Uniswap Price Prediction 2024, 2025, 2026, 2030 Forecasting Uni

As the cryptocurrency market continues to captivate investors worldwide, the UNI token emerges as a significant player in this ever-evolving landscape. With its innovative approach to decentralized finance, Uniswap has garnered considerable attention, drawing enthusiasts and skeptics alike. However, rather than relying solely on speculation, the question arises: can we predict the future trajectory of the UNI token?

Exploring the realm of price forecasting may provide valuable insights into the potential growth and value appreciation of UNI. By employing various analytical tools and methodologies, market analysts aim to unearth patterns and trends that can equip investors with informed decision-making abilities.

The UNI token, with its unique features and functionality, holds promise for those seeking investment opportunities within the realm of decentralized finance. Understanding the factors that influence its value and projecting its future trajectory can be instrumental in unlocking its full potential. As the crypto sphere increasingly embraces data-driven analysis, various forecasting techniques are employed to estimate the future price of the UNI token, ranging from traditional statistical models to sophisticated machine learning algorithms.

Understanding Uniswap: A Brief Overview of the Decentralized Exchange

In this section, we will provide a concise introduction to a prominent decentralized exchange known for its innovative features and liquidity provision mechanism. We will explore the fundamentals of this platform, highlighting its role in enabling peer-to-peer trading without relying on a centralized intermediary.

Introducing a Transparent and Autonomous Marketplace

Uniswap, a decentralized exchange protocol, revolutionizes the traditional concept of trading by operating on a decentralized and transparent marketplace. Unlike centralized exchanges that hold user funds and facilitate transactions, Uniswap empowers users to trade directly with each other without intermediaries. This ensures greater control over funds and removes the need to rely on third parties for fulfilling trades.

Through the use of smart contracts deployed on the Ethereum blockchain, Uniswap allows for the seamless exchange of digital assets. Its automated market maker (AMM) algorithm ensures that liquidity is always available for traders, enabling efficient and trustless trading on the platform.

The Liquidity Pool Mechanism

At the heart of Uniswap’s functionality lies the concept of liquidity pools. Liquidity providers, individuals or entities, deposit pairs of tokens into these pools, allowing others to trade between them. This mechanism ensures that there is always a consistent and sufficient supply of tokens available for swapping.

Rather than relying on a traditional order book model for trading, Uniswap calculates the exchange rate based on the ratio of the tokens present in the liquidity pool. As a result, this creates a predictable pricing model, which does not require counterparties for orders to execute. Traders are able to leverage this liquidity to quickly and easily exchange tokens.

In summary, Uniswap offers a decentralized and transparent alternative to centralized exchanges, allowing users to trade directly with each other while benefitting from a liquidity provision mechanism. By eliminating the need for intermediaries, Uniswap empowers individuals to have greater control over their funds and promotes a more inclusive and open financial ecosystem.

Exploring the UNI Token: Features and Use Cases

In this section, we will delve into the various characteristics and practical applications of the UNI token, offering a comprehensive understanding of its functionalities and potential benefits. By exploring the range of features and use cases that the UNI token presents, we aim to shed light on its versatile nature and its ability to contribute to the decentralized finance (DeFi) ecosystem.

The UNI token serves as the native cryptocurrency of the Uniswap protocol, functioning as a utility and governance token within the decentralized exchange (DEX) platform. Beyond its role as a medium of exchange, the UNI token is designed to provide holders with a say in the decision-making processes and evolution of the Uniswap protocol, fostering a community-driven environment where participants actively participate in shaping the platform’s future.

One of the key features of the UNI token is its governance capabilities. UNI holders have the power to propose and vote on changes to the protocol, making it a truly decentralized and autonomous platform. This governance structure ensures that the Uniswap protocol remains adaptable and responsive to the evolving needs of its users, establishing a sense of ownership and empowerment among the community.

Additionally, the UNI token plays a crucial role in incentivizing liquidity provision on the Uniswap platform. Liquidity providers are rewarded with UNI tokens as a form of compensation for their contributions in facilitating efficient trading and enabling seamless token swaps. This incentivization mechanism not only attracts liquidity to the platform but also ensures its sustainability and growth.

Furthermore, the UNI token holds the potential for broader use cases within the DeFi space. As the popularity of decentralized finance continues to surge, the UNI token could serve as a digital asset that grants access to various DeFi protocols and services. Its integration with other platforms and applications could enable seamless interoperability and introduce new possibilities for decentralized finance.

In conclusion, the UNI token represents more than just a mere medium of exchange. With its governance capabilities, incentives for liquidity provision, and potential for broader use cases, it stands as a key component in driving the growth and development of the Uniswap protocol and the decentralized finance ecosystem as a whole.

The Importance of Price Prediction in the Cryptocurrency Market

In the dynamic world of cryptocurrency, the ability to accurately predict price movements plays a crucial role in making informed investment decisions. Anticipating the future value of digital assets can provide investors with a competitive edge and help them navigate the volatile market with confidence.

