In the dynamic landscape of financial markets, identifying key shifts in price action can significantly enhance one’s approach to investment. As traders navigate through various cycles, recognizing specific signs of potential reversals becomes essential for capitalizing on opportunities and mitigating risks. These indicators serve as crucial tools that can help market participants make informed decisions.

The ability to interpret these signals requires a keen eye and an understanding of the market’s behavioral nuances. Each formation embodies a story of collective sentiment and psychology, hinting at possible turning points amidst ongoing trends. By dissecting these sequences, traders can gain insights into prevailing forces and anticipate future movements.

As we delve deeper into the realm of price signal analysis, it becomes evident how fostering a solid grasp of these formations can empower decision-making. By integrating these insights into their portfolio management approaches, investors position themselves to achieve greater efficacy in their market engagements, ultimately aiming for improved profitability and risk management.

Identifying Key Candlestick Formations

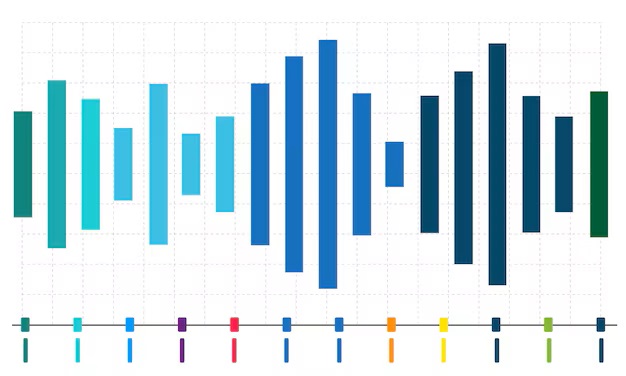

Recognizing significant formations on charts is crucial for predicting market movements. These visual signals provide insights into the psychology of traders and investors. By learning to identify these formations, one can enhance decision-making processes, leading to more informed actions in the financial arena.

One of the most notable formations to look out for involves a pronounced body accompanied by little to no upper or lower shadows. This suggests strong momentum in the price direction, indicating either bullish or bearish sentiment. In contrast, when a formation features long wicks on both ends, it may highlight uncertainty and indecision among market participants.

Additionally, the position and relationship of successive formations play a vital role. For instance, a specific configuration appearing after a notable price trend can signal a potential shift. Observing how these shapes interact with established support and resistance levels can provide further validation of potential market reversals.

Ultimately, becoming adept at spotting these significant indicators can greatly enhance one’s ability to navigate the complexities of the financial markets, leading to improved outcomes.

Interpreting Market Sentiment through Candles

The behavior of price movements on charts provides invaluable insight into the emotions and reactions of traders. Each individual light on a chart tells a story, reflecting the ongoing battle between buyers and sellers. By analyzing these visual indicators, one can grasp the underlying mood of the market, which can be critical for making informed decisions.

Deciphering Emotional Responses

Market reactions often stem from a mix of optimism and pessimism. Certain formations can signal bullish or bearish inclinations among participants. Recognizing these formations aids in forecasting future trends and market shifts. For instance, a pattern that suggests exhaustion among buyers may hint at an impending downturn, while a surge in buying pressure can indicate a potential upswing.

Identifying Key Market Shifts

When traders interpret the signals emitted by these graphical representations, they can pinpoint critical moments in the market. Observing how price movements unfold in conjunction with significant formations allows for a clearer perspective on potential shifts in direction. By harnessing this knowledge, participants can align their actions to capitalize on emerging trends.

Combining Reversal Signals with Indicators

Integrating various signals with technical indicators can significantly enhance the effectiveness of one’s market approach. By leveraging multiple data points, traders can gain deeper insights into potential trend shifts. This synergy allows for more informed decision-making and can lead to increased success rates in market executions.

Enhancing Signal Reliability

When signals align with indicators such as moving averages or oscillators, the likelihood of a valid trend change increases. For instance, if a specific pattern emerges and is confirmed by a relative strength index suggesting overbought or oversold conditions, the resulting confluence can bolster confidence in trade entries. This collaboration brings together price action and momentum analysis, creating a more robust framework for assessing market conditions.

