In the fast-paced world of cryptocurrency, patterns have emerged as a vital tool for investors and traders. These patterns, formed by the price action and volume of various cryptocurrencies, can provide valuable insights into market trends and potential opportunities. By analyzing these patterns, traders and investors can make more informed decisions and increase their chances of success.

But what exactly are crypto patterns? Simply put, they are repetitive formations in the price and volume charts of cryptocurrencies. These formations can take many different shapes and sizes, ranging from simple patterns like triangles and rectangles to more complex ones like head and shoulders and double tops. Each pattern has its own unique characteristics and can signal different outcomes, such as trend continuation or reversal.

Unlocking the secrets of crypto patterns requires a combination of technical analysis and market understanding. Traders and investors must first familiarize themselves with the different types of patterns and learn how to identify them on charts. They must also understand the fundamental factors that can influence the formation and interpretation of these patterns, such as market sentiment, news events, and support and resistance levels.

Once armed with this knowledge, traders and investors can then use crypto patterns to their advantage. By recognizing patterns early on, they can anticipate potential price movements and adjust their strategies accordingly. For example, a trader may decide to buy a cryptocurrency when it forms a bullish pattern, indicating a potential upward trend, or sell when it forms a bearish pattern, indicating a potential downward trend.

In conclusion, crypto patterns are a powerful tool for understanding and predicting the movements of cryptocurrencies. They can provide valuable insights into market trends and help traders and investors make more informed decisions. By unlocking the secrets of these patterns, anyone can potentially unlock the secrets of crypto success.

Understanding Crypto Patterns

When it comes to cryptocurrency, understanding patterns is crucial. Patterns can provide valuable insight into market trends and help predict future price movements. By recognizing and analyzing these patterns, investors and traders can make informed decisions.

The Importance of Identifying Patterns

Identifying patterns in cryptocurrency charts is an essential skill for anyone looking to invest or trade in the crypto market. Patterns can be classified into various categories, such as continuation patterns and reversal patterns.

Continuation patterns, as the name suggests, indicate that the prevailing trend is likely to continue. These patterns are characterized by a temporary pause in the price movement before the trend resumes. By correctly identifying continuation patterns, traders can take advantage of the expected price movement.

In contrast, reversal patterns indicate a potential change in the prevailing trend. These patterns occur when the price movement shows signs of reversing its direction. Recognizing reversal patterns can help traders exit positions before a significant price reversal occurs.

Common Crypto Patterns

There are several common patterns that frequently appear in cryptocurrency charts:

- Head and Shoulders: This pattern is a reversal pattern that signals a potential trend change. It consists of three peaks, with the middle peak being the highest (the head), and the surrounding peaks being lower (the shoulders).

- Double Top: This pattern occurs when the price reaches a high point, retraces, and then reaches the same high point again, forming two peaks. It is a bearish reversal pattern.

