As the cryptocurrency landscape continues to evolve, the focus shifts toward understanding the dynamics that shape the value of digital assets. Investors and enthusiasts alike are keen on uncovering potential trajectories that these currencies might take, driven by technological advancements, market demands, and overall economic factors. Such evaluations help individuals navigate their decisions in the ever-changing financial environment.

In the following sections, we will delve into the methodologies employed by analysts to interpret market behaviors. These assessments rely on a combination of quantitative data, market sentiment, and historical performance, aiming to shed light on what the future may hold for innovative digital coins. By examining various influential elements, from regulatory developments to consumer adoption, a clearer picture emerges for stakeholders.

As we explore these projections, we’ll highlight key trends and significant indicators that can influence shifts in value, allowing for informed considerations in assessing the potential of these digital currencies. The journey through the intricacies of this market will provide valuable contextual understanding for those looking to invest or engage with this rapidly growing sector.

Current Market Trends Affecting Toncoin

The cryptocurrency landscape is constantly evolving, significantly influenced by various market dynamics. Understanding these dynamics is crucial for stakeholders looking to navigate the intricate environment of digital assets. Several key trends are shaping the way investors and developers perceive and interact with this particular currency.

Technological Advancements

Innovation within the blockchain space plays a pivotal role in determining the fate of digital currencies. Key aspects include:

- Development of new protocols that enhance scalability and security.

- Integration of advanced decentralized applications (dApps).

- Enhancements in transaction speed and cost efficiency.

Regulatory Environment

The evolving legal framework surrounding cryptocurrencies can greatly impact market behavior. Notable factors include:

- Government regulations that either support or hinder the adoption of digital assets.

- Taxation policies affecting profitability for investors.

- International collaboration or conflict regarding cryptocurrency standards.

By keeping a close eye on technological innovations and regulatory changes, stakeholders can make more informed decisions in this rapidly shifting market.

Key Factors Influencing Toncoin Valuation

The value of any digital currency is subject to a variety of elements that can significantly impact its standing in the market. Understanding these factors is crucial for stakeholders who seek to make informed decisions regarding their investments. Various economic, technological, and social influences contribute to the fluctuations in worth, ultimately shaping the perception and real value of the asset.

Market Demand and Supply Dynamics

At the core of the financial instruments’ valuation lies the principle of supply and demand. When the appetite for a particular cryptocurrency surges, it generally leads to an increase in its market value. Conversely, if the availability exceeds the demand, prices tend to drop. Analyzing trading volumes and investor interest can provide glimpses into potential future movements.

Technological Advancements and Ecosystem Development

The underlying technology plays a vital role in determining the attractiveness of a digital currency. Enhancements in blockchain protocols, increased transaction speeds, and improved security measures are factors that can elevate interest and utility. Additionally, the growth of the ecosystem, including partnerships and use cases, can further bolster the appeal and perceived worth of the currency.

Understanding these complexities allows investors to gauge a more accurate picture of market trends and potential future movements, ensuring that they are better equipped to navigate the evolving landscape.

Expert Opinions on Toncoin’s Future

In the rapidly evolving world of cryptocurrencies, various analysts and market specialists are weighing in on the prospects of a particular digital currency. Their assessments reflect a blend of market trends, technological advancements, and regulatory landscapes that may shape its trajectory in the coming years.

Many professionals highlight the underlying technology as a crucial factor in determining the asset’s long-term viability. With its robust framework and unique features, it has the potential to stand out in a saturated market. This has led to a growing interest from both individual investors and institutional players, who are increasingly looking toward innovative solutions that promise efficiency and scalability.

Furthermore, experts emphasize the importance of community engagement and adoption rates. A strong, active user base can significantly impact the viability and stability of a digital currency. As collaborations with various sectors continue to unfold, the potential for increased acceptance could unlock new avenues for growth.

However, caution is advised as analysts point out the unpredictable nature of the cryptocurrency market. External factors, such as regulatory changes and market sentiment, could pose challenges that might affect its performance. Understanding these dynamics is essential for anyone looking to navigate this complex landscape.

