In today’s fast-paced financial landscape, the digital currency market has emerged as a significant player, captivating attention from investors and enthusiasts alike. As more individuals seek to participate in this evolving ecosystem, understanding the key aspects of acquiring virtual currencies becomes crucial. This exploration aims to shed light on the fundamental processes and strategies that can simplify the experience of entering this innovative financial realm.

Engaging with these technologies offers numerous advantages, including enhanced convenience and increased transaction efficiency. However, navigating the intricacies of the market can pose challenges for newcomers. Familiarity with the right platforms, compliance aspects, and security measures will significantly enhance the experience and facilitate smoother transactions.

By examining effective approaches and best practices, aspiring digital currency holders can gain confidence in their decisions. This discussion will equip readers with the insights needed to confidently engage in the acquisition process while minimizing potential obstacles. Embarking on this journey will not only expand one’s understanding of digital finance but also open doors to various investment opportunities.

Understanding USD Coin (USDC)

This section delves into a digital currency that aims to bring stability and transparency to the world of cryptocurrency. It operates on a decentralized network while maintaining a close relationship with traditional finance. By leveraging the power of blockchain technology, this currency provides a secure and efficient method for transactions, appealing to both individuals and businesses alike.

Key Features of This Digital Asset

The primary characteristic of this asset is its peg to a traditional fiat currency, which reduces volatility commonly associated with other cryptocurrencies. Each unit is backed by an equivalent amount of the underlying fiat, promoting trust among users. Additionally, the transparent nature of its reserves fosters confidence, as anyone can verify the backing of the asset in real-time.

Benefits of Using This Cryptocurrency

Utilizing this form of digital currency allows for faster transactions with lower fees compared to traditional banking systems. It empowers users to transfer value internationally without the delays typically encountered through conventional methods. Furthermore, it offers unprecedented access and inclusivity in the financial system, catering to individuals who may not have access to traditional banking options.

Benefits of Using USD Coin

The utilization of a digital asset pegged to a stable fiat currency provides numerous advantages for both traders and investors. Its design promotes resilience against market volatility, offering a reliable option for those seeking stability in the ever-fluctuating world of cryptocurrencies.

Stability and Predictability

One of the primary merits of this digital token is its inherent stability. Linked to a well-established currency, it mitigates risks associated with drastic price fluctuations commonly seen in the crypto market. This predictability allows users to confidently transact, safeguarding their investments from sudden market shifts.

Enhanced Liquidity and Accessibility

This crypto asset also boasts significant liquidity, enabling quick transactions and seamless exchanges across various platforms. Coupled with easy accessibility, it empowers users to engage in digital finance without facing the complexities of traditional banking systems, making it an attractive choice for daily transactions and financial operations.

In summary, the reliability, ease of use, and liquidity make this digital asset an appealing option for both newcomers and seasoned participants in the digital currency ecosystem.

Choosing the Right Exchange

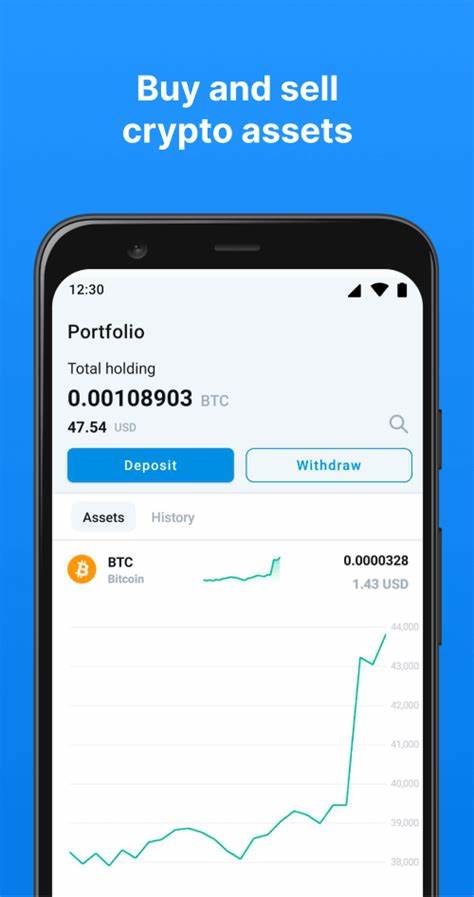

Selecting a suitable platform for your transaction is crucial for a seamless experience. The marketplace you choose can significantly influence not only the ease of the process but also the security of your assets and potential fees involved. To make an informed decision, it’s essential to consider several key factors that could impact your trading journey.

Factors to Consider

When evaluating various trading platforms, prioritize factors such as user experience, available trading pairs, transaction speeds, and security measures. A user-friendly interface will enhance your overall experience, ensuring that even beginners can navigate the platform with ease. Moreover, ensure that the platform supports the specific assets you wish to engage with, as limited options may constrain your trading capabilities.

