In the ever-evolving world of cryptocurrencies, mining remains a popular and profitable activity. But with hundreds of cryptocurrencies available, it can be overwhelming to determine which one is the most profitable to mine. Whether you are a seasoned miner or just starting out, finding the right cryptocurrency to mine can make a significant difference in your earnings.

When it comes to profitability, several factors need to be considered. These include the price of the cryptocurrency, the mining difficulty, the cost of electricity, and the mining equipment’s efficiency. Additionally, it is essential to stay up to date with the latest trends and market analysis to ensure your mining efforts are directed towards the most profitable cryptocurrencies.

One of the most profitable cryptocurrencies to mine is Bitcoin. As the first and largest cryptocurrency, Bitcoin has gained significant traction and has a market dominance that makes it a favorable choice for miners. However, with the increased difficulty of mining Bitcoin, alternative cryptocurrencies, known as altcoins, have emerged as profitable options.

Ethereum, for instance, is another highly profitable cryptocurrency to mine. With its smart contract capabilities and decentralized applications, Ethereum has become a preferred choice for many miners. Other altcoins such as Litecoin, Monero, and Zcash also offer lucrative opportunities for miners due to their popularity and potential for growth.

In conclusion, the world of cryptocurrency mining offers ample opportunities for profitability. By staying informed about the market trends and assessing the various factors that contribute to profitability, miners can discover the most profitable cryptocurrency to mine. Whether it be Bitcoin, Ethereum, or other altcoins, mining can be a rewarding venture for those willing to put in the effort and resources.

Why Cryptocurrency Mining Is Profitable

Cryptocurrency mining has become a highly profitable venture for many individuals and businesses. There are several reasons why mining can be profitable:

1. High Demand: Cryptocurrencies like Bitcoin, Ethereum, and Litecoin have gained popularity and are in high demand. As the demand for these digital assets rises, the value increases, making mining profitable.

2. Block Rewards: Miners are rewarded with newly minted coins for successfully adding a new block to the blockchain. These block rewards can be substantial, especially for popular cryptocurrencies.

3. Transaction Fees: Miners also receive transaction fees for validating and adding transactions to the blockchain. With the increasing number of transactions happening in cryptocurrencies, these fees can add up and contribute to mining profitability.

4. Income Stability: Unlike traditional investments, cryptocurrency mining offers a relatively stable source of income. While the value of cryptocurrencies may fluctuate, mining provides a consistent stream of rewards and transaction fees.

5. Control over Hardware and Costs: Miners have control over their mining hardware, allowing them to optimize efficiency and reduce costs. By choosing the right equipment and managing electricity costs, miners can maximize their profitability.

6. Opportunity for Passive Income: Cryptocurrency mining can be a passive income source. Once set up, mining rigs can operate 24/7, generating income even when the miner is not actively managing or monitoring the process.

In conclusion, cryptocurrency mining is profitable due to the high demand for cryptocurrencies, block rewards, transaction fees, income stability, control over hardware and costs, and the opportunity for passive income. However, it is essential to consider factors such as electricity costs, equipment expenses, and the volatility of the cryptocurrency market when evaluating the profitability of mining.

Understanding the Cryptocurrency Mining Process

Cryptocurrency mining is the process of validating and adding transaction records to a blockchain, as well as creating new cryptocurrency as a reward for mining. This process requires powerful computer hardware, specialized software, and a stable internet connection.

When a cryptocurrency transaction occurs, it is added to a pool of pending transactions known as the mempool. Miners then compete to solve complex mathematical problems in order to validate the transactions and add them to the blockchain. This process is often referred to as proof-of-work.

Miners use powerful computers called mining rigs or ASICs (Application-Specific Integrated Circuits) to perform the mining process. These rigs are specifically designed for mining and can solve complex mathematical problems much faster than a regular computer.

Once a miner solves a mathematical problem, they broadcast the solution to the network, which then verifies the solution. If the solution is correct, the miner is rewarded with a certain amount of cryptocurrency. This reward serves as an incentive for miners to continue mining and securing the network.

The amount of cryptocurrency rewarded for mining varies depending on various factors, such as the network difficulty, the mining power of the individual miner, and the specific cryptocurrency being mined. In some cases, miners may also receive transaction fees for including transactions in a block.

As more miners join the network, the mining difficulty increases, making it harder and more resource-intensive to mine new cryptocurrency. This is designed to ensure a stable and secure network, as it prevents any single entity from gaining too much control over the blockchain.

It’s important to note that cryptocurrency mining can consume a significant amount of electricity. As a result, mining operations are often located in areas with cheap electricity or where renewable energy sources are abundant.

