The realm of digital currencies has rapidly evolved, driven by technological advancements and increasing interest from both users and institutions. As these virtual assets gain prominence, the need for a structured framework to govern their use has become paramount. This push for clarity seeks to create a balance between fostering innovation and ensuring security, thus shaping the future of financial interactions.

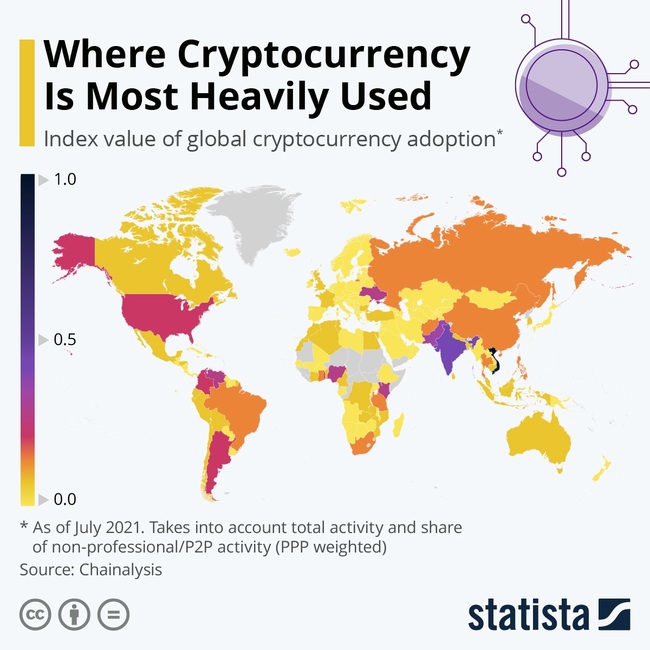

Amidst the various approaches taken by different jurisdictions, notable patterns have emerged. These patterns reflect the unique economic, cultural, and social contexts of each region, influencing how authorities address the challenges and opportunities presented by decentralized financial systems. As a result, an intricate mosaic of guidelines and practices has begun to take shape around the world.

Looking ahead, the interplay between innovation and oversight is poised to bring about significant shifts. Stakeholders across the spectrum are continually assessing how emerging technologies will influence existing frameworks, paving the way for a more cohesive and adaptable structure. Understanding these dynamics is essential for all those involved in the evolving landscape of digital assets.

Current State of Global Cryptocurrency Regulations

As digital assets continue to evolve, various countries are grappling with how best to approach oversight and governance. This ever-changing landscape reflects the diverse perspectives and cultural nuances that influence policy-making across different regions. Stakeholders are focused on balancing innovation with the need for consumer protection and financial stability.

Regional Approaches

Different parts of the world are adopting unique frameworks tailored to their specific economic environments. For instance, some nations have embraced a permissive stance, fostering an ecosystem that encourages innovation and entrepreneurship. Others, however, have opted for more restrictive measures, implementing stringent rules to mitigate risks associated with these novel financial instruments.

Key Challenges

Despite the varied approaches, challenges persist across all jurisdictions. Security concerns remain paramount, as incidents of fraud and hacking continue to undermine trust. Additionally, the lack of uniformity in policies can lead to confusion among participants, which complicates compliance efforts. As a result, collaboration among nations is increasingly viewed as essential to create a cohesive framework that can facilitate cross-border transactions.

Key Players in Cryptocurrency Policy Making

In the intricate landscape of digital asset governance, various entities play pivotal roles in shaping the legal frameworks and guidelines. Understanding the stakeholders involved in this dynamic process is crucial, as each contributes uniquely to the establishment of rules and standards that affect the industry.

- Government Bodies:National authorities, including ministries of finance and central banks, are fundamental in formulating laws. They often establish the overarching framework within which financial technologies operate.

- Regulatory Agencies:Specialized organizations are tasked with enforcing compliance, protecting consumers, and ensuring market integrity. Their decisions can significantly influence the operational landscape for innovative financial solutions.

- International Organizations:Global entities such as the International Monetary Fund (IMF) and the Financial Action Task Force (FATF) set guidelines that transcend borders, promoting cooperation among nations in maintaining standards.

- Industry Associations:Trade groups and advocacy organizations represent the interests of firms operating in the space, advocating for favorable policies and providing a collective voice in discussions with regulators.

- Academic Institutions:Researchers and scholars contribute through analysis and studies that inform stakeholders about the implications of different approaches, helping to guide policymakers in their decisions.

- Technology Developers:Entities involved in creating innovative solutions often provide insights into practical challenges and opportunities, influencing how policies are formulated to accommodate evolving technologies.

