Understanding Maker and Taker in Crypto Trading

In the constantly evolving realm of digital currency, there exists a fundamental dichotomy between two distinct groups of individuals. These groups revolve around those who actively contribute to the development and growth of the digital currency ecosystem, and those who passively benefit from the innovations and advancements brought forward by the former.

The pioneers of the digital currency landscape, whom we shall refer to as “innovators,” possess a unique ability to conceive novel ideas, create groundbreaking technologies, and establish new frameworks that shape the future of the digital economy. They exhibit exceptional resilience, vision, and creativity as they navigate through the complex world of cryptocurrency, laying the foundations for groundbreaking solutions and paving the way for financial transformation.

On the other side of the spectrum, we find the “recipients” – individuals who embrace the technological breakthroughs and monetary opportunities created by the innovators. These individuals are driven by their desire to participate and benefit from the advancements achieved in the realm of digital currency. While the recipients may not possess the same level of technical expertise or disruptive ideas as the innovators, their role in the ecosystem remains crucial, as they offer support and drive adoption through their own investment, usage, and promotion of digital currency platforms.

Understanding the distinction between these two groups, the innovators and the recipients, is essential to comprehending the dynamics and potentials of the digital currency landscape truly. By recognizing the different roles each group plays, we can appreciate the interconnectedness of their contributions and the vital role they collectively play in propelling the world of digital currency forward.

The Concept of Makers in Cryptocurrency Trading

Exploring the Role of Makers in the Cryptocurrency Trading Landscape

In the realm of cryptocurrency trading, individuals known as makers play a crucial role in facilitating market liquidity and shaping price movements. Makers are key participants who create and place orders on exchanges, establishing the foundation for trading activity. Understanding the concept of makers is essential for comprehending how the cryptocurrency market functions and the dynamics of trading.

At the core of the maker’s role is their ability to provide liquidity to the market. By submitting buy or sell orders that are not immediately fulfilled, they contribute to the pool of available assets for other participants. These orders are usually placed on the order book, where they await a taker’s response to execute a transaction. Instead of seeking immediate trades, makers are patient and willing to wait for favorable market conditions.

Furthermore, makers have the power to influence market prices through their order placement strategies. By setting competitive prices, makers can attract takers who are looking for quick trades. Through carefully calculated order parameters such as limit prices and time durations, makers can position themselves strategically to yield profits or execute specific trading strategies.

Another significant aspect of makers is their potential to earn trading fees. Exchanges often provide incentives in the form of reduced fees to makers due to their crucial role in maintaining market liquidity. This incentivizes makers to actively participate in the market, contributing to its overall efficiency and stability.

In conclusion, makers serve as key drivers of liquidity and price determination in the cryptocurrency trading ecosystem. Their patient approach, strategic order placement, and influential role in market dynamics make them indispensable participants in the constantly evolving world of cryptocurrency trading.

Exploring the Role of Takers in the Cryptocurrency Market

In this section, we will delve into the crucial role that takers play within the dynamic cryptocurrency market. By examining the actions and functions performed by takers, we gain a deeper understanding of their impact on the overall ecosystem. Without takers, the cryptocurrency market would lack the necessary liquidity and transactional volume needed for efficient trading.

Defining the Taker

The term “taker” refers to the participant in the cryptocurrency market who accepts existing offers or asks, thereby filling the order book made by the makers. Takers are individuals or entities seeking immediate execution of their trades, often motivated by specific market conditions or investment strategies. While makers provide liquidity by creating a market for buying and selling, takers facilitate price discovery and contribute to the overall efficiency of the market.

The Role of Takers

Takers play a pivotal role in the cryptocurrency market by ensuring that there is a constant flow of transactions and liquidity. By actively participating in the market, takers provide a vital function by executing trades. Their actions contribute to the establishment of fair prices for digital assets and enable a more efficient exchange of value.

Benefits and Considerations for Takers

As takers, individuals and entities can benefit from immediate execution of trades, allowing them to enter or exit positions quickly in response to market conditions. However, takers should also be mindful of potential costs and fees associated with their role. Rapidly executing trades may come with higher fees and slippage, especially during periods of high volatility. Understanding and managing these considerations can help takers optimize their trading strategies.

Takers and Market Stability

The participation of takers contributes to market stability by facilitating trade flow and accurate price discovery. Their willingness to fill orders helps prevent excessive price fluctuations and promotes market efficiency. Takers ensure that there is always demand for cryptocurrencies, enhancing overall market confidence and attracting further participation from both makers and other takers.

In conclusion, takers bring essential liquidity and transactional volume to the cryptocurrency market. By actively participating in trades and accepting existing offers, takers play a crucial role in establishing fair prices and facilitating efficient market exchanges. Their actions contribute to the overall health and stability of the cryptocurrency ecosystem.

