Main Trade and Margin Balances

Amidst the dynamic realm of financial markets and intricate interplays between variables, the domain of commerce bears witness to a quintessential facet known as Main Trade and Margin Balances. This profound concept serves as the cornerstone of economic success, encapsulating the symbiotic relationship between core exchanges and profit ratios.

The realm of Main Trade and Margin Balances embodies the intricacies of transactions that fuel the global economy, stimulating growth and fostering stability. Reverberating across markets, its essence lies in the synchronized dance of buying and selling, offering a playground for both seasoned investors and daring entrepreneurs alike.

In the pursuit of profit, Main Trade and Margin Balances act as the lynchpin, encompassing a myriad of financial instruments and strategies. With each transaction, the delicate balance between supply and demand is tested, as buyers and sellers partake in a synchronized ballet, perpetuating a perpetual cycle of exchange.

From the enchanting allure of commodities to the calculated risks of stock markets, Main Trade and Margin Balances beckon the brave souls willing to venture into the labyrinthine corridors of financial prowess. Armed with extensive knowledge and sharpened acumen, individuals navigate the tumultuous seas of volatility, searching for opportunities to reap the rewards of lucrative gains and surmount the perils of potential losses.

Determining Trade Balances in the Global Market

In the ever-evolving global market, understanding and analyzing trade balances is crucial for assessing the economic health of nations and identifying opportunities for growth. Trade balances refer to the difference between exports and imports of goods and services of a country over a specific period. By examining trade balances, policymakers, economists, and businesses can gain insights into the competitiveness of nations, the impact of trade policies, and the potential for economic expansion.

Factors Affecting Trade Balances

There are various factors that influence trade balances in the global market. One key factor is the competitiveness of a country’s industries and the comparative advantage they possess. Nations with industries that can produce goods or services at a lower cost or with higher quality compared to other countries tend to have positive trade balances as they can export more than they import. Additionally, international trade policies and regulations, exchange rates, global demand and supply dynamics, and geopolitical factors all play a role in determining trade balances.

Analyzing Trade Balances

Analyzing trade balances involves examining the data related to exports and imports of goods and services. Trade balance data often includes information on the value, volume, and nature of traded goods in addition to the countries involved in the trade. This data can be organized and presented in various ways, such as through tables, graphs, or charts. One commonly used method is to create a trade balance table that categorizes exports and imports by industry or product type, enabling a more detailed analysis of trends, patterns, and disparities.

Trade imbalances, where the value of imports exceeds that of exports, can indicate potential issues such as a lack of competitiveness in certain industries or reliance on imported goods and services. On the other hand, trade surpluses, where exports exceed imports, can suggest a country’s strength in certain sectors or a favorable trade environment. Understanding the reasons behind trade imbalances is vital for policymakers to devise strategies to address any economic vulnerabilities and promote sustainable growth.

| COUNTRY | TOTAL EXPORTS | TOTAL IMPORTS | TRADE BALANCE |

|---|---|---|---|

| Country A | $X billion | $Y billion | $Z billion |

| Country B | $X billion | $Y billion | $Z billion |

Trade balances can have significant implications for a country’s overall economic health. Positive trade balances can contribute to increased employment, production, and national income, while negative trade balances can lead to trade deficits, currency devaluations, and potential economic instability. Therefore, policymakers, economists, and businesses must closely monitor and analyze trade balances in the global market to make informed decisions and foster sustainable economic growth.

The Impact of Trade Balances on the Economy

In this section, we will explore the significance and influence of trade balances on the overall health and stability of an economy. Understanding the impact of trade balances is crucial for policymakers, economists, and businesses alike as it provides insights into the country’s competitiveness, export-import dynamics, and overall economic performance.

The Significance of Trade Balances

Trade balances, referring to the difference between the value of a country’s exports and imports, have a profound impact on the functioning of an economy. A positive trade balance, also known as a trade surplus, occurs when a country exports more goods and services than it imports, leading to increased foreign exchange reserves, job creation, and economic growth. Conversely, a negative trade balance, or trade deficit, arises when a country imports more than it exports, potentially leading to a drain on foreign reserves and affecting domestic industries.

Effects on Domestic Industries

The trade balance has a direct bearing on domestic industries, particularly in terms of competitiveness and market demand. A country with a trade surplus can invest in its industries, research and development, and infrastructure, fostering innovation, and enabling industries to expand their operations both domestically and abroad. Additionally, a trade surplus can result in increased demand for goods and services, leading to job creation, higher wages, and improved living standards.