Risk Management and Timing

Combining signals and indicators not only aids in identifying potential entry points but also enhances risk management. By interpreting both price movements and indicator readings, traders can better assess stop-loss levels and profit targets. Additionally, specific timeframes can be aligned with signals to optimize trade timing, ensuring that actions are taken at the most opportune moments.

Common Mistakes in Pattern Analysis

In the realm of market analysis, practitioners often fall into various traps that can lead to misguided interpretations and poor decision-making. Recognizing these pitfalls is crucial for enhancing one’s approach and resulting outcomes. Many analysts may overlook key elements or allow biases to cloud their judgment, ultimately affecting their overall effectiveness.

One frequent error is relying solely on historical data without considering the current market context. Trends can shift rapidly, and patterns that once held significance may no longer apply. Failing to adapt to changing conditions can lead to substantial losses.

Another common issue involves overconfidence in identifying signals. Traders may see a formation and assume it will lead to a predictable outcome, ignoring the inherent uncertainties in market behaviors. Overestimating the reliability of a specific structure can result in unexpected outcomes and financial setbacks.

Emotional involvement presents another challenge. Decisions based on fear or greed can overshadow objective analysis. Maintaining a clear, rational perspective is essential to avoid the trap of making impulsive choices rooted in emotion rather than solid analysis.

Lastly, neglecting proper risk management is a significant error that can amplify the consequences of incorrect assumptions. Traders must always implement safeguards to minimize potential downsides, ensuring that even in the face of mistakes, their portfolios remain protected.

Backtesting Strategies for Candlestick Patterns

Evaluating the effectiveness of specific market indicators is crucial in developing effective approaches to financial trading. By systematically analyzing historical data, traders can gain insights into how certain formations behave under various circumstances. This practice enables the refinement of techniques and enhances decision-making based on empirical evidence.

Key Steps in Backtesting

- Define Your Criteria: Clearly outline the variables you wish to analyze. This includes the timeframe, market conditions, and parameters of the indicators you want to assess.

- Collect Historical Data: Gather data from reliable sources. It’s essential to have a comprehensive dataset covering a wide range of market scenarios.

- Simulate Trades: Execute hypothetical trades based on the chosen configurations. Record the outcomes to assess performance.

- Analyze Results: Review the success rate, loss ratios, and other relevant metrics to determine the viability of the approach.

- Refine the Method: Adjust your parameters and re-test as necessary to improve performance and reduce risk.

Tools and Software for Backtesting

Various resources can facilitate the process of analyzing historical data:

- Trading Platforms: Many platforms include built-in backtesting features that allow users to input their criteria and evaluate outcomes.

- Spreadsheet Software: Customizable spreadsheets can also aid in organizing and analyzing data, particularly for manual testing processes.

- Dedicated Applications: Specialized software is available that focuses specifically on backtesting market strategies, offering advanced analytics and simulation options.

Ultimately, thorough examination and adjustment will lead to better predictive capabilities and enhanced confidence in market decisions.

Q&A: Reversal candlestick patterns

What are reversal candlestick patterns and why are they important in trading strategies?

Reversal candlestick patterns are specific formations that occur on price charts, signaling a potential change in the direction of the market trend. These patterns are important because they help traders identify possible turning points in the market, allowing them to make informed decisions about buying or selling assets. By recognizing these patterns, traders can enhance their entry and exit strategies, potentially increasing their profitability.

Can you explain some common types of reversal candlestick patterns?

Certainly! Some common reversal candlestick patterns include the “Hammer,” “Shooting Star,” “Engulfing Pattern,” and “Doji.” The Hammer is a bullish reversal pattern that occurs after a downtrend, indicating potential upward momentum. Conversely, the Shooting Star is a bearish reversal pattern that appears after an uptrend, signaling a possible downturn. The Engulfing Pattern consists of a smaller candlestick followed by a larger candlestick that completely engulfs it, indicating a shift in momentum. The Doji, characterized by its small body, suggests indecision in the market and can signal a potential reversal when combined with other indicators.

How can I effectively incorporate reversal candlestick patterns into my trading strategy?

