terms and conditions, as coverage limits and exclusions can vary greatly between platforms.

Is it really necessary to have insurance for my cryptocurrency investments?

While not strictly necessary, having insurance for your cryptocurrency investments is highly recommended. The crypto market is known for its volatility, and exchanges have been targets of numerous high-profile hacks, leading to substantial losses for investors. Insurance provides an added layer of security, giving you peace of mind knowing that you have some financial protection in case things go wrong. However, it is important to choose an exchange that offers reputable insurance and to understand the extent of the coverage provided.

How can I find an exchange that offers insurance for crypto accounts?

To find an exchange that offers insurance for cryptocurrency accounts, start by conducting thorough research on popular exchanges in the market. Websites that review exchanges often provide insights into their security measures, including insurance options. Look for exchanges that explicitly mention insurance coverage on their websites or in their user agreements. Additionally, you can reach out to customer service for confirmation and details about the type of insurance offered, what it covers, and any associated costs.

What should I do if my exchange does not offer account insurance?

If your chosen exchange does not offer account insurance, you have a few options to consider. First, you could look for alternative exchanges that provide insurance coverage, offering you a safer environment for your investments. Secondly, you should strengthen your personal security measures, such as enabling two-factor authentication, using strong passwords, and regularly transferring your assets to secure wallets with private keys. Additionally, you could investigate third-party insurance options that cover digital assets even if the exchange itself does not provide it directly. Ultimately, weighing the risks and pros/cons of your current exchange is essential before making any changes to your investment strategy.

How do insurance policies provide coverage for crypto users?

Insurance policies provide coverage for crypto users by protecting against losses from theft, hacking, and other cybercrimes. Crypto exchange insurance policies often cover assets held in hot wallets and may include additional protections like cold storage insurance to safeguard funds stored offline.

Why is cold storage insurance important for cryptocurrency companies?

Cold storage insurance is important for cryptocurrency companies because it protects against the loss of assets stored offline, which is a key method for securing large amounts of cryptocurrencies. This type of insurance is crucial in mitigating risks associated with cyberattacks and theft.

What role does the FDIC play in the financial services industry, and how does it differ from crypto insurance?

The FDIC plays a crucial role in the financial services industry by insuring deposits in traditional banks up to a certain limit, offering protection against bank failures. In contrast, crypto insurance is designed to protect crypto users and investors from specific risks in the cryptocurrency industry, such as hacking or theft, which are not covered by FDIC insurance.

How does a cryptocurrency company ensure investor protection through insurance policies?

A cryptocurrency company ensures investor protection through insurance policies by securing insurance to protect against various risks, including theft, hacking, and operational failures. These policies often include crime insurance and D&O (Directors and Officers) insurance, which cover financial losses and legal liabilities, enhancing overall investor protection.

What is the significance of FDIC insurance for custodial accounts in traditional financial institutions?

FDIC insurance for custodial accounts in traditional financial institutions is significant because it provides federal deposit insurance that protects depositors’ funds up to a certain limit in the event of a bank failure. This level of protection is not typically available in the cryptocurrency industry, where crypto insurance policies are used instead.

How does the insurance industry address the risks associated with hot wallets in cryptocurrency exchanges?

The insurance industry addresses the risks associated with hot wallets in cryptocurrency exchanges by offering specialized crypto insurance policies that cover losses due to hacking, theft, and other cybercrimes. Insurers often require exchanges to implement strong cybersecurity measures to qualify for coverage.

Why is it challenging for crypto companies to find insurance providers that offer comprehensive coverage?

It is challenging for crypto companies to find insurance providers that offer comprehensive coverage because the cryptocurrency industry is still largely unregulated, and the risks involved, such as cybersecurity threats and operational failures, are complex and difficult to quantify. This uncertainty makes many traditional insurers hesitant to provide coverage.

How do crime insurance policies benefit crypto investors?

Crime insurance policies benefit crypto investors by providing financial protection against losses resulting from criminal activities such as theft, fraud, and hacking. These policies are particularly important in the unregulated cryptocurrency industry, where such risks are prevalent.

What are the differences between professional liability insurance and errors and omissions insurance in the context of cryptocurrency companies?

Professional liability insurance and errors and omissions insurance both protect cryptocurrency companies from legal claims, but they cover different risks. Professional liability insurance covers general legal liabilities arising from professional services, while errors and omissions insurance specifically protects against claims of negligence or mistakes made in the company’s operations.

How do various insurance providers tailor their policies to the needs of crypto companies?

Various insurance providers tailor their policies to the needs of crypto companies by offering customized coverage options, such as cold storage insurance, cybercrime coverage, and D&O insurance. These policies are designed to address the unique risks associated with managing cryptocurrencies and operating within the cryptocurrency industry.

What measures do insurers require from cryptocurrency companies to qualify for crypto exchange insurance policies?

Insurers require cryptocurrency companies to implement stringent cybersecurity measures, such as the use of cold storage for large amounts of assets and robust security protocols for online hot wallets. These measures are necessary to qualify for crypto exchange insurance policies that provide coverage against theft and hacking.

Why is it important for cryptocurrency exchanges to have a privacy policy in place when offering insurance?

It is important for cryptocurrency exchanges to have a privacy policy in place when offering insurance because it ensures the protection of users’ personal information. A well-defined privacy policy is crucial for building trust with crypto users and is often a requirement from insurance providers to mitigate legal risks.

How do D&O insurance policies protect cryptocurrency companies and their executives?

D&O insurance policies protect cryptocurrency companies and their executives by covering legal defense costs and financial liabilities arising from lawsuits related to their managerial decisions. This type of insurance is crucial in safeguarding the personal assets of company directors and officers in the event of legal claims.

Why is insurance crucial for maintaining investor confidence in the cryptocurrency industry?

Insurance is crucial for maintaining investor confidence in the cryptocurrency industry because it provides a safety net against financial losses due to unforeseen events like cyberattacks, fraud, or operational failures. This protection helps mitigate the high risks associated with cryptocurrencies and encourages more investors to participate in the market.

How does crime insurance differ from federal deposit insurance in the context of crypto assets?

Crime insurance differs from federal deposit insurance in the context of crypto assets as it specifically covers losses from criminal activities such as theft or hacking, which are common risks in the crypto market. Federal deposit insurance, on the other hand, protects bank deposits in traditional financial institutions and does not apply to cryptocurrencies.

What are the key challenges that the insurance industry faces in providing coverage for cryptocurrencies?

The key challenges that the insurance industry faces in providing coverage for cryptocurrencies include the lack of regulation, the high volatility of crypto assets, and the difficulty in assessing risks like cybersecurity threats. These factors make it challenging for insurers to develop comprehensive and affordable crypto insurance policies.