Conversely, a trade deficit can have adverse effects on domestic industries. When a country relies heavily on imports, its domestic industries may face stiff competition from foreign companies. This can lead to reduced production, layoffs, and even closure of businesses. Additionally, dependence on imports may erode the country’s technological capabilities, hinder innovation, and limit growth prospects.

It is worth noting that excessive reliance on one type of trade balance, such as consistently maintaining a trade surplus or deficit, can pose risks to the economy. A prolonged trade surplus may lead to over-reliance on exports, making the country vulnerable to fluctuations in international markets. On the other hand, a chronic trade deficit can result in increased borrowing, accumulation of debt, and potential economic instability.

In conclusion, understanding the impact of trade balances on the economy provides a comprehensive view of a country’s economic health. By analyzing trade balances, policymakers and businesses can make informed decisions to enhance competitiveness, stimulate economic growth, and foster a balanced and sustainable economy.

Margin Balances and Risk Management

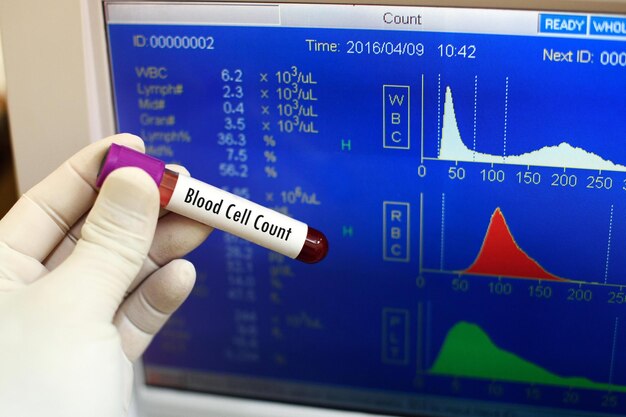

In the realm of financial trading, the proper management of margin balances is crucial for effectively managing risks and ensuring overall portfolio stability. Margin balances refer to the difference between a trader’s account equity and the required margin for open positions. This section explores the significance of margin balances in risk management and why maintaining proper margin levels is essential for traders.

Margin balances play a vital role in determining the amount of leverage a trader can employ and influence their potential profits and losses. By maintaining adequate margin requirements, traders can minimize the possibility of margin calls and associated costs, while also safeguarding against catastrophic losses. The effective utilization of margin balances allows traders to enhance their trading strategies and take advantage of market opportunities while keeping risks under control.

Moreover, monitoring margin balances ensures that traders remain within acceptable risk parameters set by regulatory bodies or brokerage firms. By adhering to these boundaries, traders can prevent excessive exposure to market volatility and protect their capital. This proactive approach to risk management through margin balances helps traders maintain financial stability and longevity in their trading endeavors.

When it comes to risk management, maintaining adequate margin balances also enables traders to diversify their portfolios effectively. By utilizing margin efficiently, traders can spread their investments across different asset classes or trading strategies, thereby reducing the impact of potential losses on their overall portfolio performance. This diversification helps traders build resilience against market fluctuations and enhance their chances of long-term success.

In conclusion, margin balances serve as a critical component of risk management in financial trading. By properly managing margin requirements, traders can maximize potential gains, minimize losses, and maintain a disciplined trading approach. Understanding the significance of margin balances and implementing effective risk management strategies are pivotal for traders aiming to achieve sustainable profitability and navigate the complexities of the financial markets.

Strategies for Enhancing Trade and Margin Performance

Addressing the Operation of Trade and Margin

In this section, we delve into effective approaches to optimizing the performance of trade and margin. We explore various methods that businesses can employ to bolster their trade operations and enhance their margin balances. By implementing these strategies, companies can bolster their revenue generation and improve financial efficiency without compromising the integrity of their trade and margin processes.

Maximizing Trade Efficiency

Efficiency plays a pivotal role in achieving optimal trade and margin balances. By streamlining and automating trade processes, businesses can minimize operational costs and reduce the risks associated with trade activities. Additionally, enhancing communication and collaboration with suppliers, partners, and customers can expedite trade procedures, resulting in increased trade volumes and improved balance ratios. Companies can further leverage advanced technologies such as artificial intelligence and blockchain to facilitate seamless trade execution and minimize potential errors.