Understanding the Importance of Market Liquidity

In the realm of cryptocurrency, one aspect that holds utmost significance is market liquidity. Market liquidity refers to the ease with which a digital asset can be bought or sold on an exchange without causing a significant impact on its price. This liquidity is vital for the overall functioning and stability of the cryptocurrency market.

When there is high market liquidity, it implies that there is a substantial volume of buyers and sellers actively participating in the market. This abundance of trading activity ensures that there is a constant flow of supply and demand for various cryptocurrencies. In turn, this helps to establish a fair and competitive environment for traders and investors to operate in.

Market liquidity plays a crucial role in determining the efficiency and effectiveness of price discovery. With higher liquidity, there is a greater chance of accurate pricing for cryptocurrencies, as there are more participants buying and selling at various price levels. This allows traders to make informed decisions and execute transactions more effectively.

Furthermore, market liquidity also impacts the degree of price volatility. In a liquid market, large orders can be executed without causing significant price fluctuations. On the other hand, in illiquid markets, even a relatively small trade can lead to a significant impact on the asset’s price. This volatility can deter traders and investors from participating in the market, leading to decreased overall market activity.

Overall, understanding and recognizing the importance of market liquidity is essential for anyone involved in the world of cryptocurrency. It directly influences the efficiency, stability, and fairness of the market, allowing participants to make informed decisions and trade with confidence.

The Benefits of Being a Maker in Cryptocurrency Trading

Becoming a maker in the world of cryptocurrency trading holds numerous advantages and opportunities for individuals looking to actively participate in this dynamic market. Being a maker means actively contributing to the liquidity of the market by placing limit orders on the order book, providing opportunities for other traders to trade against.

One of the significant benefits of being a maker is the potential to take advantage of lower transaction fees. Many cryptocurrency exchanges offer reduced fees for makers compared to takers. This fee structure incentivizes traders to provide liquidity to the market, resulting in a more efficient and liquid trading environment.

Being a maker also allows individuals to have control over their trading strategies. By placing limit orders, makers have the ability to set their desired buying or selling price and wait for the market to reach those levels. This approach provides flexibility and empowers traders to execute trades based on their individual strategies and market outlook.

Furthermore, being a maker can lead to more favorable execution prices. As makers provide liquidity to the market, they are more likely to have their limit orders filled at their desired price levels. This can result in cost savings and improved profitability compared to takers who may need to buy or sell at less optimal prices in order to immediately execute their trades.

Additionally, being a maker in cryptocurrency trading allows individuals to actively participate in shaping the market. By providing liquidity and contributing to the order book, makers influence the market dynamics and help to create a more vibrant and efficient trading environment. This active involvement can provide traders with a deeper understanding of the market and enhance their overall trading knowledge and experience.

In conclusion, becoming a maker in cryptocurrency trading offers numerous benefits, including lower transaction fees, control over trading strategies, potential for more favorable execution prices, and the ability to actively shape the market. These advantages make being a maker a compelling choice for individuals looking to actively engage in the world of cryptocurrency trading.

The Advantages of being a Taker in Cryptocurrency Trading

Exploring the Benefits of being a Taker in the Exciting World of Cryptocurrency Trading

Enhanced Market Access

One significant advantage of being a taker in cryptocurrency trading is the enhanced market access it provides. As a taker, you have the ability to immediately execute trades by accepting the available prices set by makers. This allows you to enter the market swiftly and take advantage of lucrative opportunities without waiting for orders to be filled.

Reduced Transaction Costs

Becoming a taker in cryptocurrency trading can also lead to reduced transaction costs. Since takers accept existing prices set by makers, they are not responsible for setting the rates themselves. This eliminates the need for additional fees associated with setting limit orders and the potential for the orders to not be filled at desired rates. As a result, takers can execute their trades efficiently and cost-effectively.

| ADVANTAGES OF BEING A TAKER IN CRYPTOCURRENCY TRADING |

|---|

| Enhanced Market Access |

| Reduced Transaction Costs |

Strategies for Maximizing Profits as a Maker or Taker in Cryptocurrency Trading

Exploring effective approaches to enhance profitability as a creator or executor in the realm of digital currency exchange requires a comprehensive understanding of the dynamics at play. By delving into various tactics that can be employed, individuals can enhance their chances of maximizing gains within this volatile market.

To optimize profits as a maker, it is imperative to focus on crafting efficient buy and sell orders that contribute to market liquidity. By strategically placing limit orders with competitive prices, makers create opportunities for traders to take advantage of. Additionally, makers can explore the potential benefits of utilizing advanced trading tools and algorithms to increase the efficiency and effectiveness of their order placements.