Each of these participants not only shapes the discourse but also interacts with one another, creating a multifaceted ecosystem that requires continuous dialogue and adaptation to new developments within the financial domain.

Impact of Regulations on Market Stability

The framework governing the financial ecosystem plays a crucial role in maintaining balance within the marketplace. It shapes behavior, instills trust, and can either hamper or enhance participation among investors. Striking the right equilibrium is essential to foster a healthy environment for growth and innovation while minimizing volatility.

- Investor Confidence: Clear guidelines can increase trust among participants. When individuals understand the rules, they are more likely to engage actively in trading activities.

- Market Volatility: Excessive ambiguity or inconsistent enforcement can lead to erratic price movements, deterring long-term investment.

- Fraud Prevention: Comprehensive frameworks help identify and reduce fraudulent activities, further protecting individuals and promoting a fair playing field.

- Institutional Participation: Established firms are more inclines to enter the market when they are assured of a stable system that mitigates risk.

Moreover, the influence of governance systems extends to various aspects, such as technological innovation and the development of new financial products. Proper oversight can spur advancements by providing a secure environment for exploration. However, overly restrictive measures may stifle creativity and limit the expansion of novel solutions.

- Balance is essential. Striking an appropriate mix between fostering innovation and ensuring security can have profound effects.

- Global collaboration among different jurisdictions can lead to more harmonious practices that alleviate concerns over regulatory arbitrage.

- Continuous adaptation to market evolution is crucial to keep pace with rapid changes and emerging threats.

Ultimately, the interaction between control mechanisms and the market significantly impacts stability. A well-structured approach can provide the necessary foundations for a robust marketplace that supports sustainable growth.

Comparative Analysis of International Approaches

This section aims to delve into the various methodologies adopted by different nations regarding the oversight and management of digital assets. By examining a range of strategies, we can better understand how cultural, economic, and political factors influence policy-making in this dynamic sector.

Countries differ significantly in their treatment of digital currencies, with some embracing innovation while others impose strict barriers. This variation reflects distinct national priorities, risk perceptions, and investment climates. Below, we present a table summarizing the unique stances of selected nations:

| Country | Approach | Key Features |

|---|---|---|

| United States | Decentralized Regulation | Multiple agencies involved; guidance evolving with technology. |

| China | Restrictive | Comprehensive ban on trading; focus on state-controlled digital currency. |

| European Union | Integrated Framework | Proposed legislation for harmonized oversight across member states. |

| Japan | Proactive | Legal recognition; regulatory clarity fostering innovation. |

| Switzerland | Supportive | Clear guidelines; attractive domicile for blockchain startups. |

This comparative overview highlights the spectrum of approaches, revealing that there is no one-size-fits-all solution. Each strategy is informed by local contexts, challenges, and aspirations, demonstrating a complex landscape that stakeholders must navigate.

Challenges Faced by Regulatory Bodies

As the digital asset landscape evolves, authorities encounter numerous hurdles that complicate their efforts to establish effective frameworks. The rapid pace of technological advancement, coupled with the innovative nature of decentralized systems, poses significant challenges for governance entities striving to create a secure and reliable environment for users and investors.

Key Issues Encountered

- Rapid Technological Change: The speed at which new technologies emerge makes it difficult for authorities to keep pace, often resulting in outdated policies that inadequately address current realities.

- Cross-Border Jurisdiction: Differing legal systems and regulatory approaches across nations hinder the ability to enforce unified standards, allowing for regulatory arbitrage.

- Risk of Stifling Innovation: Over-regulation may inhibit the development of new technologies and solutions, discouraging entrepreneurs and investors from participating in the ecosystem.

- Resource Limitations: Many oversight bodies lack the necessary resources and expertise to thoroughly understand and monitor digital assets effectively.

- Consumer Protection: Protecting users from fraud and scams remains a priority, but implementing adequate measures without suffocating the market poses a daunting task.

Balancing Act

Finding an equilibrium between fostering innovation and ensuring safety is critical for authorities. They must adapt to the dynamic nature of the environment while addressing public concerns, which requires ongoing dialogue with stakeholders, including industry players, consumers, and international counterparts. As the sector continues to mature, developing tailored strategies to tackle these obstacles will be essential for achieving sustainable growth.

Future Trends in Cryptocurrency Governance

The evolving landscape of digital assets presents intriguing possibilities for oversight and management frameworks. As technology advances and the use of virtual currencies proliferates, the need for adaptive governance approaches becomes increasingly apparent. Stakeholders are beginning to explore innovative methodologies to ensure safety, transparency, and accountability.

