Pepe price prediction 2024, 2025, 2030

As the world of cryptocurrency continues to evolve and capture the imagination of investors, a particular digital asset has been steadily gaining traction in recent months. This article delves into the fascinating realm of Pepe Pepe, a coin that holds the promise of significant returns and long-term growth.

With a focus on the future, this analysis aims to provide an insightful perspective on the potential trajectory of Pepe Pepe. By exploring various factors, including market trends, technological advancements, and investor sentiment, we can paint a picture of what lies ahead for this emerging digital currency.

While it is important to acknowledge that predicting the future of any investment is an inherently speculative endeavor, exploring the underlying foundations and trends surrounding Pepe Pepe can offer valuable insights. By delving into the intricate details and dynamics of this up-and-coming coin, investors and enthusiasts alike can potentially gain a deeper understanding of its growth potential and the various factors that may impact its trajectory.

Through this comprehensive analysis, we will explore the fundamentals that contribute to the allure of Pepe Pepe. From its innovative underlying technology to market adoption and regulatory considerations, we will delve into the factors that may shape its future. By examining historical performance and drawing parallels from established cryptocurrencies, we can begin to decipher the potential road ahead for Pepe Pepe and its ability to become a prominent player in the digital asset realm.

An Overview of Pepe Coin’s Past Performance

In this section, we will take a closer look at the historical performance of Pepe Coin, shedding light on its previous accomplishments and trends. By examining its past trajectory, we can gain valuable insights into the growth and potential of this cryptocurrency.

By delving into the history of Pepe Coin, we can explore its previous accomplishments and observe the patterns and fluctuations that have influenced its value over time. This analysis will enable us to better understand the factors that have contributed to its success and identify potential opportunities for future growth.

Examining the historical data of Pepe Coin allows us to uncover significant price movements and market trends it has experienced in the past. By examining these patterns, we can identify the key drivers that have influenced its value and gain a deeper understanding of the underlying dynamics of this cryptocurrency.

Furthermore, understanding how Pepe Coin’s past performance compares to other similar cryptocurrencies can provide valuable insights into its competitive position within the market. By evaluating its past performance relative to its peers, we can gauge its strengths and weaknesses and assess its future potential.

Ultimately, a comprehensive overview of Pepe Coin’s past performance will empower investors and enthusiasts alike to make informed decisions about their involvement in this cryptocurrency. By analyzing its historical achievements and trends, we can obtain a clearer perspective on its future prospects and the potential opportunities it may hold.

The Factors Influencing Pepe Coin’s Price

In this section, we will explore the various elements that can have an impact on the value of Pepe Coin. Understanding these factors is crucial for investors seeking to make informed decisions about their involvement with the cryptocurrency.

1. Market Demand

One of the primary factors influencing the price of Pepe Coin is the level of market demand. If there is a high demand for the coin, its price is likely to increase as buyers compete for available tokens. Conversely, if the demand is low, the price may decrease due to a lack of interest.

2. Market Sentiment

Market sentiment refers to the overall attitude and perception of investors towards Pepe Coin. Positive news, partnerships, and developments can create a more optimistic outlook, leading to increased demand and higher prices. On the other hand, negative sentiment surrounding issues like regulatory concerns or security breaches can drive down the price.

3. Project Development and Roadmap

The progress of the Pepe Coin project and its development roadmap also play a significant role in determining its price. Key milestones being achieved, successful partnerships, and the implementation of innovative features can instill confidence in investors, attracting more demand and potentially driving up the price.

4. Cryptocurrency Market Trends

The broader trends in the cryptocurrency market can have an indirect influence on Pepe Coin’s price. If the entire market is experiencing a bull run, where the prices of most cryptocurrencies are rising, it can have a positive impact on Pepe Coin as well. Similarly, during a bear market, when prices are declining, the value of Pepe Coin may be affected negatively.