To effectively incorporate reversal candlestick patterns into your trading strategy, start by mastering the identification of these patterns on various timeframes, such as daily, hourly, or even minute charts. Additionally, look for confirmation through other technical indicators, such as volume analysis or trend lines, to validate the signals provided by candlestick patterns. It’s also essential to have a risk management plan in place, considering factors such as stop-loss orders to mitigate potential losses. Regularly backtesting your strategy can help ensure its effectiveness in different market conditions.

Are reversal candlestick patterns reliable indicators for trading?

While reversal candlestick patterns can be valuable tools for traders and can indicate potential market reversals, it is crucial to remember that they are not foolproof indicators. The reliability of these patterns depends on various factors, including market context, the presence of other confirming signals, and the overall trend. Relying solely on candlestick patterns without considering the broader market environment can lead to false signals. Therefore, it’s best to use reversal candlestick patterns as part of a comprehensive trading strategy that includes multiple analyses and risk management techniques.

What should I do if I identify a reversal candlestick pattern but the market doesn’t follow through?

If you identify a reversal candlestick pattern but the market doesn’t follow through, it’s important to remain calm and avoid reacting impulsively. First, re-evaluate the context in which the pattern occurred—consider any macroeconomic factors, news events, or other technical signals that may influence the market. Sometimes, markets can fake out traders by initially moving in the opposite direction before taking a more decisive turn. If your risk management strategy is in place, consider adjusting your stop-loss orders to protect against further losses. Staying disciplined and being prepared for the market’s unpredictability will help you become a better trader in the long run.

What are reversal candlestick patterns and why are they important for traders?

Reversal candlestick patterns are specific formations on a price chart that indicate a potential reversal in the direction of price movement. They are important for traders because they can signal when a trend may be changing, allowing traders to make informed decisions about entering or exiting positions. For example, when a bullish reversal pattern appears at the end of a downtrend, it may indicate that buyers are gaining strength and a price increase could follow. Recognizing these patterns can help traders to maximize profits and minimize losses in their trading strategies.

How can a trader effectively incorporate reversal candlestick patterns into their trading strategies?

To effectively incorporate reversal candlestick patterns into trading strategies, a trader should first familiarize themselves with the most common patterns, such as the Hammer, Shooting Star, and Engulfing patterns. Once they can identify these patterns, they should look for them in conjunction with other technical indicators, such as moving averages or RSI (Relative Strength Index), to confirm potential reversals. Additionally, it’s crucial for traders to set risk management parameters, like stop-loss orders, to protect against false signals. By combining candlestick analysis with other tools and strategies, traders can develop a more robust approach to identifying entry and exit points in the market.

How can bullish and bearish candlestick patterns indicate potential trend reversals in trading?

Bullish and bearish candlestick patterns are vital tools for traders looking to identify potential trend reversals in the market. A bullish engulfing candlestick pattern occurs when a long white candlestick completely engulfs the previous bearish candle, suggesting a strong bullish reversal. Conversely, a bearish engulfing candlestick pattern consists of a long black candlestick that completely covers the previous bullish candle, indicating a potential bearish reversal. These reversal candlestick patterns can form with one or more candlesticks, with confirmation of the reversal typically required through subsequent price action. Traders should also look for bullish reversal candlestick patterns like the bullish harami or bullish abandoned baby, which can further confirm a change in trend direction.

What is the significance of the color and size of candlesticks in determining market sentiment?

The color and size of a candlestick can provide valuable insights into market sentiment and potential price movements. A long bullish candlestick often suggests strong buying pressure, while a long black candlestick indicates selling pressure. When analyzing candlestick patterns, traders look for formations like the bullish harami, which is made up of one candlestick with a small body that appears within the range of the previous long candlestick. The reversal pattern would be stronger if the first candlestick is bearish and followed by a small white candlestick, indicating a potential bullish reversal. Conversely, small black candlesticks might indicate indecision or a possible trend reversal. Understanding these nuances helps traders interpret the strength of price movements and make informed decisions.

How do traders use candlestick charting to identify continuation and reversal patterns?