Key developments to watch in governance models include:

- Decentralized Governance: Enhanced focus on community-led decision-making processes that empower users and stakeholders.

- Interoperability: Increased collaboration between different platforms, allowing for seamless operations across various digital asset systems.

- Enhanced Regulatory Collaboration: Greater dialogue between industry players and governing bodies, fostering a mutual understanding of objectives and challenges.

- Adoption of Advanced Technologies: Utilization of artificial intelligence and blockchain analytics for more effective monitoring and compliance.

- Consumer Protection Initiatives: Development of frameworks ensuring the safety of users, emphasizing education and awareness.

As these dynamics unfold, organizations and communities will need to adapt to ensure resilient frameworks that can withstand the test of time. The interplay between innovation and governance will shape the future landscape of financial interactions, paving the way for enhanced trust and security among participants.

Q&A: Cryptocurrency regulations around the world

What are the main trends in global cryptocurrency regulations currently?

The main trends in global cryptocurrency regulations include increasing oversight from governments and regulatory bodies, a push for clearer guidelines to protect consumers, and initiatives aimed at preventing money laundering and fraud. Additionally, many countries are exploring legislation that balances innovation with security, reflecting a desire to foster the growth of the cryptocurrency market while ensuring that risks are managed effectively. We’re also seeing a trend towards international cooperation, as countries recognize that cryptocurrency operates globally and requires a coordinated regulatory response.

How do different countries approach cryptocurrency regulation?

Countries vary significantly in their approach to cryptocurrency regulation. For instance, the United States has a fragmented regulatory landscape, with different states and federal agencies implementing their own rules. Conversely, countries like Switzerland have adopted a more welcoming stance, creating a framework that encourages cryptocurrency innovation while maintaining regulatory oversight. In contrast, some countries, such as China, have imposed strict bans on cryptocurrency trading and Initial Coin Offerings (ICOs). This divergence reflects differing national priorities regarding finance, innovation, and consumer protection.

What potential future changes in cryptocurrency regulations should investors be aware of?

Investors should be mindful that future changes in cryptocurrency regulations may involve stricter compliance requirements, particularly in areas such as anti-money laundering (AML) and know-your-customer (KYC) practices. Additionally, the regulatory landscape could evolve to include clearer definitions of digital assets, leading to more robust investor protections. Policymakers may also implement tax regulations specifically tailored for cryptocurrency transactions. As the technology behind cryptocurrencies continues to evolve, regulation will likely adapt to address new challenges and opportunities, which could significantly impact the investment landscape.

Why is it important for regulations to be established in the cryptocurrency market?

Establishing regulations in the cryptocurrency market is crucial for several reasons. Firstly, it provides consumers with protection against fraud and scams, which are prevalent in a largely unregulated market. Regulations help build trust between users, investors, and service providers by ensuring a level of accountability. Secondly, clear regulations encourage more institutional investment in cryptocurrencies, as firms are more likely to participate in a market with defined legal frameworks. Lastly, regulations can help mitigate risks associated with financial crimes, such as money laundering and terrorist financing, by ensuring that transactions are transparent and traceable.

What role does international cooperation play in cryptocurrency regulation?

International cooperation is vital for effective cryptocurrency regulation due to the global nature of digital currencies. Cryptocurrencies can easily cross borders, making it challenging for any single country to regulate their usage and prevent illicit activities effectively. Collaborative efforts between countries can lead to the standardization of regulations, improved information sharing, and the development of best practices. Initiatives such as the Financial Action Task Force (FATF) guidelines are examples of how countries can work together to ensure a consistent approach to combatting financial crimes associated with cryptocurrencies while supporting legitimate use cases. Ultimately, international cooperation enhances the ability to address risks and foster innovation on a global scale.

What are the main trends in global cryptocurrency regulations as of 2023?

As of 2023, the main trends in global cryptocurrency regulations include increased scrutiny from governments and regulatory bodies, the development of comprehensive legal frameworks, and a growing emphasis on consumer protection. Many countries are seeking to establish clear guidelines to prevent fraud, money laundering, and other illicit activities associated with cryptocurrencies. Additionally, there is a notable push for collaboration between nations to create a cohesive regulatory environment. Countries like the United States and the European Union are moving towards establishing standardized regulations that foster innovation while ensuring the safety of investors. The rise of Central Bank Digital Currencies (CBDCs) is also influencing regulatory approaches, as governments explore ways to leverage blockchain technology for their monetary systems while regulating private cryptocurrencies more strictly.

What are the key regulatory changes for crypto in 2024?

In 2024, key regulatory changes for crypto include the implementation of new regulations focusing on crypto service providers, stricter oversight of crypto exchanges, and comprehensive frameworks for stablecoins. Governments around the world are expected to enhance regulations to address issues related to money laundering, terrorism financing, and investor protection.