In conclusion, cryptocurrency mining is a crucial process that enables the operation and security of blockchain networks. It involves the validation of transactions, the creation of new cryptocurrency, and the overall maintenance of the network. Understanding the mining process is essential for anyone looking to get involved in cryptocurrency mining or understand how cryptocurrencies work.

Factors that Affect the Profitability of Cryptocurrency Mining

When it comes to cryptocurrency mining, there are several factors that can greatly affect its profitability. Understanding these factors is crucial for miners to make informed decisions and maximize their profits. Here are some key factors to consider:

- Difficulty Level: The difficulty level of mining a specific cryptocurrency refers to how hard it is to solve the mathematical algorithms and validate transactions. As more miners join the network, the difficulty level increases, making it more challenging to mine and reducing profitability.

- Hashrate: The hashrate represents the computational power used by miners to solve complex algorithms. A higher hashrate means more calculations can be performed, increasing the chances of mining a block and earning rewards.

- Electricity Costs: Mining cryptocurrencies requires significant energy consumption, particularly for high-power mining rigs. The cost of electricity in the mining location can greatly impact profitability, as it directly determines operational expenses.

- Cryptocurrency Price: The price of the cryptocurrency being mined has a direct impact on profitability. Higher prices increase the value of the mined coins, resulting in greater profits. Conversely, a drop in price can diminish profitability.

- Hardware Costs: The initial investment in mining hardware, such as ASICs or GPUs, is a factor that affects profitability. Miners need to consider the cost of purchasing and maintaining these devices, as well as their lifespan and mining efficiency.

- Transaction Fees: Some cryptocurrencies include transaction fees within their network. These fees can boost profitability, as miners receive a portion of these fees for validating transactions. Networks with high transaction volumes typically have higher fee rewards.

- Block Reward: The block reward refers to the number of cryptocurrency coins miners receive when they successfully mine a new block. A higher block reward can increase profitability, especially for miners who can mine blocks faster.

- Network Congestion: When the network becomes congested with an excessive number of transactions, mining becomes slower and less profitable. Network congestion can result from increased transaction volume or limitations in network scalability.

Considering these factors and staying updated with market trends is essential for miners to adjust their strategies and choose the most profitable cryptocurrency to mine. Additionally, factors such as mining pool fees, mining software, and cooling costs can also impact profitability.

Evaluating the Potential Profitability of Different Cryptocurrencies

When it comes to mining cryptocurrencies, one of the most important factors to consider is the potential profitability of each cryptocurrency. While some cryptocurrencies may have a higher market value, they may not necessarily be the most profitable to mine.

There are several factors to evaluate when determining the potential profitability of a cryptocurrency:

- Market Value: The market value of a cryptocurrency is an important aspect to consider. However, it should not be the sole determinant of profitability. A higher market value does not always translate to higher mining profitability.

- Difficulty: The mining difficulty of a cryptocurrency is a measure of how hard it is to mine new blocks. Higher difficulty levels can make it more challenging to mine a cryptocurrency, resulting in lower profitability.

- Reward System: Each cryptocurrency has its own reward system for miners. Some cryptocurrencies offer a fixed reward per block, while others have a variable or fluctuating reward. The reward system can significantly impact the profitability of mining a specific cryptocurrency.

- Electricity Cost: The cost of electricity is an essential consideration when evaluating the profitability of mining. Mining cryptocurrencies can consume a significant amount of electricity, and high electricity costs can eat into potential profits.

- Hardware Requirements: Different cryptocurrencies have varying hardware requirements for mining. Some cryptocurrencies may require expensive equipment or specialized hardware, which can impact profitability.

- Price Volatility: Price volatility refers to the degree of variation in the price of a cryptocurrency. Higher price volatility can present both opportunities and risks. While it can lead to potential profit gains, it can also result in significant losses if the price drops suddenly.

- Competition: The level of competition in mining a particular cryptocurrency can also affect its profitability. As more miners join the network, the competition increases, which can decrease profitability over time.

It is crucial to evaluate all these factors carefully when considering which cryptocurrency to mine. A combination of factors, including the market value, difficulty, reward system, electricity cost, hardware requirements, price volatility, and competition, needs to be taken into account to determine the potential profitability of mining a specific cryptocurrency.

By thoroughly evaluating these factors, miners can make informed decisions and increase their chances of choosing the most profitable cryptocurrency to mine.

The Most Profitable Cryptocurrency to Mine in 2021

As the popularity of cryptocurrency continues to grow, mining has become an attractive way for individuals to earn digital assets. However, not all cryptocurrencies are created equal when it comes to mining profitability. In 2021, there are several cryptocurrencies that stand out as being the most profitable to mine.