5. Competition and Industry Developments

The competitive landscape and developments within the cryptocurrency industry can also impact Pepe Coin’s price. The emergence of new and potentially more innovative projects can divert investor attention and funds away from Pepe Coin, leading to a decrease in demand and value. Conversely, if Pepe Coin differentiates itself from competitors or becomes a popular choice within a specific niche, it may experience increased demand and price appreciation.

| FACTORS | DESCRIPTION |

|---|---|

| Market Demand | Level of interest and demand from buyers |

| Market Sentiment | Investor perception and overall attitude toward Pepe Coin |

| Project Development and Roadmap | Progress and milestones achieved by Pepe Coin project |

| Cryptocurrency Market Trends | Broader market movements and trends in the cryptocurrency industry |

| Competition and Industry Developments | Competitive landscape and advancements in the cryptocurrency sector |

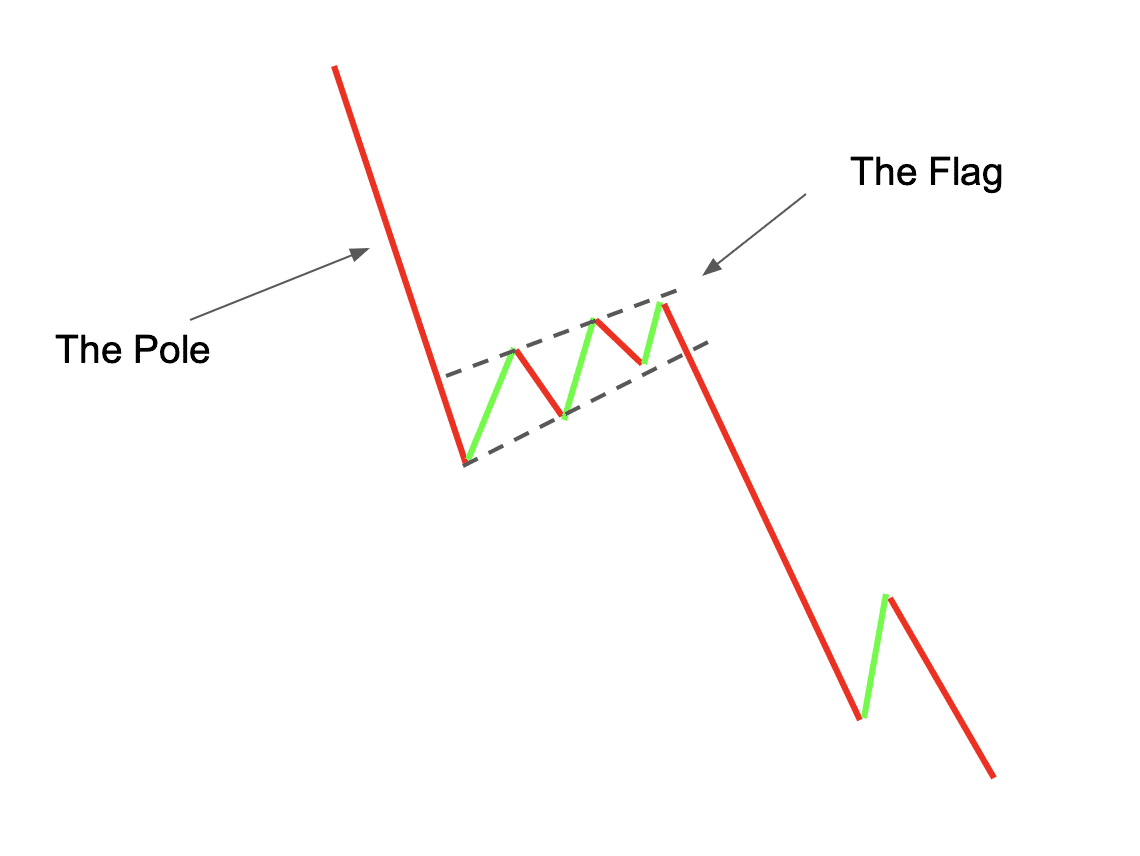

Technical Analysis: Chart Patterns and Indicators

In this section, we will delve into the world of technical analysis and explore the significance of chart patterns and indicators in understanding the future trends of a cryptocurrency. By studying historical price movements and analyzing patterns formed on price charts, traders and investors can gain valuable insights into potential future price movements.