Managing Margin Levels

The management of margin levels is crucial in maintaining a healthy financial standing. Companies need to proactively monitor and assess their margin levels to identify potential areas of improvement. Employing effective pricing strategies, including dynamic pricing and value-based pricing, can help optimize margins and maximize profitability. Additionally, implementing cost control measures and actively managing expenses can contribute to maintaining healthy margin balances. By closely monitoring market trends and customer demands, companies can also identify opportunities to adjust their product mix or expand into new markets to increase margin opportunities.

Strengthening Risk Management Practices

Enhanced risk management practices are essential in sustaining favorable trade and margin balances. Businesses should assess and manage potential risks associated with trade activities, such as currency fluctuations, geopolitical risks, and supply chain disruptions. Implementing robust risk mitigation strategies, such as hedging and diversification, can help safeguard against unforeseen events and minimize financial volatility. Furthermore, regular monitoring of key performance indicators and conducting comprehensive risk assessments can enable proactive decision-making and ensure the resilience of trade and margin balance.

Fostering Supplier and Customer Relationships

Building and nurturing strong relationships with suppliers and customers is crucial for long-term trade and margin success. Collaborative partnerships can lead to favorable trade terms, competitive pricing, and access to new markets. By leveraging customer feedback and actively engaging with suppliers, businesses can identify areas for improvement and create tailored solutions that deliver value to all stakeholders. Additionally, incorporating flexible payment terms and offering attractive incentives can encourage prompt payments and strengthen trade relationships, contributing to improved margin balances.

Continual Monitoring and Evaluation

Achieving sustained trade and margin performance necessitates ongoing monitoring and evaluation. By consistently tracking key indicators such as trade volume, margin ratios, and market trends, companies can identify potential areas for optimization and make data-driven decisions. Regular performance reviews and benchmarking against industry standards can provide valuable insights into areas needing improvement and aid in the formulation of future strategies. Additionally, leveraging advanced analytics and reporting tools can enhance visibility into trade and margin performance, facilitating proactive decision-making and ensuring long-term financial success.

In conclusion, this section explores a range of strategies for improving overall trade and margin balances. By effectively managing trade operations, maximizing trade efficiency, strengthening risk management practices, nurturing relationships with suppliers and customers, and continually monitoring performance, businesses can achieve sustainable growth and financial success. Employing these strategies enables organizations to enhance their competitive advantage and adapt to evolving market conditions while maintaining healthy trade and margin balances.

Regulation and Oversight of Trade and Margin Balances

The proper management and control of trade and margin balances are crucial for ensuring the stability and integrity of financial markets. In order to maintain a fair and transparent trading environment, regulatory bodies play a pivotal role in overseeing and enforcing rules and regulations associated with trade and margin balances. This section will provide an overview of the regulatory framework and supervision mechanisms implemented to ensure the responsible and efficient handling of these balances.

Regulatory Framework

Regulatory frameworks are established by government authorities to define the rules and guidelines that govern trading activities and margin balances. These frameworks are designed to protect market participants, maintain market integrity, and mitigate systemic risks. They encompass various laws, regulations, and policies which are regularly reviewed and updated to adapt to changing market dynamics and emerging trends. Regulatory bodies are responsible for both creating and implementing these frameworks, often in collaboration with industry stakeholders.

Supervision and Enforcement

The supervision and enforcement of trade and margin balances are carried out by regulatory bodies to ensure compliance with the established regulatory framework. Through proactive monitoring, inspections, and audits, these bodies assess the adherence of market participants to the prescribed rules. They have the authority to impose penalties and sanctions on those found in violation of the rules, in order to maintain market discipline and deter fraudulent activities.

| ROLE OF REGULATORY BODIES | RESPONSIBILITIES |

|---|---|

| Licensing and Registration | Ensuring that market participants meet the necessary requirements for conducting trading activities and managing margin balances. |

| Surveillance | Monitoring trading activities and margin balances to detect any irregularities or manipulative behavior. |

| Reporting and Disclosure | Requiring market participants to regularly report and disclose information related to trade and margin balances, ensuring transparency. |

| Education and Investor Protection | Providing educational resources and ensuring the protection of investors by implementing measures to prevent fraud and misconduct. |

In summary, the regulation and oversight of trade and margin balances are essential components of maintaining a fair and efficient financial marketplace. Regulatory bodies establish and enforce a framework of rules and regulations to safeguard market integrity and protect the interests of market participants. Through their supervision and enforcement efforts, they ensure compliance and impose penalties when necessary, thereby promoting transparency and stability in trading and margin management activities.