Security and Reputation

Ensure that the platform has robust security protocols in place to protect your investments. A reputable exchange should have a history of reliable performance and positive user feedback. Look for information on their security measures, such as two-factor authentication and cold storage of assets. A trustworthy platform can provide peace of mind as you engage in transactions.

Ultimately, thorough research and assessment of various options will lead you to a platform that aligns with your needs and preferences, enhancing your overall trading experience.

Steps to Purchase USDC Safely

Acquiring digital currencies can be a straightforward endeavor, provided certain precautions are taken. Ensuring security throughout the transaction process is essential for a hassle-free experience. Below are key actions to consider to safeguard your investments.

First, it is crucial to conduct research on reliable platforms that facilitate this type of transaction. Look for exchanges with a strong reputation, positive user reviews, and comprehensive security measures in place. Verify their regulatory compliance to further enhance trustworthiness.

Next, set up a secure digital wallet to store your assets safely. Choose wallets equipped with advanced security features such as two-factor authentication (2FA) and encryption methods that provide an additional layer of protection against unauthorized access.

When ready to proceed, create an account on your chosen exchange if you haven’t already done so. Ensure you enable all security features offered, including secure passwords and account recovery options. This reduces the risk of account compromise.

After your account is set up and wallet created, familiarize yourself with the verification process required by the platform. Complete any identity checks or document submissions accurately to facilitate smooth transactions.

Once everything is in place, initiate a transaction carefully, taking into account the best time to purchase and the fees involved. Confirm all details before finalizing the exchange to avoid any costly mistakes.

Finally, after the transaction is completed, transfer your assets to your wallet immediately. This action minimizes the risk associated with leaving funds on the exchange, where they may be vulnerable to potential hacks.

Storing Your USD Coin Securely

Ensuring the safety of your digital assets is crucial in the ever-evolving landscape of cryptocurrency. With the right approach, you can protect your holdings from potential threats and unauthorized access. It’s important to understand the various methods available for safeguarding your investments and the steps you can take to enhance security.

Types of Storage Options

There are primarily two categories for saving your digital currencies: hot wallets and cold wallets. Hot wallets are connected to the internet, providing convenience for frequent transactions, while cold wallets are offline, offering increased protection against online threats. Each option has its advantages and disadvantages, so consider your individual needs and preferences when choosing a storage solution.

Best Practices for Enhanced Security

Regardless of the storage method you select, following a few best practices can significantly enhance the security of your digital assets. Always enable two-factor authentication on your accounts, use strong and unique passwords, and regularly update your software. Furthermore, consider backing up your private keys and storing them in a secure location. By implementing these strategies, you can protect your investments from potential risks and enjoy peace of mind.

Navigating USDC Transactions and Fees

Understanding the intricacies of digital currency transactions and associated costs is essential for anyone looking to engage in this innovative financial ecosystem. These elements can significantly influence the effectiveness and efficiency of transferring assets, so it is crucial to familiarize oneself with the challenges and considerations at play.

Transaction Process Overview

When utilizing a stablecoin, users must follow several essential steps to ensure a smooth exchange. Initially, selecting an appropriate platform that supports the digital asset is vital. This entails registering an account, undergoing any necessary identity verification, and linking a payment method. Once these prerequisites are met, users can initiate transactions, ensuring they double-check the destination address to avoid costly errors.

Understanding the Costs Involved

In addition to the standard transaction fees associated with transfers, users may encounter various costs depending on the chosen platform and network congestion. Exchange fees can vary widely, often influenced by the service provider’s policies and market demand. Additionally, network fees, determined by the blockchain’s current load, must also be considered, as they can fluctuate. Being aware of these expenses beforehand can lead to more informed financial decisions.

Tracking the Market and Price Trends

Understanding the dynamics of the financial landscape is essential for anyone interested in digital assets. This involves observing patterns, key indicators, and the overall sentiment that can influence values. By effectively monitoring these elements, participants can make informed decisions and enhance their engagement with the market.

To effectively track price movements and market trends, consider the following methods:

- Price Charts: Analyze historical and real-time data through various charting tools available on trading platforms.

- News Aggregators: Stay updated with the latest developments by following news websites and aggregators that focus on cryptocurrency.

- Market Sentiment Indicators: Utilize tools that gauge investor mood based on social media trends and community discussions.

- Volume Analysis: Track trading volumes to assess market strength and identify potential breakout points.

Additionally, employing a combination of technical analysis techniques can aid in recognizing emerging trends:

- Moving Averages: Use short-term and long-term moving averages to identify potential price reversals and confirmation of trends.

- Relative Strength Index (RSI): Apply this momentum oscillator to determine if a market is overbought or oversold.

- Support and Resistance Levels: Identify key levels where price reactions are likely to occur, providing valuable insight into future movements.

By actively engaging in these practices, investors and enthusiasts can simultaneously enhance their understanding of market mechanisms while strategically positioning themselves for future opportunities.

Q&A: How to buy usd coin usdc

What is USD Coin (USDC) and why should I consider buying it?