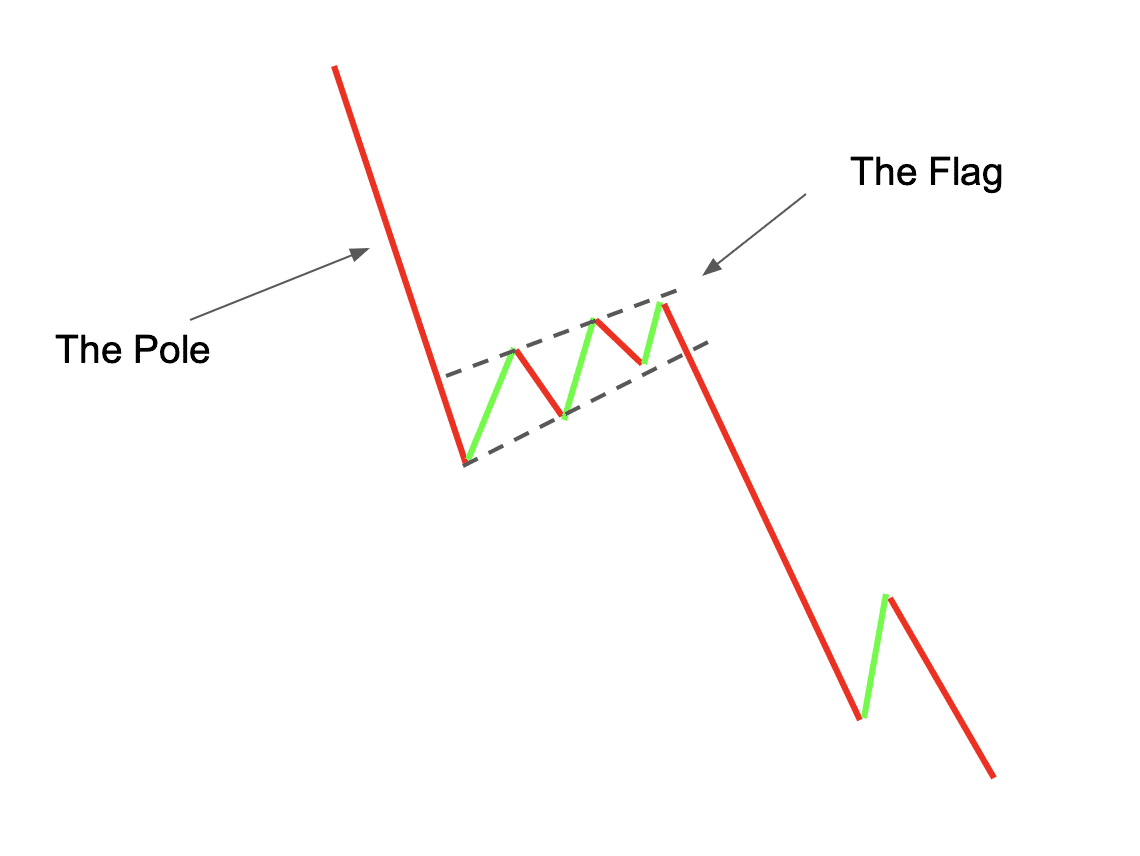

On the other hand, takers can employ strategies to capitalize on market movements by executing timely transactions. Active monitoring of market conditions and identifying moments of significant price fluctuations can help takers seize opportunities for quick profit. Utilizing stop-loss orders and trailing stops can also be advantageous for takers, as these measures can help mitigate potential losses and secure profits.

Furthermore, both makers and takers can benefit from diversifying their trading portfolios. By allocating their investments across multiple cryptocurrencies, individuals can spread their risks and potentially capitalize on various market trends. Additionally, staying informed about the latest industry news, regulatory developments, and technological advancements can provide valuable insights and enable traders to make informed decisions.

Lastly, risk management is crucial for both makers and takers. Engaging in thorough market research, setting realistic profit targets, and adhering to disciplined trading strategies are essential for mitigating potential losses and maximizing long-term profitability. Constantly evaluating and adjusting trading approaches based on market conditions and individual risk tolerance is key to achieving sustainable success.

In conclusion, employing effective strategies to maximize profits as a maker or taker in cryptocurrency trading involves a combination of market analysis, strategic planning, and risk management. By adopting these approaches and remaining adaptable in the ever-evolving landscape of cryptocurrencies, individuals can enhance their prospects for financial success in this dynamic market.

Q&A: What is maker and taker in crypto

How do maker and taker fees work on a crypto exchange?

Maker and taker fees are charged on crypto exchanges to incentivize adding liquidity to the order book. Maker fees are lower and are charged when you place an order that adds liquidity to the market, while taker fees are higher and charged when you place an order that removes liquidity from the market.

What is the difference between a maker order and a taker order?