As the cryptocurrency market continues to mature, price prediction tools and techniques have become invaluable resources for traders, speculators, and enthusiasts alike. These predictions are not only based on historical data but also on various indicators, market trends, and external factors that influence the value of cryptocurrencies.

By leveraging price prediction models, investors can gain insights into potential price fluctuations, enabling them to optimize their investment strategies. This allows them to identify opportunities for buying or selling cryptocurrencies at the most favorable times, maximizing their profits.

Accurate price predictions also contribute to a healthier market overall. When investors have reliable forecasts at their disposal, they can make more informed decisions, reducing the likelihood of panic selling or buying based on hype. This promotes stability and sustainability in the cryptocurrency market, creating a more trustworthy and credible ecosystem.

Furthermore, price prediction plays a vital role in risk management. Understanding the potential risks associated with a particular cryptocurrency assists investors in determining their risk tolerance and adjusting their portfolios accordingly. By analyzing price predictions, investors can assess the potential returns and potential losses, allowing them to make calculated investment decisions.

It is important to note that price predictions are not foolproof and should be used as part of a comprehensive analysis. Factors such as regulatory developments, technological advancements, and investor sentiment can significantly impact the value of cryptocurrencies, making it essential to consider multiple variables when making investment decisions.

In conclusion, price prediction serves as a valuable tool in the cryptocurrency market, providing investors with insights into potential price movements and enabling them to make informed investment choices. By leveraging accurate forecasts, investors can optimize their strategies, manage risks, and contribute to a more stable and trustworthy cryptocurrency ecosystem.

Factors Influencing the Future Value of UNI Token

In this section, we will explore the various factors that can impact the future valuation of the UNI token. Understanding these factors is essential for making informed decisions regarding investments in the cryptocurrency market.

Economic Indicators

Economic indicators play a crucial role in determining the future value of the UNI token. Factors such as inflation rates, GDP growth, and interest rates can have a significant impact on the overall market sentiment towards cryptocurrencies. Moreover, geopolitical events, governmental policies, and global economic trends can also influence the market value of UNI.

User Adoption and Technology Development

The adoption of the Uniswap platform and the advancements in blockchain technology can greatly impact the future value of the UNI token. A higher user adoption rate and increasing demand for decentralized exchanges can drive the value of UNI up. Additionally, technological developments that improve the efficiency, scalability, and security of the Uniswap platform can enhance the desirability of the UNI token among investors.

In summary, the future value of the UNI token can be influenced by economic indicators, such as inflation rates, GDP growth, and interest rates, as well as user adoption of the Uniswap platform and advancements in blockchain technology. Understanding these factors and staying informed about market trends can help investors make more accurate predictions and decisions regarding the value of the UNI token.

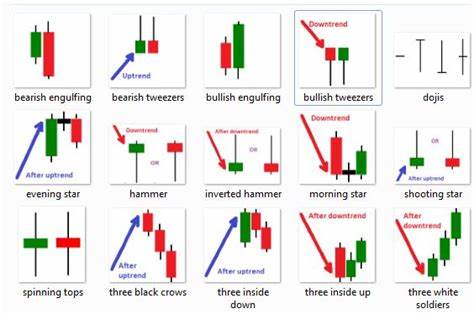

Technical Analysis: Tools for Predicting UNI Token’s Price

In this section, we will explore various techniques and tools that can be used to predict the future price of the UNI token. By analyzing historical data and identifying patterns, technical analysis can provide insights into potential price movements and trends.

1. Moving Averages

One commonly used tool in technical analysis is moving averages. Moving averages help smooth out price fluctuations and identify the underlying trend of the UNI token’s price. By calculating the average price over a specific period, such as 50 or 200 days, traders can identify potential support and resistance levels.

2. Relative Strength Index (RSI)

The Relative Strength Index (RSI) is another popular tool used by traders to predict price movements. RSI measures the speed and change of price movements and ranges from 0 to 100. A high RSI value indicates that the UNI token may be overbought, while a low value suggests it may be oversold. Traders can use this information to anticipate potential reversals or continuation of trends.

By incorporating these tools into their analysis, traders can gain a better understanding of the UNI token’s price movements and make more informed trading decisions. However, it is essential to note that technical analysis is not foolproof and should be used in conjunction with other forms of analysis and indicators to achieve more accurate predictions.

Expert Opinions and Market Sentiment: Evaluating UNI Token’s Potential

In this section, we will delve into the evaluation of the potential of UNI Token by exploring expert opinions and analyzing market sentiment surrounding the token. By examining the insights provided by industry specialists and considering the prevailing attitudes within the cryptocurrency market, we aim to gain a comprehensive understanding of the future prospects of the UNI Token.

Industry Experts’ Perspectives

Industry experts play a crucial role in assessing the potential of a cryptocurrency, and their opinions offer valuable insights. By considering the viewpoints of these esteemed professionals, we can gain a well-rounded perspective on the future value of UNI Token. These experts possess in-depth knowledge of the blockchain industry, economics, and market trends, allowing them to provide informed predictions about UNI Token’s potential.

