Starting a Crypto Business 101 Cryptocurrency Exchange

Embarking on a transformative journey towards establishing a flourishing digital enterprise in the expansive realm of cryptocurrency necessitates an intricate understanding of the underlying mechanisms and strategic maneuvers that shape this innovative marketplace.

Advancing in this fast-paced and dynamic domain demands more than just an entrepreneurial spirit; it necessitates a well-crafted roadmap that encompasses a multitude of vital components and judicious decision-making at every turn. From conceptualizing groundbreaking ideas to mitigating risks and carving an indelible niche amidst fierce competition, every step in this process is crucial in laying the foundation for a prosperous crypto venture.

Intrinsically tied to technological advancements and the power of decentralization, the world of digital currencies has emerged as a tantalizing landscape teeming with opportunities waiting to be seized. However, diving headfirst into the chaos without comprehensive preparation and a cohesive strategy can be perilous. Indeed, one must navigate through a complex network of complexities and uncertainties, skillfully leveraging resources and embracing emerging trends to build a resilient and scalable crypto enterprise.

Understanding the Crypto Industry Landscape

In this section, we will explore the intricacies and dynamics of the ever-evolving landscape of the digital currency industry. By delving into the various facets and dimensions of the crypto world, we aim to provide a comprehensive understanding of the ecosystem in which crypto business ventures operate.

The crypto industry is a multifaceted domain that encompasses a wide range of digital currencies, blockchain technology, and decentralized finance. It is a fast-paced and highly volatile market that operates 24/7 across the globe.

One key aspect of the crypto industry landscape is the presence of numerous cryptocurrencies, each with its unique features and potential use cases. These digital assets, such as Bitcoin, Ethereum, and Litecoin, serve as mediums of exchange and units of value within the blockchain ecosystem.

Moreover, the crypto industry landscape extends beyond just cryptocurrencies. It includes various blockchain platforms that facilitate smart contracts and decentralized applications (dApps). These platforms, like Ethereum, provide the foundation for building innovative solutions and disrupting traditional industries.

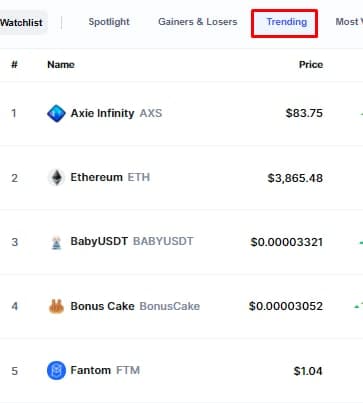

In addition to cryptocurrencies and blockchain platforms, the crypto industry landscape also encompasses exchanges, wallets, and other infrastructure providers. Exchanges act as marketplaces where individuals can buy, sell, and trade different cryptocurrencies. Meanwhile, wallets provide a secure means of storing and managing digital assets.

Furthermore, the emergence of decentralized finance (DeFi) has revolutionized the crypto industry landscape. DeFi platforms enable users to engage in lending, borrowing, and yield farming, all without relying on traditional intermediaries. This disruptive trend has the potential to reshape the future of financial services.

Overall, comprehending the crypto industry landscape is crucial for aspiring entrepreneurs and businesses looking to enter the world of digital currencies. By understanding the diverse components and dynamics of this rapidly evolving sector, one can navigate the challenges and seize opportunities in building a successful crypto business.

Identifying a Niche or Unique Selling Proposition

One of the crucial factors in establishing a successful presence in the crypto industry is the ability to identify a niche or develop a unique selling proposition (USP). This involves finding a specific area or market segment that sets your crypto business apart from others, allowing it to stand out and attract a targeted audience.

Finding your Niche

When identifying a niche within the crypto industry, it is essential to thoroughly research various sectors and identify areas of untapped potential. By analyzing market trends and consumer needs, you can identify gaps in the market and areas where your business can provide value. This could involve targeting a specific cryptocurrency, focusing on a particular type of blockchain technology, or catering to a specific audience segment.

Developing a Unique Selling Proposition

Once you have identified a potential niche, the next step is to develop a unique selling proposition. Your USP should clearly communicate the value your crypto business offers to customers and differentiate it from competitors. This could involve offering innovative features or services, providing a superior user experience, or implementing cutting-edge security measures.

By understanding the unique needs and preferences of your target market, you can tailor your USP to appeal to their specific desires. This will enable you to position your crypto business as the go-to solution for customers within your niche, leading to increased brand recognition and customer loyalty.