Understanding Chart Patterns

Chart patterns are graphical representations of price movements over a specific period. These patterns emerge due to the continuous buying and selling activity in the market. By identifying and interpreting these patterns, traders can predict potential future price movements.

Support and resistance levels are key chart patterns that indicate price levels at which the cryptocurrency has historically experienced buying (support) or selling (resistance) pressure. These levels can act as indicators of potential price reversal or continuation.

Trend lines are another important chart pattern used to visualize the direction of the market. By connecting successive highs or lows, trend lines provide insights into the overall trend of the cryptocurrency’s price movement.

Indicators for Analysis

Indicators are mathematical calculations applied to price and volume data, providing additional information and insights into market trends. By studying these indicators, traders can make more informed decisions about buying or selling the cryptocurrency.

Moving averages are commonly used indicators that smooth out price data over a specific period and help identify trends. They can provide signals for potential entry or exit points based on the crossover of different moving averages.

Relative Strength Index (RSI) is an indicator that measures the strength and speed of price movements. It helps identify overbought or oversold conditions in the market, indicating potential upcoming price reversals.

Bollinger Bands are indicators that measure volatility and help identify potential price breakouts. By analyzing the width of the bands, traders can gauge market volatility and anticipate possible price movements.

In conclusion, understanding chart patterns and utilizing indicators can greatly enhance a trader’s ability to predict future price movements in the cryptocurrency market. By combining technical analysis with fundamental analysis, investors can make more informed decisions and navigate the volatile nature of the market.

Market Sentiment and Community Impact of Pepe Coin

Exploring the market sentiment and community impact of Pepe Coin provides valuable insights into the trajectory of this cryptocurrency. By analyzing the attitudes, opinions, and behaviors of investors and community members, we can gain a more comprehensive understanding of the factors influencing the coin’s success and adoption.

The Power of Sentiment Analysis

Sentiment analysis, also known as opinion mining, is a technique used to determine the sentiment expressed in a piece of text. By applying this method to discussions, social media posts, and news articles related to Pepe Coin, we can gauge the overall sentiment towards the cryptocurrency. Positive sentiment indicates optimism, while negative sentiment may suggest skepticism or caution. Understanding the prevailing sentiment can help predict potential market movements and investor behavior.

The Role of the Community

The community surrounding Pepe Coin plays a vital role in shaping its market performance. Comprised of passionate investors, enthusiasts, and developers, the community actively engages in discussions, provides support, and drives adoption. A strong and vibrant community fosters trust and reliability in the project. Moreover, community-driven initiatives such as partnerships, events, and collaborations can have a significant impact on the coin’s growth and reputation.

Engaging the community: By involving the community in decision-making processes, such as governance and project development, projects like Pepe Coin can ensure a sense of ownership and loyalty among its supporters. Collaborative efforts and open communication channels enable the community to contribute their ideas, expertise, and resources, strengthening the project’s foundation.

Community-driven marketing: The community’s commitment to promote and raise awareness about Pepe Coin can greatly influence its market sentiment. Through social media campaigns, online forums, and offline events, the community can drive positive sentiment, creating a wave of interest and attracting new investors. Additionally, the community’s ability to address concerns and provide timely support can significantly enhance trust and confidence in the coin.

In conclusion, understanding the market sentiment and community impact of Pepe Coin is crucial for predicting its future trajectory. By analyzing sentiment and nurturing a supportive and enthusiastic community, the coin can better position itself for success and wider adoption.

Expert Insights and Projections for Pepe Coin’s Future

In this section, we will explore the perspectives and forecasts shared by industry experts regarding the potential future of the cryptocurrency known as Pepe Coin. It is fascinating to gain insights into the opinions and predictions of those who closely follow the developments in the crypto market and can offer valuable insights into the trajectory that Pepe Coin may take.