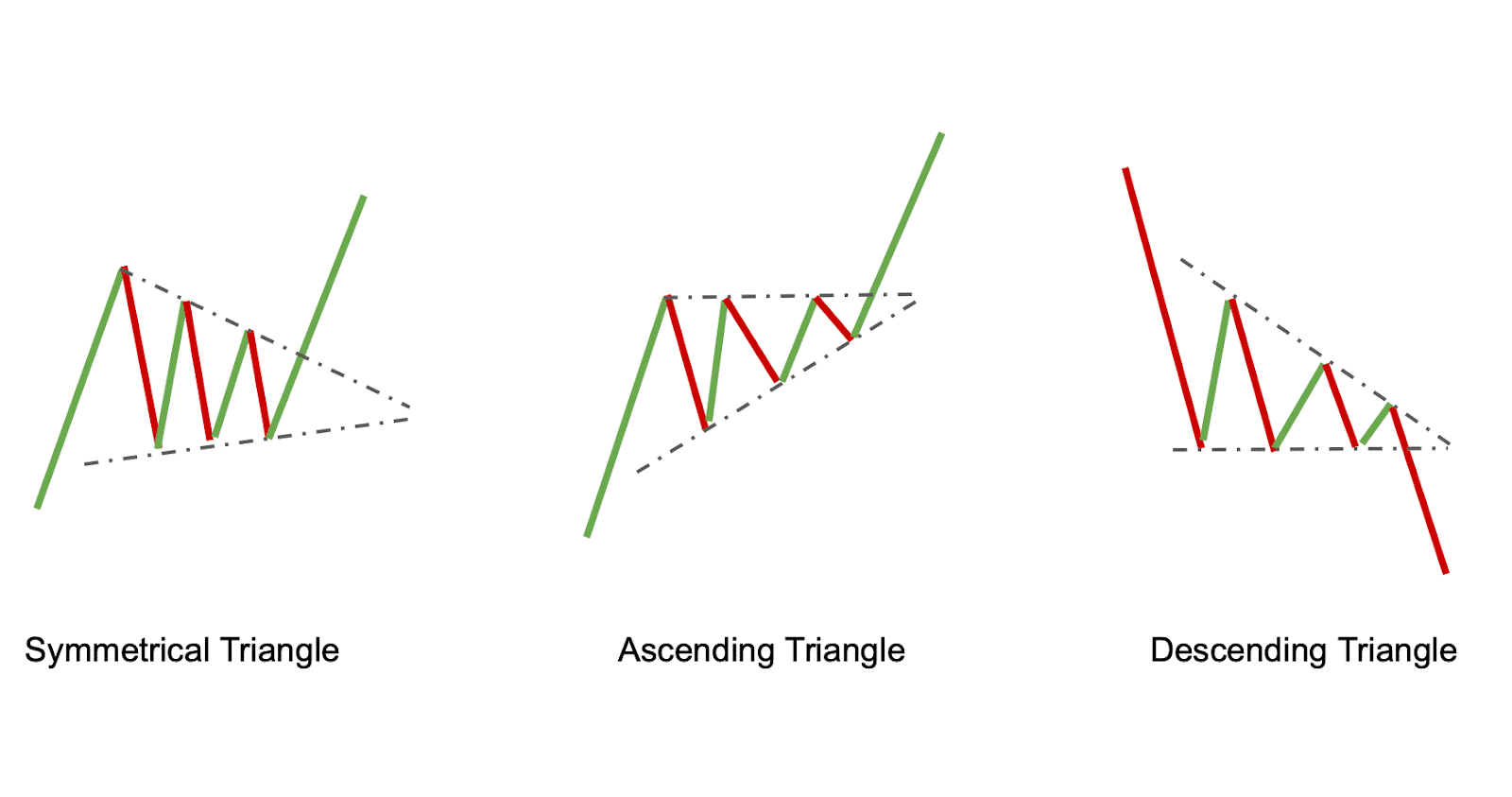

- Ascending Triangle: This pattern forms when the price reaches a series of higher lows and a horizontal resistance level. It is a bullish continuation pattern.

- Descending Triangle: This pattern is the opposite of the ascending triangle and forms when the price reaches a series of lower highs and a horizontal support level. It is a bearish continuation pattern.

Understanding these patterns and their implications can assist investors and traders in making educated decisions in the cryptocurrency market. It is important to note that patterns are not foolproof indicators, and other factors should be considered when making investment choices.

No matter the strategy or approach, having a solid understanding of crypto patterns is an invaluable tool for navigating the cryptocurrency market.

Disclaimer: This article is not financial advice and should not be interpreted as such. Cryptocurrency investments come with risks, and thorough research and caution should be exercised.

Analyzing Cryptocurrency Data

When it comes to investing in cryptocurrencies, it is crucial to have access to reliable and accurate data. Analyzing cryptocurrency data can provide valuable insights and help investors make informed decisions. Here are some key aspects to consider when analyzing cryptocurrency data:

- Price Patterns: Analyzing price patterns is essential to understanding the market behavior of cryptocurrencies. By studying historical price data, investors can identify trends, support and resistance levels, and potential entry or exit points.

- Volume Analysis: Volume analysis is another crucial aspect of analyzing cryptocurrency data. It helps investors gauge the strength of a price move and identify potential buying or selling pressure. High volume during a price breakout can indicate a strong trend, while low volume may suggest a lack of market interest.

- Market Sentiment: Understanding market sentiment is vital in the cryptocurrency market, as it can significantly impact prices. Analyzing social media trends, news sentiment, and investor sentiment indicators can help investors gauge the market’s overall sentiment and make more informed decisions.

- Fundamental Analysis: In addition to technical analysis, fundamental analysis plays a crucial role in analyzing cryptocurrency data. Factors such as the team behind the project, partnerships, adoption rates, and regulatory developments can influence the value of a cryptocurrency in the long term.