Candlestick charting is a widely used method for analyzing price movements and identifying both continuation and reversal patterns. For instance, a bullish confirmation after a bullish harami pattern suggests that the market may continue to rise. On the other hand, bearish reversal candlestick patterns like the bearish harami or bearish engulfing pattern signal potential short-term reversals after an advance. Patterns can form with one or multiple candlesticks, and the confirmation of this reversal pattern is crucial. Traders often look for patterns that indicate strong buying or selling pressure, such as a long white candlestick followed by a small black candlestick, which might qualify as a reversal. By studying these chart patterns, traders can gain insights into potential market movements and align their strategies accordingly.

How do candlestick reversal patterns in securities trading indicate market direction?

Candlestick reversal patterns are crucial for traders to identify potential market direction changes. In candlestick charting explained, various patterns exist, such as the bearish harami pattern or the outside reversal chart pattern. These patterns are short-term and usually appear after an extended bullish or bearish trend. For example, a bullish reversal pattern that forms after a decline signals a likely reversal, while bearish reversals after an advance require further bearish confirmation. Patterns would be considered neutral if they do not indicate a clear direction. Traders often use these patterns to identify potential reversals, with the first candlestick being a doji or small white or black candlestick, followed by a stronger second candlestick that indicates strong market momentum.

What are some key characteristics of a bullish engulfing pattern and its significance in candlestick reversal structures?

A bullish engulfing pattern is a powerful bullish candlestick pattern that signifies a potential reversal in the market. This pattern typically consists of two candlesticks: the first is a small black candlestick that represents the previous candlestick and the second is a larger bullish candlestick that engulfs the body of the first. The color of the first candlestick is critical, as it sets the context for the reversal. When the second candlestick begins to form and gaps above the previous candlestick, it suggests a strong bullish reversal. This engulfing candlestick pattern is similar to the outside reversal, making it one of the top candlestick patterns traders look for. Reversal candlestick patterns to know include this bullish reversal pattern, which often occurs after a decline, indicating likely bullish reversals. Candlestick patterns are short-term signals, and traders currently have common candlestick patterns on their charts to help identify potential reversals in securities trading.

What role do single candlesticks play in identifying reversal patterns in securities trading?

Single candlesticks can provide critical insights into market sentiment and potential reversal patterns in securities trading. For instance, a small candlestick forms at the end of a trend, often indicating indecision in the market. When this single candlestick is a black candlestick that gaps away from the previous candlestick, it may suggest a potential reversal. Traders analyze the context, considering whether it leads to a bullish reversal or bearish reversal. If the candlestick indicates strong buying pressure following a bearish trend, it could signal a bullish reversal after a decline. Conversely, a single candlestick that opens lower but closes near its high may point to a likely reversal in the opposite direction. Reversal candlestick pattern FAQs often address how these patterns function, emphasizing that the candlestick must open at a significant level for them to be effective. Additionally, the presence of a second candlestick that gaps can reinforce the potential for a reversal, making single candlesticks an essential aspect of candlestick reversal in securities trading.

How can traders identify and interpret reversal candlestick structures to predict market direction?

Traders can identify reversal candlestick structures by analyzing specific patterns that indicate potential market direction changes. These structures often highlight both bullish and bearish reversal signals. A bullish candlestick reversal typically occurs after a downtrend, suggesting a potential shift to an upward price movement. Conversely, bearish reversal candlestick patterns show potential price declines after an uptrend. Observing a reversal in securities trading near key support or resistance levels can significantly increase the reliability of these signals. When traders spot a candlestick that can also indicate indecision, such as a doji or spinning top, it often signals that a reversal is likely. If the second candlestick gaps in the opposite direction after the first candlestick, it further reinforces the anticipated reversal. By combining these observations, traders can make more informed predictions about potential market movements.

What are the key characteristics of continuation patterns in candlestick charting, and how do they relate to potential reversals?

Continuation patterns are critical in candlestick charting, as they indicate that the current trend is likely to persist rather than reverse. These patterns often form after a strong price movement, suggesting that the market is consolidating before continuing in the same direction. While continuation patterns signify a strong trend, traders must remain vigilant for signs that could indicate the reversal. For instance, a candlestick can also form a pattern that suggests a change in market sentiment, leading to a possible reversal. Recognizing these patterns involves analyzing the context of recent price action and confirming the strength of the trend. When a continuation pattern forms, it is essential to consider market conditions, as this can help traders distinguish between a true continuation and a likely reversal that may catch them off guard.