A maker order adds liquidity to the order book by placing a buy or sell order that doesn’t match an existing order immediately. A taker order removes liquidity from the order book by placing an order that matches an existing order at the current market price.

Why are maker fees usually lower than taker fees on crypto exchanges?

Maker fees are usually lower than taker fees to encourage traders to add liquidity to the order book. By providing incentives for adding liquidity, exchanges create a more stable and efficient trading environment with tighter bid-ask spreads and higher trading volume.

How does a market order affect maker and taker fees?

A market order affects taker fees because it executes immediately at the best available current market price, removing liquidity from the order book. Therefore, placing a market order typically incurs the higher taker fee rather than the lower maker fee.

Why might a trader prefer a maker order over a taker order?

A trader might prefer a maker order over a taker order to benefit from lower maker fees. By adding liquidity to the order book, traders can reduce their transaction costs and potentially influence the current market price in a favorable direction.

How can adding liquidity to the order book benefit the overall market?

Adding liquidity to the order book benefits the overall market by creating a more liquid trading environment, reducing price volatility, and tightening bid-ask spreads. This makes it easier for traders to buy and sell without significant price changes and improves the efficiency of the market.

What are taker fees and how do they impact trading strategies?

Taker fees are charges applied when an order removes liquidity from the market by matching an existing order at the current market price. These fees impact trading strategies by making it more costly to execute market orders, encouraging traders to consider placing limit orders to add liquidity instead.

How does trading volume affect maker and taker fees on a crypto exchange?

Trading volume can affect maker and taker fees on a crypto exchange, as some exchanges offer lower fees for higher trading volumes. Traders with high trading volumes might receive discounts on both maker and taker fees, incentivizing more active participation in the market.

What happens to the order book when a buy order is placed at the current price?

When a buy order is placed at the current price, it matches an existing sell order in the order book, removing liquidity from the market. This buy order is considered a taker order and typically incurs the higher taker fee.

How do crypto exchanges use maker and taker fees to balance liquidity in the market?

Crypto exchanges use maker and taker fees to balance liquidity in the market by incentivizing traders to add liquidity through lower maker fees and disincentivizing the removal of liquidity with higher taker fees. This fee structure helps maintain a stable and liquid trading environment.

How do taker fees in crypto trading work?

Taker fees in crypto trading are charged when a trader places an order that immediately matches an existing order in the order book, removing liquidity from the market. These fees are usually higher than maker fees and are applied to market orders or limit orders that execute instantly.

Why are maker fees lower than taker fees in the crypto market?

Maker fees are lower than taker fees in the crypto market to incentivize traders to add liquidity to the order book. By offering lower fees to market makers, exchanges encourage the creation of a more liquid and stable market environment, which benefits all participants.

What is the role of market makers and market takers in the cryptocurrency world?

Market makers add liquidity to the order book by placing limit orders that do not immediately execute, while market takers remove liquidity by placing orders that match existing orders at the current price. Market makers provide depth to the market, while takers create immediate transactions.

How do maker vs taker fees impact trading strategies?

Maker vs taker fees impact trading strategies by encouraging traders to place limit orders rather than market orders. Traders who want to minimize fees will place limit orders to act as market makers, thus paying lower maker fees. Those who need immediate execution will pay higher taker fees.

Why are taker fees in crypto higher than maker fees?

Taker fees in crypto are higher than maker fees because removing liquidity from the order book is considered less beneficial to market stability. Higher taker fees discourage immediate execution orders, promoting a more orderly market with a balance of buy and sell orders.

What types of fees do market participants pay in the cryptocurrency world?

Market participants in the cryptocurrency world pay maker fees and taker fees. Maker fees are charged for placing orders that add liquidity to the order book, while taker fees are charged for orders that remove liquidity. These fees vary depending on the trading platform and volume.

How do market makers and takers affect liquidity in the market?

Market makers affect liquidity by adding limit orders to the order book, providing depth and options for other traders. Market takers affect liquidity by removing these orders, leading to a decrease in available trading options at specific price points. This dynamic ensures continuous market activity.

Why do exchanges differentiate fees for market makers and takers?

Exchanges differentiate fees for market makers and takers to balance liquidity. Maker fees are lower to encourage the addition of liquidity, while taker fees are higher to disincentivize the removal of liquidity. This fee structure helps maintain an efficient and liquid market.

How do taker fees apply to different types of trading fees in crypto?

Taker fees apply to market orders and any limit orders that execute immediately. These fees are a part of the overall trading fees that a trader incurs and are usually higher to discourage removing liquidity from the order book.

What is the significance of maker fees vs taker fees for crypto assets?

The significance of maker fees vs taker fees for crypto assets lies in trading cost efficiency. Lower maker fees encourage traders to add liquidity, enhancing market depth and stability. Higher taker fees deter instant transactions that deplete order book liquidity, promoting a more balanced market.