- Correlations: Analyzing correlations between cryptocurrencies, as well as their correlations with other asset classes, can provide insights into the overall market dynamics and potential diversification opportunities.

- Risk Management: Effective risk management is essential when analyzing cryptocurrency data. Investors should assess the risk-reward profile of their investments, set stop-loss orders, and diversify their portfolios to mitigate potential losses.

By analyzing cryptocurrency data, investors can gain a better understanding of the market and improve their decision-making process. However, it’s important to remember that analyzing data is just one part of the equation. Investors should also stay updated with market news, keep abreast of regulatory changes, and continuously refine their strategies to adapt to a rapidly evolving market.

Identifying Trends in Crypto Markets

One of the key challenges for investors in the cryptocurrency market is to identify trends and patterns that can help predict future price movements. Identifying trends can provide valuable insights into when to buy or sell cryptocurrencies.

Trend analysis is a popular method used by traders and investors to identify the direction of the market. It involves analyzing historical price data to find patterns, such as higher highs and higher lows, or lower highs and lower lows.

Once a trend is identified, traders can use it to make informed decisions about when to enter or exit a trade. If a market is in an uptrend, meaning prices are consistently increasing, it may be a good time to buy. Conversely, if a market is in a downtrend, prices are consistently decreasing, it may be a good time to sell.

Technical indicators can also be used to identify trends in crypto markets. These indicators, such as moving averages or relative strength index (RSI), can help confirm the presence of a trend by analyzing price data in different ways.

It’s important for traders and investors to remember that trends can change, and it is crucial to continuously monitor the market and adjust strategies accordingly. While trends can provide valuable insights, they are not foolproof indicators of future price movements.

In conclusion, identifying trends in crypto markets is a crucial component of successful trading and investing. By using trend analysis and technical indicators, investors can gain insights into the direction of the market and make informed decisions about when to enter or exit trades.

Exploring Key Cryptocurrency Patterns

When it comes to cryptocurrency, there are several key patterns that can be observed. These patterns can provide valuable insights and help make informed decisions when it comes to trading or investing in cryptocurrencies. In this section, we will explore some of the most common patterns seen in the cryptocurrency market.

- Trend: The trend pattern refers to the overall direction of the price movement of a cryptocurrency. It can be classified as an uptrend, where prices are increasing, or a downtrend, where prices are decreasing. Understanding the trend pattern can help identify potential buying or selling opportunities.

- Support and Resistance: Support and resistance levels are key patterns that indicate levels where the price of a cryptocurrency is likely to reverse or consolidate. Support levels represent a level where buying pressure is strong enough to prevent the price from falling further, while resistance levels represent a level where selling pressure is strong enough to prevent the price from rising further.

- Breakout: The breakout pattern occurs when the price of a cryptocurrency breaks above or below a significant level of support or resistance. This pattern indicates a potential change in the trend or the start of a new trend. Traders often look for breakouts as they can provide profitable trading opportunities.

- Continuation: The continuation pattern is characterized by a pause in the price movement of a cryptocurrency after a significant trend. This pattern indicates that the price is likely to continue in the same direction as the previous trend once the consolidation or pause is over. Recognizing continuation patterns can help traders plan their entry or exit points.

- Reversal: The reversal pattern occurs when the price of a cryptocurrency changes direction after a sustained trend. This pattern indicates a potential change in the trend and can provide opportunities to buy at the bottom or sell at the top of a trend. Reversal patterns can be identified by specific candlestick formations or chart patterns.

By understanding and recognizing these key cryptocurrency patterns, traders and investors can improve their decision-making process and increase the likelihood of successful trades. It is important to note that no pattern is foolproof, and it is always advisable to use other technical analysis tools and indicators in conjunction with these patterns for a more comprehensive analysis.

The Role of Technical Analysis in Cryptocurrency Patterning

Technical analysis plays a crucial role in the patterning of cryptocurrencies. It involves the examination of historical market data, such as price and volume, to identify patterns and trends. By analyzing these patterns, traders and investors can make informed decisions about buying or selling cryptocurrencies.

Identifying Trends

One of the primary objectives of technical analysis in cryptocurrency patterning is to identify trends. Trends can be classified as either bullish (upward) or bearish (downward). By analyzing historical price data, technical analysts can identify patterns that indicate the direction of a trend. This information can be used to determine when to enter or exit a trade.