One key aspect that experts emphasize when discussing Pepe Coin is its potential for growth and adoption. The rising interest in digital currencies and blockchain technology has paved the way for various altcoins to gain prominence, and Pepe Coin appears to be no exception. Analysts suggest that its unique features and potential applications could contribute to its future success.

Another point of discussion revolves around the volatility and risks associated with Pepe Coin’s future. As the crypto market is known for its fluctuations, experts warn that investors should be aware of the potential risks involved in trading or investing in Pepe Coin. However, some experts believe that the risks come with the territory and that with thorough analysis and understanding, investors can make informed decisions to maximize their gains.

Several experts also emphasize the significance of market trends and user sentiment when examining Pepe Coin’s future. By closely monitoring factors such as market demand, technological advancements, and community engagement, analysts can gain a better understanding of the potential growth or decline of Pepe Coin. This comprehensive approach to analyzing the market dynamics allows experts to make more accurate forecasts.

Finally, experts recognize the importance of regulatory developments on Pepe Coin’s future. As governments and regulatory bodies worldwide continue to grapple with the integration of cryptocurrencies, regulatory changes can significantly impact Pepe Coin’s market value and adoption. Expert opinions vary on how this could unfold, with some suggesting that favorable regulations could fuel Pepe Coin’s growth, while others caution against potential risks associated with increased regulation.

Overall, gathering expert opinions and forecasts about Pepe Coin’s future provides valuable insights into the potential growth, risks, market trends, and regulatory factors that could shape the coin’s trajectory. Investors and enthusiasts alike can benefit from studying these insights to make informed decisions about their involvement in Pepe Coin.

Potential Risks and Challenges for Pepe Coin Investors

Investing in Pepe Coin comes with several potential risks and challenges that investors should be aware of. Understanding these factors is crucial for making informed investment decisions and managing expectations for the future.

Market Volatility and Price Fluctuations

One of the main risks associated with Pepe Coin is market volatility. Like any other cryptocurrency, the price of Pepe Coin can experience significant fluctuations in a short period. These fluctuations can be influenced by various factors, such as market sentiment, investor speculation, regulatory changes, and the overall crypto market conditions. It is important for investors to be prepared for potential price swings and to have a long-term investment strategy to mitigate the impact of short-term volatility.

Regulatory and Legal Uncertainty

Another challenge that Pepe Coin investors may face is the regulatory and legal landscape surrounding cryptocurrencies. The regulatory environment for cryptocurrencies is still developing and can vary from country to country. Governments and regulatory bodies may introduce new regulations or restrictions that could impact the use, trading, or legality of Pepe Coin. Investors should stay updated on regulatory developments and ensure legal compliance to avoid potential legal risks.

Limited Adoption and Market Acceptance

Pepe Coin’s success relies on its adoption and acceptance in the market. While the project may have strong fundamentals and potential, there is a risk that it may not gain widespread adoption or acceptance among users, businesses, or investors. Limited adoption can negatively impact the liquidity and value of Pepe Coin, making it difficult for investors to buy or sell their holdings at favorable prices. Investors should consider the current market dynamics and potential adoption challenges before investing in Pepe Coin.

Cybersecurity Threats and Hacking Risks

Investing in Pepe Coin also exposes investors to cybersecurity threats and hacking risks. As a digital asset, Pepe Coin is vulnerable to cyber attacks, such as phishing, hacking, or malware attacks. These attacks can result in the theft of personal information, private keys, or even the loss of funds. It is essential for investors to implement robust security measures, including two-factor authentication, cold storage wallets, and regular software updates, to mitigate the risk of cyber attacks.

- Market Volatility and Price Fluctuations

- Regulatory and Legal Uncertainty

- Limited Adoption and Market Acceptance

- Cybersecurity Threats and Hacking Risks

By understanding the potential risks and challenges associated with investing in Pepe Coin, investors can make informed decisions and develop strategies to navigate the dynamic cryptocurrency market.