In today’s dynamic economic landscape, finding the most suitable financial partner can significantly impact one’s portfolio and overall wealth accumulation. As individuals seek to grow their assets, understanding the variables that influence this relationship becomes paramount. A well-informed decision can pave the way for opportunities, while a hasty choice may lead to unforeseen challenges.

Several critical aspects must be considered when evaluating potential advisors in this realm. From their expertise and reputation to the tools and resources they offer, every element plays a crucial role in shaping an effective strategy. Creating a lasting alignment with a knowledgeable entity can be the cornerstone of achieving long-term objectives.

With the abundance of options available, individuals can sometimes feel overwhelmed by the intricacies of this process. It is essential to approach it with a discerning mindset, asking the right questions and gathering relevant information. This careful evaluation not only empowers investors but also sets the stage for a fruitful and collaborative relationship, ensuring a path to enhanced prosperity.

Understanding the Role of Investment Brokers

Investment brokers serve as intermediaries in the financial markets, facilitating transactions between buyers and sellers. Their expertise and guidance can significantly impact an individual’s portfolio, helping them navigate complex investment landscapes. By leveraging their knowledge, investors can make informed decisions that align with their financial goals.

Key Responsibilities of Brokers

- Executing trades on behalf of clients

- Providing market analysis and insights

- Offering personalized financial advice

- Assisting with portfolio management

- Keeping clients updated on market trends

Types of Brokers

- Full-service Brokers: These professionals offer comprehensive services, including financial planning and wealth management.

- Discount Brokers: They provide basic trading services with lower fees, focusing primarily on executing trades.

- Online Brokers: Operating through digital platforms, these brokers allow clients to manage investments independently at reduced costs.

Understanding the various roles and responsibilities of brokers is crucial for investors seeking to optimize their investment strategies. Selecting a broker that aligns with one’s financial objectives can lead to better market outcomes and enhanced growth potential.

Criteria for Selecting a Broker

When embarking on an investment journey, identifying a suitable intermediary is crucial. Numerous aspects influence the decision-making process, each contributing to the overall experience and potential profitability. Whether you are a newcomer or an experienced trader, paying attention to specific factors will aid in making an informed choice.

Key Factors to Consider

- Regulation and Safety: Ensure that the firm operates under strict regulatory frameworks. This offers protection for your capital and instills confidence in their practices.

- Trading Fees: Compare the commission structures and fees associated with various services. Lower expenses can lead to increased net returns over time.

- Available Investment Options: Review the range of assets available to trade. A diverse selection allows for better portfolio diversification.

- Platform Usability: A user-friendly trading interface is essential for effective execution of strategies. Consider reviewing demo accounts to assess functionality.

- Customer Support: Reliable assistance can make a significant difference, especially during critical trading moments. Evaluate the availability and responsiveness of the support team.

Long-Term Fit

- Account Types: Look for platforms that offer various account types to match your trading style and capital.

- Research and Educational Resources: Access to quality research materials and educational tools can enhance your trading knowledge.

- Reviews and Reputation: Investigate feedback from current and past users to gauge the overall performance and integrity of the service.

By systematically analyzing these criteria, investors can better navigate the multitude of options available and align their choice with their financial objectives.

Types of Investment Brokers Explained

In the world of finance, various professionals assist individuals and institutions in executing trades and managing assets. Understanding the distinctions among these experts is crucial for making informed decisions about where to allocate resources. This section delves into several classifications of these financial intermediaries, highlighting their unique characteristics and functionalities.

Full-service advisors provide a comprehensive suite of offerings that often include personalized consultations, portfolio management, and financial planning. They typically cater to clients looking for extensive support and are charged higher fees, reflecting the breadth of services rendered.

Discount providers, in contrast, focus primarily on facilitating trades at lower costs. These platforms usually require clients to conduct their own research and decision-making, making them suitable for more experienced investors who are comfortable operating independently.

Robo-advisors represent a modern approach to investing, utilizing algorithms to manage portfolios automatically based on individual risk tolerance and financial goals. This option is popular among tech-savvy investors seeking a hands-off experience without the high fees associated with traditional services.

Finally, specialized professionals may focus on particular types of assets or investment strategies, such as real estate or options trading. Their expertise can offer unique insights and strategies that are particularly beneficial for niche markets.