One of the top contenders in terms of mining profitability is Ethereum (ETH). Ethereum is a decentralized platform that enables developers to build and deploy smart contracts. It has a large community and wide adoption, making it a highly sought-after cryptocurrency. The Ethereum network uses a proof-of-work (PoW) algorithm, which means that miners compete to solve complex mathematical problems to validate and secure transactions. As Ethereum’s price has skyrocketed in recent years, mining ETH has become more and more lucrative.

Another profitable cryptocurrency to mine in 2021 is Monero (XMR). Monero is known for its strong emphasis on privacy and anonymity. It uses a unique obfuscated public ledger, which makes it difficult to trace transactions. Monero also employs a proof-of-work algorithm, but it is designed to be ASIC-resistant, meaning that it can be mined using CPUs and GPUs. This makes it more accessible to average miners, as specialized mining hardware is not required.

Litecoin (LTC) is also a highly profitable cryptocurrency to mine in 2021. Litecoin is often referred to as the “silver to Bitcoin’s gold” and is one of the oldest cryptocurrencies in existence. It was created by Charlie Lee, a former Google engineer, and offers faster block generation times and a different hashing algorithm than Bitcoin. This makes it more efficient to mine, especially for individual miners who may not have access to large-scale mining operations.

When choosing the most profitable cryptocurrency to mine in 2021, it’s important to consider factors such as market value, mining difficulty, and energy costs. Additionally, it’s crucial to stay informed about the latest trends and developments in the cryptocurrency space, as mining profitability can fluctuate over time. By conducting thorough research and staying up to date, miners can maximize their chances of success and profitability.

| Cryptocurrency | Algorithm | Market Value | Mining Difficulty |

|---|---|---|---|

| Ethereum (ETH) | ETHASH | High | Medium |

| Monero (XMR) | RANDOMX | Medium | Low |

| Litecoin (LTC) | SCRYPT | Medium | Low |

Recommended Hardware and Software for Cryptocurrency Mining

When it comes to cryptocurrency mining, having the right hardware and software is crucial for maximizing your profits. Here are some recommended options:

Hardware

- ASIC Miners: These specialized mining machines are designed specifically for cryptocurrency mining and offer high hash rates and energy efficiency. Some popular ASIC miners include Bitmain Antminer and Canaan Avalon.

- Graphics Processing Units (GPUs): While ASIC miners are more efficient, GPUs are more versatile and can be used for mining different types of cryptocurrencies. Popular options include NVIDIA GeForce and AMD Radeon GPUs.

- Central Processing Units (CPUs): While CPUs are not as powerful as ASIC miners or GPUs, they can still be used for mining certain cryptocurrencies. However, CPU mining is generally less profitable and more energy-consuming compared to other options.

Software

- Mining Software: To mine cryptocurrencies, you will need mining software that connects your hardware to the mining pool or network. Some popular mining software options include CGMiner, BFGMiner, and EasyMiner.

- Wallet Software: When you mine cryptocurrencies, you will earn rewards in the form of digital coins. To store and manage these coins, you will need a cryptocurrency wallet. Popular wallet options include Exodus, Coinomi, and Ledger Wallet.

- Monitoring Software: It’s important to monitor the performance of your mining hardware and track your mining progress. There are various monitoring software tools available, such as Awesome Miner and Minerstat.

Remember that the choice of hardware and software depends on the specific cryptocurrency you want to mine. Some cryptocurrencies may require specific hardware or software configurations, so it’s essential to do thorough research before investing in equipment or software.

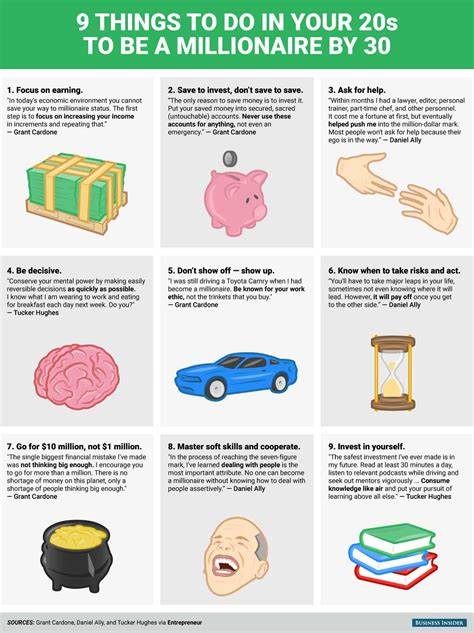

Tips and Strategies for Maximizing Profit in Cryptocurrency Mining

As the cryptocurrency market continues to gain popularity, more and more people are getting involved in mining to earn profits. However, with increasing competition, it is important to have a well-thought-out strategy to maximize your earnings. Here are some tips to help you make the most out of your cryptocurrency mining efforts:

1. Choose the right cryptocurrency to mine: Not all cryptocurrencies are created equal when it comes to mining profitability. Research and identify cryptocurrencies that have a high potential for growth and offer favorable mining rewards. Consider factors such as network difficulty, block rewards, and market demand before making a decision.