Support and Resistance Levels

Technical analysis also involves identifying support and resistance levels. Support levels are price levels at which the demand for a cryptocurrency is strong enough to prevent it from falling further. Resistance levels, on the other hand, are price levels at which the supply of a cryptocurrency is strong enough to prevent it from rising further. By analyzing these levels, traders can make decisions about when to buy or sell.

Support and resistance levels can also help in identifying potential patterns, such as channels or triangles. These patterns can provide insight into the future movement of a cryptocurrency’s price.

| Pattern | Description |

|---|---|

| Head and Shoulders | A reversal pattern that indicates the end of an uptrend. |

| Double Bottom | A bullish reversal pattern that signals the end of a downtrend. |

| Cup and Handle | A continuation pattern that indicates a bullish breakout. |

By recognizing these patterns and using technical analysis, traders can gain an edge in the cryptocurrency market. However, it is important to note that technical analysis is not foolproof and should be used in conjunction with other forms of analysis and risk management strategies.

In conclusion, technical analysis plays a crucial role in cryptocurrency patterning by identifying trends, support and resistance levels, and patterns. By using these techniques, traders can make more informed decisions and increase their chances of success in the cryptocurrency market.

Using Crypto Patterns to Inform Investment Strategies

Cryptocurrency has gained significant attention in recent years, with many investors looking for ways to capitalize on the volatility and potential growth of this new asset class. One approach that has emerged is the use of crypto patterns to inform investment strategies.

Understanding Crypto Patterns

Crypto patterns refer to recurring trends or behaviors in the cryptocurrency market. These patterns can be identified by analyzing historical price data and market indicators. By recognizing and understanding these patterns, investors can make more informed decisions about when to buy, sell, or hold their cryptocurrency investments.

There are several types of crypto patterns that investors commonly look for:

- Breakout patterns: These patterns occur when the price of a cryptocurrency breaks through a certain level of resistance or support. This often indicates a significant shift in market sentiment and can be a signal for investors to buy or sell.

- Trend patterns: Trend patterns involve the identification of long-term trends in the cryptocurrency market. This can help investors identify which cryptocurrencies are likely to appreciate in value over time.

- Reversal patterns: Reversal patterns can indicate a potential change in the direction of a cryptocurrency’s price movement. These patterns can be helpful for investors looking to capitalize on short-term price fluctuations.

- Volume patterns: Volume patterns involve analyzing the trading volume of a cryptocurrency. High trading volume can indicate increased market interest and liquidity, while low trading volume can suggest a lack of buyer or seller interest.

Using Crypto Patterns for Investment Strategies

Integrating crypto patterns into investment strategies can help investors make more informed decisions and potentially increase their returns. Here are a few ways that investors can utilize crypto patterns:

- Timing trades: By recognizing breakout or reversal patterns, investors can time their trades to take advantage of potential price movements. For example, if a breakout pattern suggests that a cryptocurrency is about to experience a significant price increase, an investor may choose to buy the cryptocurrency before the breakout occurs.

- Diversifying portfolios: Crypto patterns can also be used to identify opportunities to diversify investment portfolios. By analyzing trend patterns and identifying cryptocurrencies that are likely to appreciate in value over time, investors can strategically allocate their investments across different types of cryptocurrencies.

- Managing risk: Understanding crypto patterns can also help investors manage risk in their portfolios. By recognizing patterns that indicate potential price declines, investors can set stop-loss orders or implement other risk management strategies to protect their investments.

However, it’s important to note that crypto patterns should not be the sole basis for investment decisions. Market conditions can change quickly, and patterns may not always accurately predict future price movements. It’s crucial for investors to conduct thorough research, consider other factors such as fundamental analysis and market sentiment, and consult with financial professionals before making investment decisions.

In conclusion, using crypto patterns to inform investment strategies can be a valuable tool for investors in the cryptocurrency market. By understanding and recognizing these patterns, investors can make more informed decisions about when to buy, sell, or hold their cryptocurrency investments, potentially increasing their chances of success in this rapidly evolving market.

The Limitations of Crypto Patterns

While crypto patterns can provide valuable insights into the cryptocurrency market, it is important to recognize their limitations. It is essential for investors and traders to approach these patterns with a critical mindset and understand their potential drawbacks.