Evaluating Broker Fees and Commissions

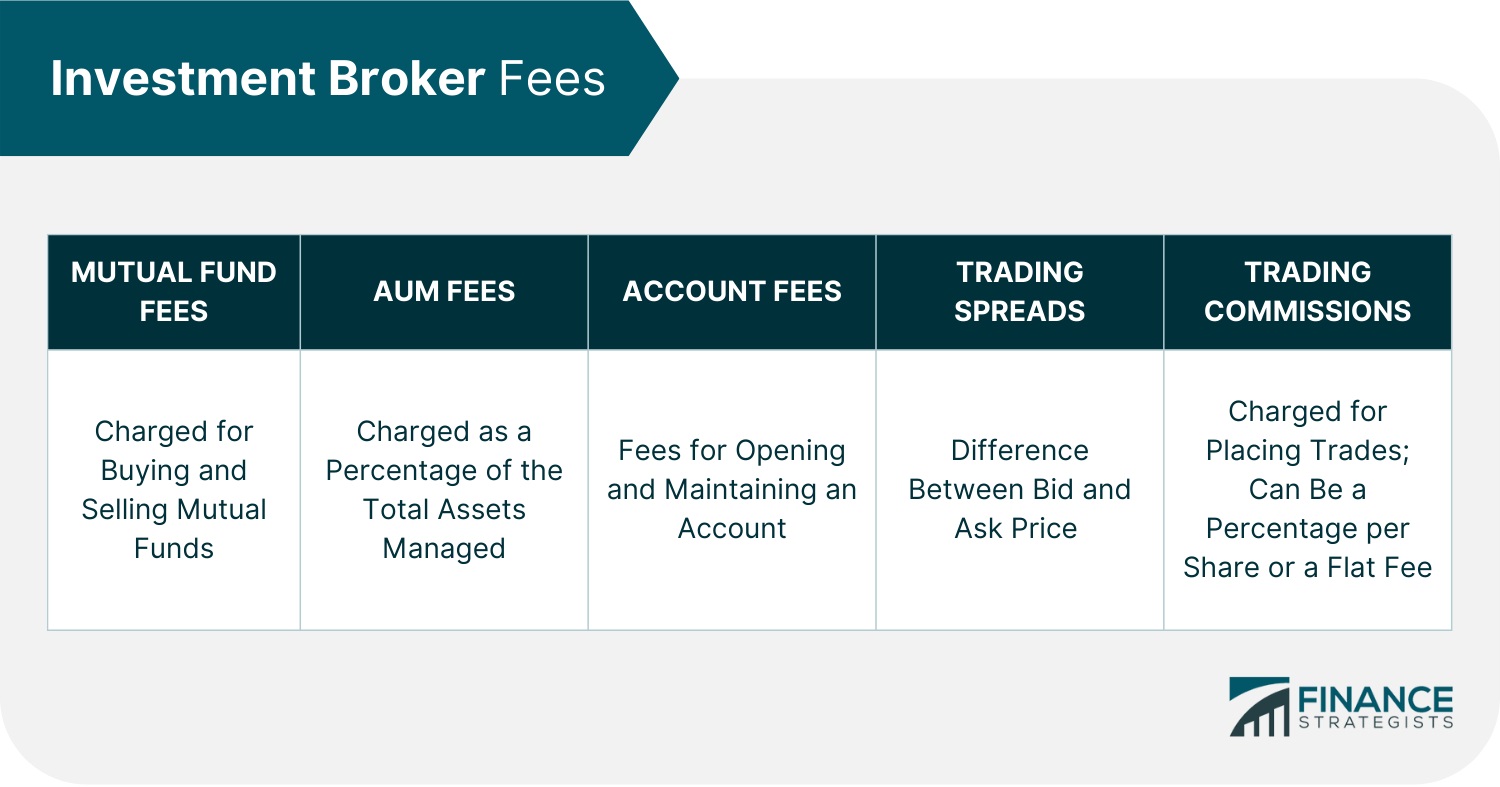

Understanding the costs associated with trading is crucial for anyone looking to engage in financial markets. Fees and commissions can significantly impact overall returns, making it essential to analyze these charges meticulously. Learning about different pricing structures enables investors to make informed decisions and maximize their potential gains.

Types of Fees

Various fees may apply, including trading commissions, account maintenance charges, and withdrawal fees. Trading commissions are typically the most visible, as they apply to each buy or sell order. In contrast, account maintenance fees might be assessed monthly or annually, depending on the platform. Additionally, understanding if a broker has hidden costs, such as inactivity charges, is vital for evaluating their overall value.