It is important to continually evaluate and evolve your niche and USP as the crypto industry evolves. By staying informed about new trends and emerging technologies, you can ensure that your business remains relevant and continues to offer value to your target audience.

Ultimately, identifying a niche or unique selling proposition lays the foundation for a successful crypto business. By finding your distinct place within the industry and catering to the specific needs of your target market, you can establish a strong presence and gain a competitive edge in the ever-evolving world of cryptocurrencies.

Building a Knowledgeable and Trustworthy Team

In the realm of establishing a reputable cryptocurrency venture, assembling a team that possesses both expertise and integrity plays a pivotal role. The success of any crypto business is heavily reliant on the collective knowledge and trustworthiness of its members. In this section, we will delve into the essential aspects of building a team that can navigate the complexities of the crypto landscape and foster trust among stakeholders.

1. Recruit Individuals with Domain Expertise

One of the fundamental steps in constructing a knowledgeable team is identifying and recruiting individuals who possess domain expertise in the cryptocurrency industry. Seek out professionals who have a deep understanding of blockchain technology, digital assets, smart contracts, and related fields. Their specialized knowledge will be crucial in making informed decisions, mitigating risks, and staying up-to-date with the ever-evolving crypto ecosystem.

2. Foster Integrity and Trustworthiness

In addition to expertise, it is imperative to prioritize integrity and trustworthiness when selecting team members for your crypto business. Seek individuals who demonstrate a strong ethical compass, are transparent in their actions, and prioritize the long-term success of the venture over personal gain. Establishing a culture of trust within the team will not only enhance collaboration but also inspire confidence among investors, partners, and customers.

Embracing a culture of continuous learning, encouraging open communication, and fostering a sense of accountability are key elements in building a knowledgeable and trustworthy team in the realm of cryptocurrency. By assembling individuals with domain expertise and placing integrity at the core of your team’s values, you generate the foundation for a successful crypto business.

Creating a Comprehensive Business Plan and Strategy

In the ever-evolving world of digital assets, establishing a solid foundation for your venture is crucial for long-term success. This section delves into the essential steps required to craft a comprehensive business plan and strategy, ensuring that your crypto business is well-positioned to thrive in the competitive landscape.

1. Define Your Vision: A clear and compelling vision sets the direction for your crypto business. Outline your long-term goals, values, and objectives, emphasizing the unique value proposition you aim to offer to the market.

2. Conduct Market Research: Thoroughly analyze the crypto industry, identifying emerging trends, potential opportunities, and key competitors. Gain insights into your target audience, understanding their needs and preferences, in order to tailor your products or services accordingly.

3. Determine Your Target Market: Segmenting your target market enables you to focus your efforts on specific customer groups. Consider factors such as demographics, geographical location, and purchasing power to refine your marketing strategies and better address your customers’ needs.

4. Develop a Unique Value Proposition: Find your differentiating factor by identifying what sets your crypto business apart from others in the market. Emphasize the distinctive benefits your offerings provide, positioning yourself as the go-to solution for your target market.

5. Outline Financial Projections: Forecast the financial aspects of your crypto business, taking into account factors like revenue streams, cost structure, and funding requirements. This allows you to gauge the sustainability of your venture and attract potential investors or partners.

6. Create a Marketing and Sales Strategy: Develop a comprehensive plan for promoting your crypto business and acquiring customers. Outline your marketing channels, messaging strategies, and pricing models to effectively reach and engage your target audience.

7. Establish Risk Management Measures: Assess and mitigate potential risks inherent in the crypto industry, such as regulatory changes, cybersecurity threats, or market volatility. Implement measures to safeguard your business and ensure operational continuity.

8. Build a Team of Experts: Surround yourself with skilled professionals who share your vision and can contribute their expertise to the success of your crypto business. Assemble a team that complements your strengths and addresses any skill gaps.

9. Continuously Review and Adapt: The crypto industry evolves rapidly, making it vital to regularly review your business plan and strategy. Stay updated on market dynamics, technological advancements, and customer feedback, allowing for adjustments and optimizations along the way.

By investing time and effort in crafting a comprehensive business plan and strategy, you lay a solid foundation for your crypto business and increase your chances of achieving long-term success in this dynamic and exciting field.

Developing Relationships with Key Partners and Investors

In the pursuit of creating a thriving venture in the dynamic world of cryptocurrency, one crucial aspect to consider is the development of strong alliances with key partners and investors. This section explores the significance of building meaningful relationships with these stakeholders and offers insights into how to establish and nurture them.