2. Invest in efficient mining hardware: The type and quality of your mining hardware can significantly impact your profitability. Look for mining rigs that are energy-efficient and capable of delivering high hash rates. It may require a larger upfront investment, but it will pay off in the long run by reducing electricity costs and increasing mining efficiency.

3. Join a mining pool: Mining pools allow miners to combine their resources and increase their chances of earning rewards. By joining a pool, you can benefit from shared computing power, reducing the time it takes to mine a block. Look for a reputable mining pool with a low fee structure to maximize your earnings.

4. Monitor and optimize your mining operations: Regularly monitor the performance of your mining operations and make necessary adjustments. Optimize your mining software settings, ensure proper cooling and ventilation, and keep an eye on market trends to adjust your mining strategy accordingly.

5. Consider the cost of electricity: Electricity costs can significantly eat into your mining profits. Research the cost of electricity in your area and calculate the potential impact on your earnings. Consider mining during off-peak hours or in locations with lower electricity rates to reduce costs and maximize profits.

6. Stay updated with the latest industry news: The cryptocurrency market is highly volatile and subject to constant changes. Stay informed about market trends, regulatory developments, and technological advancements to stay ahead of the curve. This will help you make informed decisions and adjust your mining strategy to maximize profits.

7. Consider long-term vs. short-term mining: Mining profitability can vary depending on the chosen cryptocurrency and its future prospects. Some cryptocurrencies may offer short-term profits, while others have long-term potential. Consider your investment goals and plan accordingly to maximize your overall profitability.

Remember that cryptocurrency mining is a highly competitive and constantly evolving industry. It requires continuous learning, adaptation, and proactive decision-making to stay profitable. By implementing these tips and strategies, you can increase your chances of maximizing profits in cryptocurrency mining.

Risks and Challenges in Cryptocurrency Mining

Mining cryptocurrency can be a lucrative endeavor, but it is not without its risks and challenges. It is important for miners to be aware of these potential pitfalls in order to make informed decisions and protect their investments.

Volatility and Price Fluctuations

One of the biggest risks in cryptocurrency mining is the volatility of the market. Cryptocurrencies are known for their price fluctuations, which can sometimes be substantial and rapid. The value of the coins being mined can vary greatly from day to day, making it difficult to predict the profitability of mining operations and the potential return on investment.

Miners must be prepared for the possibility of their mined coins losing significant value. It is important to carefully monitor the market and consider factors such as the overall financial health of the cryptocurrency, demand and supply dynamics, and regulatory changes that may impact prices.

Increasing Difficulty Levels

As more miners join the network, the difficulty of mining cryptocurrency increases. This means that it becomes harder to successfully mine new blocks and receive the associated rewards. The increased competition puts pressure on miners to upgrade their hardware and invest in more efficient mining operations.

In some cases, mining difficulty can increase so rapidly that it may render existing mining equipment obsolete or unprofitable. Miners must constantly stay updated with the latest technology trends and be prepared to make timely and costly upgrades to their mining rigs.

Security Concerns

Cryptocurrency mining relies on a decentralized network, which can make it vulnerable to security breaches and attacks. Hackers may try to infiltrate mining operations to steal coins or manipulate the network for their own gain.

Miners must implement robust security measures to protect their mining rigs, wallets, and digital assets. This includes using strong passwords, two-factor authentication, and regularly updating security software.

Legal and Regulatory Risks

The legal and regulatory environment surrounding cryptocurrencies can be complex and constantly evolving. Governments and regulatory bodies around the world are still grappling with how to classify and regulate cryptocurrencies, which can create uncertainty and risk for miners.

Miners should stay updated with the laws and regulations in their jurisdiction and be prepared for potential changes that may impact their mining operations. This includes adhering to tax obligations and licensing requirements.

In conclusion, while cryptocurrency mining can be a profitable venture, it is not without its risks and challenges. Miners must be aware of the market volatility, increasing difficulty levels, security concerns, and legal and regulatory risks. By staying informed and implementing appropriate risk management strategies, miners can navigate these challenges and increase their chances of success.