1. Historical Data

Crypto patterns are primarily based on historical data, which means they are retrospective in nature. These patterns may not always accurately predict future market movements, as market conditions and dynamics can change rapidly. It is crucial to consider other factors such as market sentiment, news events, and regulatory developments when making investment decisions.

2. Market Manipulation

The cryptocurrency market is known for its high volatility and susceptibility to market manipulation. While certain patterns may seem to suggest a specific market direction, it is important to be cautious of potential manipulative practices. Traders with significant market influence can exploit patterns and create false signals, leading to misleading investment decisions.

| Limitations of Crypto Patterns | Implications |

|---|---|

| Limited Predictive Power | Patterns may not accurately predict future market movements. |

| Potential for Manipulation | Market manipulation can create false patterns and signals. |

| Dependency on Historical Data | Patterns rely on historical data and may not reflect current market dynamics. |

| Lack of External Factors | Patterns do not account for news events, market sentiment, and regulatory changes. |

To mitigate limitations, traders and investors should combine crypto patterns with other technical analysis tools, fundamental analysis, and market research. It is important to diversify investment strategies and not solely rely on patterns.

In conclusion, while crypto patterns can provide valuable insights, they should not be solely relied upon for making investment decisions. Understanding their limitations and combining them with other analytical approaches can help improve decision-making and portfolio management in the volatile cryptocurrency market.

Future Implications of Cryptocurrency Patterning

As the field of cryptocurrency continues to evolve, the study of crypto patterns opens up exciting possibilities for both investors and researchers. Understanding and predicting patterns in the cryptocurrency market can have significant future implications.

1. Investment Strategies

One of the key implications of cryptocurrency patterning is its impact on investment strategies. By analyzing historical patterns, investors can identify potential buying or selling opportunities, improving their overall performance in the market. This insight can help them make informed decisions and minimize risks.

Moreover, studying patterns can lead to the development of algorithmic trading strategies. With automated systems in place, investors can take advantage of real-time data and execute trades based on predefined patterns. This automation eliminates human emotion and improves consistency in trading, potentially increasing returns on investment.

2. Market Analysis

Cryptocurrency patterning can also provide valuable insights into market analysis. By studying patterns, researchers can identify trends, market sentiment, and potential market shifts. This information can assist in making accurate predictions about the future behavior of cryptocurrencies.

Additionally, identifying patterns can aid in market regulation and risk management. Regulatory bodies can use pattern analysis to detect potential market manipulations, identify fraudulent activities, and protect investors. Risk management professionals can utilize patterns to assess market volatility and develop strategies to mitigate potential risks.

In conclusion, the future implications of cryptocurrency patterning are vast. From improving investment strategies and implementing algorithmic trading to enhancing market analysis and regulating the cryptocurrency market, the study of patterns opens up new opportunities in this rapidly evolving field.

Q&A: Crypto patterns

What are crypto patterns?

Crypto patterns are recurring trends or formations that can be observed in the price movements of cryptocurrencies. These patterns can provide valuable insights into the future price direction of a cryptocurrency.

How can crypto patterns help in making investment decisions?

Crypto patterns can help in making investment decisions by providing clues about the future price movements of a cryptocurrency. By analyzing historical data, patterns can be identified that indicate potential opportunities for buying or selling a cryptocurrency.

Are there different types of crypto patterns?

Yes, there are different types of crypto patterns. Some common patterns include head and shoulders, double bottoms, ascending triangles, and descending channels. Each pattern has its own characteristics and can provide different insights into the future price movements of a cryptocurrency.

Do crypto patterns always accurately predict price movements?

No, crypto patterns do not always accurately predict price movements. While patterns can provide valuable insights, they are not 100% reliable. Other market factors and external events can also influence the price of a cryptocurrency, so it is important to consider multiple sources of information when making investment decisions.

How can I learn more about crypto patterns?

There are many resources available for learning more about crypto patterns. You can start by reading books or online articles on technical analysis, which often cover different types of patterns. Additionally, there are online communities and forums where experienced traders share their insights and analysis of crypto patterns.

What are crypto patterns?

Crypto patterns are repetitive trends or formations that can be observed in cryptocurrency price charts. These patterns can provide insights into the future direction of the market and help traders make informed decisions.