Technological Developments Impacting Toncoin

The evolution of blockchain technologies is a crucial factor influencing the growth and stability of various digital currencies. Innovations in this field not only enhance functionality but also improve security and scalability, which are vital for wider adoption. Staying informed about these advancements can provide valuable context for understanding future trends.

Key Innovations Shaping the Landscape

- Smart Contracts: The introduction of more sophisticated smart contract capabilities has transformed how transactions and agreements are executed. This promotes automation and reduces the need for intermediaries.

- Layer 2 Solutions: Implementing Layer 2 technologies allows for faster and cheaper transactions, addressing scalability issues inherent in many blockchain networks.

- Interoperability: Efforts to enhance compatibility between different blockchain platforms are paving the way for seamless interactions and exchanges, fostering a more integrated ecosystem.

Security Enhancements

- Decentralized Identity Management: Advances in decentralized identity frameworks enhance user privacy and security, enabling users to maintain control over their personal data.

- Improved Consensus Mechanisms: The shift from traditional consensus protocols to innovative alternatives increases efficiency while ensuring robust security, making networks less vulnerable to attacks.

- Regular Audits and Upgrades: Ongoing enhancements and assessments of codebases strengthen the platform against potential threats, ensuring long-term viability.

As these technological transformations unfold, they will significantly shape the trajectory and adoption of digital assets, ultimately influencing the market dynamics in a profound way.

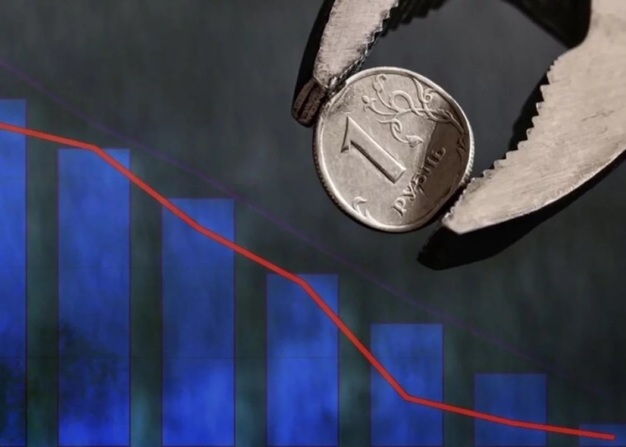

Potential Risks in Toncoin Investment

Investing in digital currencies carries inherent dangers that potential stakeholders must consider. A thorough understanding of these risks can help in making informed decisions and mitigating possible losses.

- Market Volatility: The crypto market is known for its unpredictable fluctuations. Prices can rise or plummet within short time frames, leading to significant financial losses.

- Regulatory Uncertainty: Governments worldwide are still formulating their stance on cryptocurrencies. Changes in regulations can result in sudden impacts on market value and operations.

- Technological Vulnerabilities: Despite advancements in security, digital assets are still susceptible to hacking and other cyber threats. Investors should be cautious about where and how they store their holdings.

- Project Viability: The success of various projects is often speculative. Many tokens may fail, leading to total loss for investors. Understanding the project’s fundamentals is crucial.

- Liquidity Issues: Some cryptocurrencies lack sufficient market liquidity, making it difficult to execute trades without impacting the price. This can result in challenges when attempting to realize gains or cut losses.

- Emotional Decision-Making: The high-stakes environment of crypto trading may lead to impulsive decisions based on fear or greed. Developing a disciplined investment strategy is essential to avoid this trap.

By acknowledging these potential pitfalls, investors can better navigate the complexities of the cryptocurrency landscape and enhance their decision-making processes.

Long-term Outlook for Toncoin Holders

As the digital currency landscape continues to evolve, investors and enthusiasts turn their attention to various assets that demonstrate potential for sustained growth. Holding a particular cryptocurrency can be seen as a long-term commitment, emphasizing the importance of understanding market dynamics, technological developments, and community engagement. This section delves into the future prospects for stakeholders who have chosen to maintain their positions.