Forming Strategic Partnerships

Collaborating with strategic partners can greatly enhance the chances of success for your crypto business. By teaming up with like-minded organizations or individuals, you can leverage each other’s strengths, resources, and expertise to pave the way for mutual growth. Strategic partners may include technology firms, blockchain developers, payment processors, or even established businesses looking to incorporate cryptocurrency in their operations. When seeking potential partners, it is essential to align your goals, values, and vision to ensure a mutually beneficial partnership.

Furthermore, when approaching potential partners, it’s important to emphasize the unique value proposition your business offers and how a collaboration can bring added benefits to both parties. Demonstrating a clear understanding of their objectives and how your venture aligns with them will make your proposal more compelling.

Cultivating Investor Relationships

Building solid relationships with investors is crucial for securing the necessary funding to fuel your crypto business’s growth. Investors can provide not only financial support but also valuable guidance, industry connections, and credibility. It is essential to identify potential investors who possess a genuine interest in the blockchain and cryptocurrency space, as they will be more inclined to understand the intricacies of your business model.

When cultivating investor relationships, it is important to clearly communicate your business strategy, market opportunity, and potential for return on investment. Providing comprehensive and transparent information will instill confidence in potential investors and mitigate their concerns. Additionally, regular updates and progress reports will help maintain investor interest and trust in your business.

In conclusion, developing relationships with key partners and investors is an integral part of launching and sustaining a successful crypto venture. By forming strategic partnerships and cultivating investor relationships, you can tap into additional resources, expertise, funding, and credibility, which are crucial for the long-term success of your business in the dynamic world of cryptocurrency.

Implementing Effective Marketing and Growth Strategies

In the realm of developing and expanding your crypto venture, it is crucial to employ well-crafted marketing techniques and strategic approaches to foster growth and success. By implementing effective marketing and growth strategies, businesses can propel their brand presence, attract a wider target audience, and ultimately drive higher revenues.

One fundamental aspect of effective marketing and growth strategies is understanding the unique value proposition of your crypto business. This involves identifying what sets your business apart from competitors, whether it be innovative technology, strong security measures, or a user-friendly interface. Emphasizing these unique selling points will enable you to differentiate your brand in the highly competitive crypto market, thus capturing the attention and trust of potential customers.

Another strategy for achieving growth and success in the crypto industry is to build a solid online presence through various digital marketing channels. This can encompass search engine optimization (SEO) techniques, content marketing, social media marketing, and influencer collaborations. By utilizing these channels strategically and consistently, businesses can increase their visibility, drive website traffic, and generate leads in a cost-effective manner.

Additionally, fostering a sense of community and establishing strong relationships with customers and industry professionals can significantly contribute to the growth of your crypto venture. This can be achieved through engaging with your audience on social media platforms, hosting educational webinars or events, and actively participating in relevant online forums or communities. By creating a positive and interactive environment, businesses can cultivate customer loyalty and advocacy, leading to increased brand awareness and organic growth.

- Continuously monitoring and analyzing market trends and consumer behavior is yet another crucial aspect of implementing effective marketing and growth strategies. By staying abreast of the latest industry developments and understanding the evolving needs and preferences of your target audience, businesses can adapt their marketing tactics and product offerings accordingly. This flexibility and responsiveness will not only help you maintain a competitive edge but also allow you to seize new opportunities for growth and diversification.

- When it comes to marketing and growth strategies in the crypto industry, collaborations and partnerships can be powerful tools. By actively seeking mutually beneficial partnerships with complementary businesses or industry influencers, you can tap into new customer segments, expand your reach, and leverage shared knowledge and resources. Such collaborations can take the form of co-hosted events, cross-promotions, or joint product development, opening up avenues for growth that may have been otherwise inaccessible.

- Lastly, implementing data-driven decision-making is essential for maximizing the effectiveness and efficiency of your marketing efforts. By leveraging analytics tools and tracking key metrics, businesses can gain valuable insights into the performance of their marketing campaigns, website traffic, customer behavior, and sales conversion rates. This data-driven approach allows for informed decision-making, optimization of marketing strategies, and identification of areas for improvement, ultimately leading to more successful outcomes.

By implementing effective marketing and growth strategies, businesses operating in the crypto industry can position themselves for sustainable growth, increased profitability, and long-term success. It is important to continuously evaluate and adapt these strategies in response to the dynamic nature of the crypto market, ensuring your business remains at the forefront of innovation and customer satisfaction.