Future Trends and Developments in Cryptocurrency Mining

As the cryptocurrency market continues to evolve and gain widespread adoption, the field of cryptocurrency mining is also constantly evolving. Miners are always looking for new ways to increase their profits and stay ahead of the competition. In this section, we will explore some of the future trends and developments in cryptocurrency mining.

Innovations in Mining Hardware

One of the key trends in cryptocurrency mining is the continuous development of more efficient and powerful mining hardware. As the difficulty of mining increases, miners need to upgrade their equipment to stay profitable. Companies are investing heavily in Research and Development to create state-of-the-art mining rigs that offer higher hash rates and lower power consumption.

Some of the future developments in mining hardware include the use of advanced chipsets and algorithms, liquid cooling systems, and specialized hardware for specific cryptocurrencies. These innovations will not only increase mining efficiency but also reduce the environmental impact of mining operations.

Emergence of Mining Pools

Mining cryptocurrencies solo can be a challenging and time-consuming task. To increase their chances of success, miners are increasingly joining mining pools. Mining pools allow multiple miners to combine their computing power and share the rewards based on their contribution.

In the future, we can expect the emergence of more specialized mining pools that cater to specific cryptocurrencies. These pools will offer advanced features such as real-time profitability tracking, automatic coin switching, and enhanced security measures. Joining a mining pool will become an essential strategy for individual miners to optimize their profits.

Shift towards Proof-of-Stake

Currently, most cryptocurrencies use the Proof-of-Work (PoW) consensus algorithm, which requires miners to solve complex mathematical problems to validate transactions and secure the network. However, there is a growing trend towards the adoption of the Proof-of-Stake (PoS) algorithm.

Proof-of-Stake eliminates the need for mining hardware and electricity-intensive calculations. Instead, it allows users to validate transactions and create new blocks based on the number of coins they hold and are willing to lock in a wallet. This shift towards PoS will significantly reduce the energy consumption associated with mining and make it more accessible to a wider range of individuals.

| Future Trends | Potential Impact |

|---|---|

| Increased automation | Reduced operational costs and increased efficiency |

| Integration of Artificial Intelligence | Improved decision-making and predictive analysis |

| Regulatory developments | Improved legal framework and increased investor confidence |

| Exploration of alternative energy sources | Reduced environmental impact of mining operations |

In conclusion, the future of cryptocurrency mining holds exciting possibilities. Innovations in mining hardware, emergence of specialized mining pools, and the shift towards Proof-of-Stake are some of the key trends to watch out for. Additionally, increased automation, integration of AI, regulatory developments, and exploration of alternative energy sources will play vital roles in shaping the future of cryptocurrency mining.

Question-answer: Most profitable crypto to mine

What is cryptocurrency mining?

Cryptocurrency mining is the process of validating transactions and adding them to the blockchain ledger. Miners use powerful computers to solve complex mathematical problems, and in return, they are rewarded with newly minted cryptocurrency coins.

Which cryptocurrency is currently the most profitable to mine?

The most profitable cryptocurrency to mine can change depending on various factors such as the current market price, mining difficulty, and electricity costs. However, some of the most profitable cryptocurrencies to mine at the moment include Ethereum, Monero, Zcash, and Grin.

What is the mining difficulty?

Mining difficulty is a measure of how difficult it is to find a hash below a given target. As more miners join a network, the difficulty increases, making it harder to mine new blocks. The difficulty automatically adjusts every few blocks to maintain a consistent block time.

How can I calculate the profitability of cryptocurrency mining?

To calculate the profitability of cryptocurrency mining, you need to consider factors such as the mining difficulty, electricity costs, hardware efficiency, and the current market price of the cryptocurrency you are mining. There are online calculators and mining profitability calculators available that can help you estimate your potential profits.

What hardware do I need for cryptocurrency mining?

The hardware you need for cryptocurrency mining depends on the specific cryptocurrency you want to mine. In general, you will need a powerful computer with a high-performance graphics card or ASIC miner. The more powerful your hardware, the more efficiently you can mine cryptocurrencies.

What is cryptocurrency mining?

Cryptocurrency mining is the process of validating transactions and adding them to the blockchain. It involves using specialized hardware to solve complex mathematical problems and in return, miners are rewarded with newly created cryptocurrency coins.

How can I determine which cryptocurrency is the most profitable to mine?

Determining the most profitable cryptocurrency to mine depends on various factors such as the current price of the cryptocurrency, the difficulty of mining, and the cost of electricity. One way to determine profitability is by using online mining calculators that take these factors into account and provide estimates of potential earnings.