One expert, known for their expertise in decentralized finance (DeFi), believes that UNI Token holds significant potential due to the crucial role it plays in the Uniswap decentralized exchange ecosystem. They highlight the growing demand for decentralized exchanges and predict that the increasing adoption of DeFi protocols will positively impact the value of UNI Token in the long run.

Market Sentiment Analysis

Market sentiment plays a vital role in influencing the trajectory of a cryptocurrency. By examining the prevailing sentiment towards UNI Token within the cryptocurrency community, we can gain insights into the market’s overall perception of its potential. This sentiment analysis involves monitoring discussions on social media platforms, forums, and other relevant online communities.

Initial analysis of market sentiment indicates a generally optimistic outlook towards UNI Token. Many investors express enthusiasm about its value proposition and underline the unique benefits offered by the Uniswap platform. The community’s active engagement, coupled with positive sentiment, suggests a favorable market environment for UNI Token.

| KEY FACTORS | POSITIVE SENTIMENT | NEGATIVE SENTIMENT |

|---|---|---|

| Uniswap’s Growing User Base | Investors view the expansion of Uniswap’s user base as a positive indicator for the future value of UNI Token. | Concerns exist about potential scalability challenges as the network expands. |

| Uniswap’s Innovative Features | Investors appreciate Uniswap’s continuous innovation in the field of decentralized exchanges, driving positive sentiment towards UNI Token. | Skeptics argue that competitors might emerge with superior features, posing a threat to UNI Token’s market position. |

| Regulatory Considerations | Positive sentiment prevails as the regulatory landscape becomes more defined and supportive of cryptocurrencies like UNI Token. | Uncertainties regarding potential regulatory hurdles create cautious sentiment among some investors. |

By analyzing these expert opinions and evaluating market sentiment, we can form a comprehensive understanding of UNI Token’s potential. It is important to consider both positive and negative perspectives to make informed decisions and predictions about the future value of UNI Token.

Question-answer: Uniswap price prediction

What is the current price of Uni?

The current price of Uni can be checked on various cryptocurrency uni price exchanges or market tracking websites 2023.

What is the price prediction for Uniswap in 2025?

The price prediction for Uniswap in 2025 may vary based on market trends, adoption, and protocol developments price prediction 2025.

What is the forecasted price of Uni for 2027?

The forecasted price of Uni for 2027 can be analyzed closer to that time based on market dynamics.

Should one consider investing in Uniswap?

Whether to invest in Uniswap depends on individual risk tolerance and investment objectives.

What is the price forecast for Uniswap in 2030?

The price forecast for Uniswap in 2030 depends on its long-term viability and adoption within the decentralized finance (DeFi) space price prediction 2030.

How does the current price of Uni compare to its historical price movements?

Comparing the current price of Uni to its historical price movements can provide insights uniswap price forecast into its trend and potential future movements.

What is the price of Uniswap projected to be in 2028?

The projected price of Uniswap in 2028 may depend on factors such as market sentiment, technological advancements, and regulatory developments.

How can one buy Uniswap tokens?

Uniswap tokens can be bought on various cryptocurrency exchanges that list Uni for trading.

Could Uni reach a certain price level by 2029?

Uni could potentially reach a certain price level by 2029 depending on market conditions and adoption.

What is the long-term price outlook for Uni?

The long-term price outlook for Uni depends on factors such as its role in the DeFi ecosystem, network upgrades, and overall market sentiment.

What is the minimum price that Uniswap has reached historically?

The minimum price that Uniswap has reached historically can be determined by analyzing past price data.

What is the price prediction for Uniswap in April 2024?

The price prediction for Uniswap in April 2024 may vary based on market trends and project developments at that time.

What is the average trading price of Uni?

The average trading price of Uni can be calculated by averaging its prices across various trading platforms over a specific period.

How has Uniswap’s price history influenced its current position?

Uniswap’s price history provides insights into its performance and potential future trends within the cryptocurrency market.

Could Uniswap experience price volatility in the future?

Uniswap could experience price volatility in the future, influenced by factors such as market demand and regulatory developments.

What is the long-term price prediction for Uniswap in 2030?

The long-term price prediction for Uniswap in 2030 may depend on its continued growth and adoption as a decentralized exchange platform.

How does the supply of Uniswap tokens affect its price?

The supply of Uniswap tokens can impact its price dynamics, with changes in supply potentially influencing its market value.

What is the value of Uniswap within its ecosystem?

The value of Uniswap within its ecosystem lies in its role as a decentralized exchange facilitating token swaps and liquidity provision.

What is the technical analysis suggesting for Uniswap’s price action?

Technical analysis involves studying historical price data and chart patterns to forecast future price movements for Uniswap.

Can one convert Uni to USD?

Uni can be traded for USD on various cryptocurrency exchanges that support Uni/USD trading pairs.