Factors Influencing Future Growth

Several key elements will likely shape the future trajectory of this asset. Innovations within the underlying technology, partnerships with established financial institutions, and the overall regulatory environment are critical considerations. Additionally, market sentiment and the actions of significant players can induce substantial fluctuations, further influencing long-term holders’ strategies. Staying informed about upcoming developments is paramount for making sound decisions regarding asset retention.

Community and Ecosystem Development

The strength of the community surrounding a cryptocurrency often correlates directly with its longevity and viability. Active engagement through forums, social media, and events can foster a robust ecosystem that supports sustainable growth. As initiatives flourish and the user base expands, the outlook for those invested becomes increasingly optimistic. Long-term holders should prioritize their involvement in community activities to leverage collective potential and contribute to the asset’s future success.

Q&A: Toncoin price prediction

What factors are influencing Toncoin’s price prediction for 2023?

Several factors are influencing the price prediction for Toncoin in 2023. Firstly, the increasing adoption of blockchain technology and decentralized applications can enhance the demand for Toncoin. Additionally, partnerships with various platforms and projects can drive up its utility and market visibility. Market sentiment, global economic conditions, and regulatory developments also play crucial roles. Analyzing these elements alongside historical price patterns will help experts form a more accurate projection for Toncoin’s future value.

What do experts say about Toncoin’s potential growth beyond 2023?

Experts are optimistic about Toncoin’s growth potential beyond 2023. Many analysts believe that as more users become aware of the benefits of decentralized platforms, Toncoin may experience substantial appreciation. The ongoing development of the TON ecosystem, including scalability improvements and the introduction of new features, is expected to attract developers and end-users alike. Additionally, if Toncoin can establish strategic partnerships and community support, it is poised to become a significant player in the cryptocurrency market, potentially leading to significant price increases in the long term.

How do market trends and historical data impact the price of Toncoin?

Market trends and historical data are vital for understanding Toncoin’s price movements. Historical performance analysis reveals patterns that can indicate how Toncoin may react to various market conditions. For instance, during bullish markets, cryptocurrencies often see significant gains, whereas bearish phases might bring about sharp declines. Market sentiment, driven by news, regulatory changes, and technological developments, can drastically affect Toncoin’s price. By studying these trends, analysts can develop models to forecast future price trajectories more accurately.

What are the predicted price ranges for Toncoin throughout 2023?

Predicted price ranges for Toncoin in 2023 vary among analysts, largely depending on market conditions and the overall performance of the cryptocurrency sector. Some forecasts suggest that Toncoin could trade between $1.50 and $5.00 by the end of the year, assuming continued adoption and positive sentiment. However, external factors such as regulatory actions and macroeconomic influences could lead to fluctuations outside of this range. Caution is advised as predictions inevitably come with uncertainties, and continuous monitoring of market developments is essential.

How can investors make informed decisions regarding Toncoin investments?

Investors can make informed decisions regarding Toncoin investments by conducting thorough research and staying updated on market trends, news, and technological advancements. It’s essential to analyze expert opinions and predictions, as well as to understand the underlying technology and the use case for Toncoin within the broader ecosystem. Utilizing technical analysis tools and price charts can help identify potential entry and exit points. Diversifying investments and assessing one’s risk tolerance will also contribute to more careful decision-making in the volatile cryptocurrency market.

What factors will influence the price of Toncoin in 2023?

The price of Toncoin in 2023 will be influenced by several key factors. Firstly, the overall market sentiment towards cryptocurrencies plays a significant role. If the market experiences a bullish trend, Toncoin is likely to see price increases. Secondly, developments within the Toncoin ecosystem, such as partnerships, technological advancements, and community engagement, will impact its value. Additionally, regulatory changes in major markets can either boost or hinder the price, depending on whether they are favorable or restrictive. Finally, supply and demand dynamics, including the total supply of Toncoin and how actively it is being traded, will also be crucial in determining its price trajectory.

How accurate are expert predictions for Toncoin’s price in the long term?

