In recent times, a particular phenomenon has captured the attention of enthusiasts and investors alike within the digital currency landscape. The rise of various token projects has sparked intrigue, excitement, and lively discussions among community members. This whirlwind of activity, while entertaining and engaging, carries with it a complex web of emotions and outcomes.

As participants navigate through rollercoaster price movements and fervent community interactions, underlying currents of speculation and ambition continue to evolve. Some individuals are drawn to the allure of quick profits, while others seek to establish a long-term presence in the market. Yet, amidst the fervor, there lies an inevitable truth regarding the sustainability and durability of such ventures.

In this exciting yet precarious environment, a sense of optimism pervades the air, spurring countless projects to emerge. However, as history has shown, trends in this volatile sector often lead to unexpected results. While many embrace their aspirations, a sobering reality may someday confront them, reminding us that not every journey culminates in triumph.

The Rise of Solana Memecoins

A recent phenomenon has captivated the crypto community, as playful tokens with humorous themes gain unprecedented popularity. These playful digital assets have attracted a diverse audience, blending entertainment and investment in a unique manner. Users find both amusement and potential profit in trading these whimsical currencies, fostering a vibrant ecosystem fueled by creativity and community engagement.

This trend has gained momentum due to social media platforms where enthusiasts share memes, jokes, and insights about their favorite tokens. Viral content often drives demand, with supporters rallying around particular projects. This grassroots marketing approach has proven effective, as many participants seek to capitalize on the community-driven aspect of this new wave of assets.

The influx of projects has also resulted in a competitive landscape, as developers rush to create fresh concepts. Some tokens have achieved remarkable market performance, prompting others to follow suit with their interpretations. This excitement has led to cautionary tales as well, with some participants overlooking fundamental analysis in their pursuit of quick gains.

As this playful sector continues to evolve, it remains to be seen how long this enthusiasm will last. The dynamic nature of this marketplace suggests that while opportunities abound, risks are inherent. Navigating this whimsical world requires both a sense of humor and a discerning eye to avoid pitfalls commonly associated with speculative investments.

Impact of Market Sentiment on Memecoins

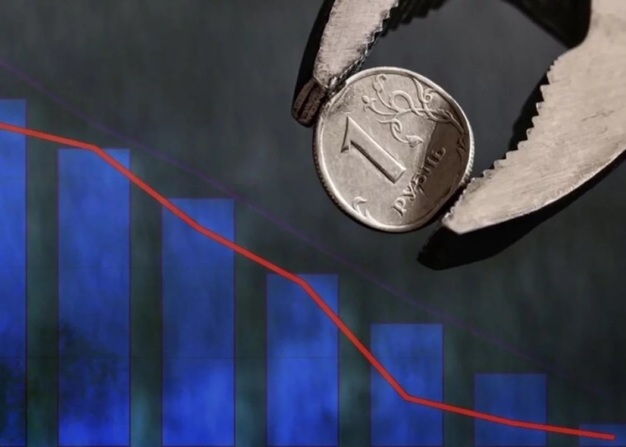

Market psychology plays a crucial role in shaping the behavior and trends of certain cryptocurrencies. Fluctuations in investor emotions and perceptions can significantly influence price movements, leading to rapid gains or losses. Participants in this sector often rely on social media buzz, community engagement, and viral trends, creating a unique cycle where sentiment drives value rather than intrinsic fundamentals.

Positive news, endorsements from influencers, or viral moments can ignite enthusiasm, causing a surge in demand. Conversely, negative press or shifts in public perception can trigger panic selling, resulting in sharp declines. This volatility underscores the importance of understanding how collective sentiment impacts these digital assets, making investment decisions contingent largely on prevailing mood rather than rational analysis.

Furthermore, platforms where discussions occur often amplify this phenomenon. Communities built around these tokens rely heavily on user engagement and sentiment, creating an ecosystem where news spreads faster than traditional assets. This rapid dissemination can lead to hyped reactions, reinforcing the notion that market sentiment is a primary driver of valuations within this niche.

Understanding the Risks Involved

Investment in emerging digital assets carries inherent uncertainties that every participant should acknowledge. Navigating this landscape requires careful consideration of potential hazards that could influence outcomes. Grasping the complexities involved can aid individuals in making informed decisions and mitigating adverse effects.

Market Volatility

Digital currencies are notorious for their rapid fluctuations in value, which can lead to substantial financial gains or losses. Factors contributing to this volatility include market sentiment, regulatory news, and technological advancements.

| Factor | Impact |

|---|---|

| Market Sentiment | Can cause sharp price swings based on public opinion and trends. |

| Regulatory News | Changes in legislation can lead to immediate fluctuations, affecting stability. |

| Technological Changes | Innovations may increase or decrease perceived value, influencing buying behavior. |

Rug Pulls and Scams

Another significant risk involves deceptive practices, which can adversely affect investors. As the market remains largely unregulated, fraudulent schemes, including rug pulls and Ponzi-like structures, have emerged, posing serious threats.

| Type of Scam | Description |

|---|---|

| Rug Pull | Developers abandon a project after attracting funds, leaving investors with worthless assets. |

| Ponzi Scheme | Returns to earlier investors are paid using the capital of new investors, unsustainable in the long term. |

Ultimately, awareness and understanding of these risks can empower individuals to navigate the intricate world of digital assets more confidently, enhancing the chances of making prudent investment choices.