Comparing Costs

When assessing different platforms, comparing the fee structures side by side can reveal significant differences. Some brokers offer zero-commission trades, while others may charge a fixed fee per transaction. It is also essential to evaluate whether a broker provides additional services or tools that justify their fees. Factors like customer support, research resources, and user-friendly interfaces can contribute to the overall investment experience. Taking time to analyze these elements can lead to more favorable outcomes in your trading ventures.

Tools and Resources for Investors

Accessing the right instruments and knowledge can significantly influence the outcomes of financial endeavors. Individuals seeking to enhance their portfolios can benefit greatly from an array of tools designed to streamline decision-making and improve market understanding. These resources can provide insights, analysis, and various functionalities to assist in navigating complex investment landscapes.

Types of Tools Available

- Analytical Software: Programs that allow investors to analyze market trends and historical data.

- Stock Screeners: Online platforms that enable users to filter stocks based on specific criteria.

- Financial News Aggregators: Services that compile news and updates from various financial sources for quick access.

- Trading Platforms: Websites and applications that facilitate buying and selling assets efficiently.

- Investment Calculators: Tools that help determine potential returns, risks, and other key financial metrics.

Additional Learning Resources

- Online Courses: Platforms offering courses on various investment topics, enhancing knowledge and skills.

- Webinars and Workshops: Interactive sessions led by professionals sharing insights and strategies.

- Books and Articles: A wealth of literature covering fundamental and advanced investment concepts.

- Forums and Communities: Online spaces where investors can share experiences and advice.

- Podcasts and Videos: Engaging content providing expert opinions and market analysis.

Utilizing these tools and resources can empower investors to make more informed decisions and positively impact their financial journey.

Assessing Customer Service and Support

The importance of quality assistance and support cannot be understated when selecting a financial partner. A satisfactory level of communication and responsiveness can make a significant difference in navigating investments and addressing challenges. Evaluating how well a firm provides customer service is a crucial step in ensuring a positive experience.

When assessing the support services of a firm, consider various factors such as availability, responsiveness, and the variety of communication channels offered. It is beneficial to conduct thorough research and gather insights on how a company interacts with its clientele. Below is a table that outlines key aspects to examine:

| Aspect | Description |

|---|---|

| Availability | Check if support is accessible 24/7 or during specific hours. |

| Response Time | Analyze how quickly agents respond to inquiries or issues. |

| Communication Channels | Determine if they offer phone, email, chat, or social media support. |

| Knowledge and Expertise | Evaluate the proficiency of support staff in resolving queries. |

| Customer Reviews | Look for feedback from other clients regarding their support experience. |

Prioritizing customer service can lead to improved investment experiences and peace of mind. Engaging with potential partners through their support channels before making a commitment will provide valuable insights into their operational ethos and commitment to client satisfaction.

Q&A: Investment broker

What are the key factors to consider when choosing an investment broker?

When selecting an investment broker, several key factors should be taken into account. First, assess the broker’s fees and commissions, as these can significantly impact your overall investment returns. Next, consider the range of investment products offered, such as stocks, bonds, ETFs, and mutual funds, to ensure they align with your investment goals. The broker’s trading platform and tools are also important; look for user-friendly interfaces and robust research resources for effective trading. Additionally, verify the broker’s regulatory status and reputation, as a properly regulated broker will provide a level of security for your investments. Finally, customer service quality should not be overlooked; responsive support can make a significant difference, especially during critical trading situations.

How important is the broker’s regulatory status in my investment decision?

The regulatory status of an investment broker is extremely important, as it ensures that the broker adheres to specific standards of conduct and financial stability. Reputable brokers are usually regulated by recognized authorities, such as the Financial Industry Regulatory Authority (FINRA) in the United States or the Financial Conduct Authority (FCA) in the UK. Choosing a broker that is regulated gives you a level of protection against potential fraud, ensures fair treatment, and provides recourse options if something goes wrong. Additionally, regulatory bodies often require brokers to keep client funds in separate accounts and maintain a certain level of capital, which adds another layer of security for investors. Hence, always verify the regulatory compliance of a broker before making your investment decisions.

What types of investment brokers are available, and which one should I choose?