Q&A: Main Trade and Margin Balances

What is a margin account, and how does it differ from a cash account?

A margin account allows investors to borrow funds from a brokerage firm to purchase securities, whereas a cash account requires investors to use their own funds for transactions.

What is margin trading, and how does it work?

Margin trading involves buying and selling securities using borrowed funds from a brokerage firm. Investors can leverage their existing capital to potentially increase their buying power and investment returns.

What is a margin loan, and how is it used in margin trading?

A margin loan is a form of borrowing provided by a brokerage firm to investors who trade on margin. It allows investors to borrow funds against the value of securities held in their margin account.

What is maintenance margin, and why is it important in margin trading?

Maintenance margin is the minimum amount of equity that must be maintained in a margin account to avoid a margin call. It ensures that investors have sufficient funds to cover potential losses and meet their financial obligations.

What is margin interest, and how is it calculated?

Margin interest is the cost incurred by investors for borrowing funds in a margin account. It is calculated based on the amount borrowed and the prevailing interest rate set by the brokerage firm.

What does it mean to buy on margin?

Buying on margin refers to the practice of purchasing securities using borrowed funds from a brokerage firm. It allows investors to increase their purchasing power and potentially amplify their investment returns.

What is a margin call, and what happens if you receive one?

A margin call occurs when the value of securities in a margin account falls below the maintenance margin requirement. Investors must either deposit additional funds or sell securities to meet the margin call and restore their account’s equity.

What is a margin agreement, and why is it necessary?

A margin agreement is a contract between an investor and a brokerage firm that outlines the terms and conditions of trading on margin. It is necessary to establish the rights, obligations, and risks associated with margin trading.

How do you open a margin account, and what are the requirements?

To open a margin account, investors must submit an application to their chosen brokerage firm. The requirements typically include completing a margin agreement, meeting minimum account equity criteria, and undergoing a credit check.

What are the risks and benefits of trading using margin?

Trading on margin offers the potential for increased profits through leverage but also carries significant risks, including the possibility of magnified losses and margin calls. It is essential for investors to carefully assess their risk tolerance and financial situation before engaging in margin trading.

What are margin securities, and how are they used in trading?

Margin securities are assets purchased using borrowed funds in a margin account, allowing investors to amplify their buying power and potentially increase investment returns.

What is a margin debit, and how does it affect your account balance?

A margin debit is the amount owed to a brokerage firm for borrowing funds to purchase securities on margin. It reduces the account balance, as it represents the borrowed portion of the investment.

What is margin buying power, and why is it important in trading?

Margin buying power refers to the maximum amount of additional securities an investor can purchase using funds borrowed from a brokerage firm. It provides flexibility and leverage in trading but also increases the potential risk.

What are the risks of trading on margin?

The risks of trading on margin include the potential for magnified losses, margin calls, and the obligation to repay borrowed funds even if the investment loses value. It can also lead to increased volatility and financial instability.

How do you trade options on margin?

Options trading on margin involves using borrowed funds to purchase options contracts. It allows investors to leverage their investment capital and potentially increase returns, but it also amplifies risks associated with options trading.

What does it mean to purchase securities on margin?

Purchasing securities on margin involves using borrowed funds from a brokerage firm to buy stocks or other financial assets. It allows investors to increase their buying power and potentially enhance investment returns.

What is equity in your margin account, and why is it significant?

Equity in a margin account refers to the difference between the account’s total value and the amount borrowed on margin. It represents the investor’s ownership stake in the account and serves as a measure of financial stability.

What are margin requirements, and can they change over time?

Margin requirements are the minimum amounts of equity that investors must maintain in their margin accounts. These requirements can change based on market conditions, regulatory policies, and the brokerage firm’s discretion.

What is a margin call, and what triggers it?

A margin call occurs when the value of securities in a margin account falls below the maintenance margin requirement. It triggers a demand from the brokerage firm for the investor to deposit additional funds or sell securities to restore the required equity.

What is margin maintenance requirement, and how does it impact trading?

The margin maintenance requirement is the minimum level of equity that investors must maintain in their margin accounts to avoid a margin call. It serves as a safeguard against potential losses and helps ensure the financial stability of the account.