Memecoins: A Short-Term Investment Perspective

Investing in certain cryptocurrencies can evoke excitement based on trends, memes, and community engagement. This environment often results in rapid price fluctuations, making them appealing for those looking for quick returns. However, careful consideration is essential when navigating this volatile space.

- High volatility: Price changes can happen within hours, offering quick gains or losses.

- Community-driven: Success often hinges on social media presence and community support.

- Speculative nature: Many participants are driven by hype rather than intrinsic value.

Those interested in this investment approach should keep the following points in mind:

- Research thoroughly; understand the market dynamics and community sentiment.

- Set clear entry and exit strategies tailored to personal risk tolerance.

- Be prepared for potential loss, as the rapid nature of these assets can lead to unforeseen circumstances.

Short-term strategies can be lucrative, yet they require vigilance and adaptability. Engaging with trends and being attuned to shifts in community sentiment can significantly influence outcomes.

Community Dynamics in Solana’s Ecosystem

Engagement and interaction among members create a vibrant atmosphere that drives innovation and growth. This unique environment fosters collaboration, idea exchange, and mutual support, making it an attractive destination for developers and enthusiasts alike. Understanding these dynamics can shed light on the underlying motivations and behaviors of participants.

Interactions and Collaborations

Active participation is essential for community development. Participants contribute through discussions, share projects, and offer feedback. Collaborative efforts on social media platforms and forums enhance connections, promoting a sense of belonging. The success of various initiatives often hinges on grassroots involvement, highlighting the power of collective action.

Challenges and Opportunities

While enthusiasm fuels progress, challenges can arise, impacting community cohesion. Conflicts and disagreements may emerge, leading to divisions. However, these obstacles also present opportunities for growth, as they encourage dialogue and solutions. Embracing diverse perspectives ultimately strengthens the community, paving the way for a resilient future.

Role of Media Influencers in Cryptos

In recent years, digital personalities have emerged as significant players in the cryptocurrency landscape, shaping perceptions and guiding decisions among followers. These influencers wield considerable influence over public sentiment, often driving trends and market movements through their social media platforms. Their ability to communicate complex ideas in an engaging manner makes them invaluable assets in bridging the gap between intricate blockchain concepts and mainstream audiences.

| Influencer Type | Impact on Cryptocurrencies | Example |

|---|---|---|

| Educators | Provide insights and tutorials, easing entry into crypto | YouTube Channels |

| Traders | Share strategies and analysis, influencing trading behavior | Twitter Analysts |

| Advocates | Promote specific projects or tokens, creating hype | Instagram Posts |

| Critics | Analyze and scrutinize projects, affecting public trust | Blogs |

As the realm continues to evolve, the effects of these media figures will likely grow, making their role increasingly pivotal in shaping the trajectory of various digital assets. Their endorsements, critiques, and educational efforts wield the power to sway investor sentiment and mold the future of financial technologies.

Q&A: The solana memecoin saga will end in tears just not today

What are the main reasons behind the rise of memecoins like those on the Solana blockchain?

The rise of memecoins on the Solana blockchain can be attributed to several factors. Firstly, the popularity of social media platforms like Twitter and Reddit has created a fertile ground for memes to influence cryptocurrency trends. Memecoins often rely on community engagement and virality, making them appealing in the fast-paced crypto environment. Secondly, the Solana blockchain offers high transaction speeds and lower fees compared to other platforms like Ethereum, making it an attractive choice for traders and investors looking to capitalize on the volatility of memecoins. Lastly, the speculative nature of the crypto market allows for rapid price surges, enticing investors to jump in for quick profits, even if the long-term value of these assets remains dubious.

What potential risks should investors be aware of when participating in memecoin trading on Solana?

Investors should be wary of several risks associated with trading memecoins on the Solana blockchain. First and foremost, the high volatility of memecoins can lead to significant financial losses, as prices can fluctuate wildly within short time spans. Additionally, many memecoins lack a solid foundation or utility, which raises concerns about their long-term viability. Investors are also susceptible to scams and fraudulent projects that can arise in the memecoin space. Moreover, regulatory scrutiny is increasing globally, and sudden shifts in legal frameworks could lead to abrupt market changes. It’s essential for investors to conduct thorough research, exercise caution, and only invest what they can afford to lose.

Why do you suggest that the Solana memecoin saga will end in tears?