USD Coin (USDC) is a type of stablecoin, which means its value is pegged to the US dollar, making it less volatile than other cryptocurrencies. USDC is backed by reserves and is fully compliant with U.S. regulations, providing a level of security and trust for investors. Many people consider buying USDC to facilitate transactions on various cryptocurrency exchanges, hedge against market volatility, or use it for yield farming and earning interest. Additionally, since it is widely accepted, it serves as a reliable bridge between cryptocurrencies and traditional finance.

How can I buy USDC easily?

Buying USDC can be straightforward. First, you’ll need a cryptocurrency wallet to store your USDC. Next, choose a cryptocurrency exchange that supports USDC trading pairs, such as Coinbase, Binance, or Kraken. After creating and verifying your account, you can deposit funds in your local currency or another cryptocurrency. Once your funds are available, navigate to the USDC trading section, select the amount you want to buy, and confirm your purchase. After the transaction, make sure to transfer your USDC to your wallet for enhanced security. Always do your research and choose a reputable exchange to ensure a smooth experience.

Are there any fees associated with buying USDC?

Yes, there are typically several types of fees associated with buying USDC. Firstly, exchanges may charge a trading fee, which is usually a percentage of the transaction amount. There may also be deposit fees depending on your payment method (credit card, bank transfer, etc.) and withdrawal fees when transferring USDC out of the exchange to your wallet. It’s important to review the fee structure of your chosen platform before making a purchase to ensure you understand the total costs involved.

Can I buy USDC with a credit card or only with cryptocurrency?

Most exchanges that facilitate USDC purchases offer various payment methods, including credit card transactions. Buying USDC with a credit card is often one of the fastest ways to acquire it, but it may also come with higher fees. Alternatively, you can also buy USDC using cryptocurrency by trading another crypto asset on the exchange. Check your chosen platform’s supported payment methods to see if credit card purchases are available and what the associated fees and limitations might be.

Is it safe to buy USDC, and what security measures should I take?

Buying USDC is generally considered safe, especially since it is a regulated stablecoin backed 1:1 by US dollars held in reserve. However, always exercise caution when purchasing any cryptocurrency. Use reputable exchanges, enable two-factor authentication on your account, and consider transferring your USDC to a private wallet after purchase for added security. Keep your private keys secure and be aware of phishing attempts. Additionally, educate yourself on common scams and how to protect your assets to enhance your overall security.

How can you buy and sell USDC using a debit card?

You can seamlessly buy and sell USDC using a debit card on various crypto exchanges, making it easy to purchase USD Coin without any hidden fees.

What is the best way to buy USDC in the U.S.?

The best way to buy USDC in the U.S. is through a reputable crypto exchange that allows you to use a credit or debit card for quick and secure transactions.

How is USD Coin’s value pegged to the U.S. dollar?

USD Coin’s value is pegged to the U.S. dollar, meaning one USDC is always intended to be equivalent to one U.S. dollar, providing stability as a stablecoin.

Can you purchase USD Coin using Apple Pay?

Yes, you can purchase USD Coin using Apple Pay on supported platforms, which makes it easy to buy USD Coin directly from your Apple device.

What is the market cap of USDC?

The market cap of USDC reflects the total value of all USD Coin in circulation, a figure that constantly changes based on the amount of USDC issued and redeemed.

How do USDC holders earn passive income?

USDC holders can earn passive income by lending their stablecoins through various financial institutions or decentralized finance platforms.

Is there a way to buy gift cards using USDC?

Yes, you can buy gift cards using USDC on select platforms, allowing you to seamlessly spend your digital dollars on a variety of retailers.

Why is USDC considered a stablecoin?

USDC is considered a stablecoin because its value is pegged to the U.S. dollar, ensuring that 1 USDC equals 1 USD, providing a reliable store of value in the crypto market.

What are the benefits of using USDC to trade on a crypto exchange?

Trading with USDC on a crypto exchange offers the advantage of stability, as its value is pegged to the U.S. dollar, reducing volatility compared to other cryptocurrencies.

How can you discover how to buy USDC with your debit card?

You can discover how to buy USDC with your debit card by exploring detailed guides on crypto exchanges or financial platforms that support debit card transactions.

How does using USDC compare to other stablecoins like USDT?

USDC is often preferred by some due to its transparency and regulation, making it a trusted stablecoin compared to other stablecoins like USDT.

Can you buy and sell USDC directly from your crypto wallet?

Yes, many crypto wallets allow you to buy and sell USDC directly within the app, providing a seamless experience for managing your digital assets.

How is the equivalent amount of USDC determined during a purchase?

The equivalent amount of USDC is determined by the current price of USD Coin, which is always pegged to the U.S. dollar at a 1:1 ratio.

What role do financial institutions play in supporting USDC?

Financial institutions back USDC by holding an equivalent amount of U.S. dollars in reserve, ensuring that the stablecoin remains pegged to the U.S. dollar.

What makes USDC a good option for those new to crypto like Ethereum?

USDC is a good option for those new to crypto like Ethereum because it provides the stability of a stablecoin, minimizing the risk of price volatility while participating in the crypto ecosystem.