Expert predictions for Toncoin’s price in the long term can vary widely based on the methodologies used and the underlying assumptions of each analyst. Some experts rely on technical analysis, examining historical price patterns and market trends, while others may focus on fundamental analysis, considering the project’s technological advancements, adoption rates, and market conditions. While these insights can offer valuable perspectives, they are inherently speculative due to the volatility of the cryptocurrency market. Long-term predictions may provide a general direction but should be approached with caution; investors are always advised to conduct their own research and consider a range of opinions before making financial decisions. Overall, while experts can provide educated insights, the unpredictable nature of cryptocurrencies makes precise long-term forecasts challenging.

What is the current price of TON and its price prediction for the upcoming months of 2024?

As of October 2024, the current price of TON, the native cryptocurrency of the TON blockchain, is USD 2.50. Based on technical analysis and recent price action, the TON price prediction for November 2024 suggests potential price volatility, with the token’s price possibly reaching USD 2.80. Looking further into December 2024, TON’s price may continue its upward trend, with a price target of USD 3.00. Analysts are optimistic that TON could see positive price movements in the upcoming months, driven by increased adoption of the TON network and its growing market cap.

What is the Toncoin price prediction for 2025 and 2030, considering long-term market trends?

The Toncoin price prediction 2025 suggests an average price of USD 4.50, with some forecasts predicting that the price of TON could reach as high as USD 5.00 by the end of that year. This projection is based on the anticipated growth of the TON blockchain and the involvement with the TON ecosystem, which is expected to drive demand. As for the prediction for 2030, analysts foresee Toncoin’s future price potentially reaching USD 10.00 or higher, depending on the overall market conditions and the continued success of the TON project. Long-term Toncoin price forecasts indicate steady growth, with the value of TON being positively affected by its integration across major crypto exchanges and increasing use cases within the TON network.

What is the Toncoin price prediction for 2024-2030, and how could market trends affect its future value?

The price prediction 2024 suggests that the current Toncoin price, sitting at around USD 2.50, may see steady growth over the year, with an average trading price reaching USD 3.00 by December 2024. Technical analysis of TON indicates that the price of Toncoin could rise as the open network develops further, with the price swings influenced by broader market trends. Toncoin faces potential volatility, but the long-term price prediction for the years 2024-2030 shows positive momentum. The Toncoin price prediction for 2030 estimates the value of TON could rise to USD 10.00, driven by increased adoption of TON storage, Ton DNS, and the growing use of the TON token in decentralized applications. If these factors align, the price of Toncoin could continue to move upwards, making it an appealing investment option.

What is the Toncoin price prediction for 2024, and how might its value change by 2025 and 2030?

The live price of Toncoin is currently around USD 2.50, and the Toncoin price prediction 2024 suggests that its value could increase steadily. By June 2024, analysts predict Toncoin may reach an average price of USD 3.00, with a further rise by December 2024 to around USD 3.50, driven by broader adoption and developments such as Ton Proxy. The Toncoin forecast 2025 shows potential price upwards momentum, with the price projections estimating Toncoin could cost between USD 4.50 and USD 5.00. The long-term price prediction 2030 expects the value of Toncoin to rise even further, potentially reaching USD 10.00, depending on market conditions and innovations within the TON ecosystem. Factors such as price history, technical analysis, and demand will continue to affect the price, making it a compelling asset to consider for those looking to invest in Toncoin.

What is the Toncoin prediction for the end of 2024 and how might its price evolve based on market analysis?

The Toncoin prediction for December 2024 suggests that the ton to USD price could reach an average of USD 3.50. This increase is based on a positive market outlook and technical analysis for Toncoin, which points to a steady upward trajectory. The average price of Toncoin in the near term may continue to rise as Ton also benefits from its growing ecosystem and usage. Ton is expected to see further growth in 2025, with experts predicting for Toncoin that its value could surpass USD 4.50. Toncoin historical trends and ongoing developments allow Toncoin to maintain its appeal in the market, providing a favorable direction for future price movements.

What is the Toncoin price prediction for December, and how might its cost change in the coming months?

The Toncoin price prediction for December suggests that Toncoin may reach a cost of USD 3.50, reflecting positive growth throughout 2024. The direction for Toncoin remains optimistic, with Ton expected to continue its upward trajectory as adoption increases and the ecosystem develops. Ton may see further price increases into 2025, driven by market demand and technological advancements within the TON network.