How does the Financial Conduct Authority (FCA) influence crypto regulation in the UK?

The Financial Conduct Authority (FCA) influences crypto regulation in the UK by overseeing cryptocurrency exchanges and crypto service providers. The FCA enforces compliance with anti-money laundering regulations and other financial services rules to ensure the safety and transparency of the crypto industry in the UK.

What impact did the introduction of the Markets in Crypto-Assets (MiCA) regulation have on the European crypto industry?

The introduction of the Markets in Crypto-Assets (MiCA) regulation has had a significant impact on the European crypto industry by providing a unified regulatory framework for crypto-assets across the EU. MiCA aims to regulate stablecoins, crypto trading platforms, and crypto service providers, ensuring greater legal certainty and protection for investors.

How does South Korea approach crypto regulation differently from other countries?

South Korea takes a progressive approach to crypto regulation by integrating crypto-assets into its financial services framework and implementing robust measures to combat money laundering and terrorism financing. The Financial Services Commission (FSC) oversees the registration and compliance of crypto businesses to protect investors and ensure market stability.

What are the regulatory challenges associated with crypto trading platforms?

Regulatory challenges associated with crypto trading platforms include ensuring compliance with anti-money laundering and counter-terrorism financing regulations, protecting consumer assets, and preventing market manipulation. Regulators must address these issues while balancing the need to foster innovation and maintain market integrity.

How do capital gains tax regulations affect cryptocurrency investments?

Capital gains tax regulations affect cryptocurrency investments by taxing the profits made from buying and selling crypto-assets. Investors must report their gains and pay taxes according to the tax laws in their jurisdiction, which can impact the overall profitability of their crypto investments.

What role does the Securities and Exchange Commission (SEC) play in regulating cryptocurrencies in the United States?

The Securities and Exchange Commission (SEC) regulates cryptocurrencies in the United States by overseeing securities-related aspects of crypto-assets, including initial coin offerings (ICOs) and certain types of crypto tokens. The SEC ensures that these activities comply with securities laws to protect investors and maintain market integrity.

How does the Commodity Futures Trading Commission (CFTC) regulate futures trading in the crypto sector?

The Commodity Futures Trading Commission (CFTC) regulates futures trading in the crypto sector by overseeing the trading of cryptocurrency futures contracts and ensuring that they comply with federal regulations. The CFTC aims to prevent market manipulation and protect investors participating in crypto futures markets.

What is the role of the Monetary Authority of Singapore (MAS) in the regulation of digital assets?

The Monetary Authority of Singapore (MAS) regulates digital assets by enforcing the Payment Services Act, which covers licensing requirements for crypto exchanges, digital payment tokens, and other digital asset services. MAS aims to ensure financial stability and foster innovation while maintaining a robust regulatory environment for digital assets.

How does the regulation of stablecoins differ from other types of crypto-assets?

The regulation of stablecoins differs from other types of crypto-assets due to their role as a means of payment and their potential impact on financial stability. Regulations for stablecoins often focus on ensuring they are adequately backed, transparent in their issuance and redemption processes, and compliant with financial stability requirements.

What is the significance of having a regulatory framework for digital assets?

A regulatory framework for digital assets is significant because it provides clarity and legal certainty for the crypto industry, helps prevent fraud and market manipulation, and ensures consumer protection. It also supports the integration of digital assets into the traditional financial system and promotes innovation while maintaining market stability.

How do money laundering and terrorism financing regulations impact the crypto industry?

Money laundering and terrorism financing regulations impact the crypto industry by imposing requirements on crypto exchanges and service providers to implement anti-money laundering (AML) measures, such as customer identification and transaction monitoring. These regulations help prevent the misuse of cryptocurrencies for illegal activities and ensure compliance with international financial standards.

What are the implications of the lack of regulation in the cryptocurrency sector?

The lack of regulation in the cryptocurrency sector can lead to increased risks of fraud, market manipulation, and financial instability. It may also result in inadequate consumer protection and challenges in addressing issues such as money laundering and terrorism financing. Regulatory uncertainty can hinder the adoption and growth of the crypto industry.

How does the Reserve Bank of India (RBI) approach the regulation of cryptocurrency?

The Reserve Bank of India (RBI) has approached the regulation of cryptocurrency with caution, initially imposing restrictions on crypto trading and banking services related to crypto-assets. However, the RBI’s stance has evolved, and it now focuses on developing a regulatory framework to address risks associated with cryptocurrencies while exploring the potential for a central bank digital currency (CBDC).