There are primarily three types of investment brokers you can choose from: full-service brokers, discount brokers, and online trading platforms. Full-service brokers provide comprehensive services including personalized investment advice, financial planning, and portfolio management, making them ideal for investors who prefer a hands-off approach or require extensive guidance. However, they usually charge higher fees. Discount brokers, on the other hand, offer fewer services at a lower cost, making them suitable for self-directed investors who are comfortable making their own investment decisions. Online trading platforms provide tools for trading and basic research capabilities, often at the lowest cost, appealing to tech-savvy individuals who prefer a DIY approach. Your choice should depend on your investment needs, experience level, and budget.

What questions should I ask a potential investment broker before opening an account?

Before selecting an investment broker, you should ask several important questions to ensure that the broker aligns with your investment needs. Start with inquiries about their fee structure—ask about commission rates, account maintenance fees, and any hidden charges. Next, inquire about the range of investment products they offer, as well as access to research tools and educational resources. It’s also crucial to understand their trading platform and its features, such as mobile trading availability and real-time market data. Don’t hesitate to ask about their customer support options, their hours of operation, and the ways you can reach them in case of issues. Additionally, request information about their regulatory compliance and security measures for protecting your personal and financial information. Gathering this information will help you make an informed decision about whether the broker is right for you.

What are some of the best online brokerage accounts for 2024?

Some of the best online brokerage accounts for 2024 include Fidelity Investments, Charles Schwab, and Interactive Brokers, all of which offer a wide range of investment products and low account minimums.

How can I find the best online broker for my investment needs?

To find the best online broker for your investment needs, consider factors like account fees, brokerage services offered, and whether the broker provides access to a wide range of investment products and tools.

What is the role of a financial advisor in managing a brokerage account?

A financial advisor can help manage a brokerage account by providing investment advisory services, guiding retirement planning, and helping to build and maintain an investment portfolio that aligns with your financial objectives.

What is the minimum investment required to open a brokerage account with Interactive Brokers?

Interactive Brokers typically has a low or no minimum investment requirement, making it accessible for new investors looking to buy and sell investments.

Why might Charles Schwab be considered the best broker for retirement accounts?

Charles Schwab is often considered the best broker for retirement accounts due to its comprehensive retirement planning tools, low account fees, and wide range of investment products, including ETFs and mutual funds.

How can I save for retirement using an online brokerage account?

You can save for retirement using an online brokerage account by investing in a retirement account like an IRA or 401(k), where you can buy and sell investments such as stocks, bonds, and ETFs.

What are the benefits of using Fidelity Investments as your brokerage firm?

Fidelity Investments offers a wide range of investment products, low-cost index funds, and top-tier customer service, making it a popular choice for both new and experienced investors.

What should I consider when choosing a brokerage firm for stock trading?

When choosing a brokerage firm for stock trading, consider factors like account fees, trading platforms, the range of available investment products, and whether the firm offers real-time market data and research tools.

Why is it important to check account fees before opening a brokerage account?

Checking account fees before opening a brokerage account is crucial because fees can impact your overall investment returns, especially if you are frequently buying and selling securities.

What makes Interactive Brokers stand out as a brokerage firm?

Interactive Brokers stands out as a brokerage firm due to its advanced trading platform, low fees, and access to global markets, making it an excellent choice for active traders and investors.

How can a new investor start with a brokerage account?

A new investor can start with a brokerage account by selecting a broker with low minimum investment requirements, such as Fidelity Investments, and gradually building their investment portfolio with a focus on long-term growth.

What are the benefits of having a checking account linked to your investment account?

Having a checking account linked to your investment account allows for seamless cash management, making it easier to transfer funds, access cash, and manage your overall financial needs in one place.

Why is retirement planning essential for managing an investment account?

Retirement planning is essential for managing an investment account because it helps ensure that your investments align with your long-term financial goals, such as saving for retirement and achieving financial security in the future.

How can I buy and sell investments through an online brokerage?

You can buy and sell investments through an online brokerage by accessing the broker’s trading platform, selecting the securities you want to trade, and executing the transactions according to your investment objectives.

What should I look for in the best overall online broker?

In the best overall online broker, look for low account fees, a wide range of investment products, reliable customer service, user-friendly trading platforms, and robust research tools to support your investment decisions.

What role do investment professionals play in managing a brokerage account?

Investment professionals provide valuable guidance in managing a brokerage account by offering personalized financial advice, helping to diversify your investment portfolio, and ensuring your investments align with your financial goals.