The phrase “end in tears” suggests that the current excitement surrounding Solana memecoins is ultimately unsustainable. Many of these coins are driven by hype rather than intrinsic value, which can create a bubble that eventually bursts. As speculative behavior peaks, it is often followed by a sharp decline when investors seek to cash out. The lack of fundamental backing for many memecoins can lead to disillusionment among investors, resulting in dramatic price crashes. Furthermore, as the market matures, we may see more robust asset projects gain traction, overshadowing memecoins and causing their value to plummet. Therefore, while the current moment is marked by enthusiasm, the likelihood of a painful correction looms on the horizon.

How does the Solana ecosystem differ from other blockchain networks regarding memecoins?

Solana’s ecosystem offers several distinct advantages that differ from other blockchain networks, particularly when it comes to memecoins. One significant difference is the blockchain’s scalability; Solana can handle thousands of transactions per second, which allows for quicker trades and a smoother user experience. This high throughput is essential for the fast-moving nature of memecoins, where timing can significantly impact profitability. Additionally, Solana’s lower transaction fees appeal to traders who might be deterred by the high gas fees often experienced on Ethereum. The vibrant Solana community and developer ecosystem also facilitate the creation of new and innovative memecoins, driving further engagement and interest in the space. Despite these advantages, the inherent risks of memecoins still apply across all networks.

What should investors keep in mind for the future of memecoins on Solana?

Investors looking at the future of memecoins on Solana should remain vigilant and flexible. It’s crucial to monitor the overall sentiment of the cryptocurrency market, as trends can change rapidly. Investors should be aware that as more serious projects emerge, the appeal of memecoins may diminish, potentially leading to market corrections. Furthermore, keeping an eye on developments within the Solana ecosystem itself—such as upgrades, partnerships, and regulatory news—can provide valuable insights into the longevity of these assets. Prioritizing strong community engagement and transparent project roadmaps is also vital for assessing the viability of particular memecoins. Ultimately, a balanced approach that combines awareness of market dynamics with sound investment principles will serve investors well.

What are some of the key features of the Solana network as compared to Bitcoin and Ethereum in 2024?

The Solana network is known for its high throughput and low transaction costs, which differentiate it from Bitcoin and Ethereum. Unlike Bitcoin, which focuses primarily on decentralized peer-to-peer transactions, Solana uses a unique consensus mechanism that combines Proof of History (PoH) with Proof of Stake (PoS) to achieve high scalability. Ethereum, on the other hand, is widely recognized for its robust smart contract capabilities and large ecosystem of decentralized applications (dApps). Solana’s focus on high-speed transactions and lower fees positions it as a competitor in the Web3 space.

How has the Solana Foundation contributed to the growth of the Solana network?

The Solana Foundation has played a significant role in promoting and supporting the Solana network through various initiatives, including funding development projects and fostering community engagement. Their efforts help in enhancing liquidity, supporting validators, and facilitating new token issuance on the Solana blockchain. The foundation also engages with the community through platforms such as the official Solana subreddit and Telegram, where updates and discussions about the network’s growth and advancements take place.

What is the significance of meme coins like Bonk and Doge in the crypto market, and how do they compare to more established cryptocurrencies like Bitcoin and Ethereum?

Meme coins like Bonk and Doge often gain attention due to their viral nature and strong community support rather than underlying technology or utility. These coins usually have a lower market cap compared to established cryptocurrencies like Bitcoin and Ethereum. While Bitcoin and Ethereum are used for serious investment and technological purposes, meme coins often serve as speculative assets and tools for community-driven projects. The popularity of meme coins can lead to significant volatility and can influence market trends in the crypto space.

How does liquidity impact the market cap of cryptocurrencies such as Solana and Ethereum?

Liquidity is crucial for determining the market cap and overall stability of cryptocurrencies like Solana and Ethereum. Higher liquidity means that there are sufficient buy and sell orders on exchanges, making it easier to trade assets without causing significant price fluctuations. For Solana, increased liquidity can help stabilize its price and attract more investors, while for Ethereum, liquidity supports its extensive ecosystem of dApps and DeFi projects. Lower liquidity can lead to higher volatility and reduced market cap stability.

What role do validators play in the Solana network and how does it affect decentralization?

Validators are essential in the Solana network as they are responsible for validating transactions and maintaining network security. They help process transactions and create new blocks on the blockchain. By distributing these responsibilities across multiple validators, Solana aims to achieve decentralization and prevent any single entity from gaining too much control. The efficiency and performance of the network rely heavily on the active participation of these validators, which in turn supports the network’s decentralization goals.

How do airdrops and presales contribute to the success of new tokens in the crypto space?

Airdrops and presales are common methods for distributing new tokens to potential users and investors. Airdrops involve giving away tokens for free, often to existing wallet holders or through promotional campaigns, which can help create buzz and initial adoption. Presales, on the other hand, allow early investors to buy tokens at a discounted rate before they become available to the public. Both strategies can generate interest, increase market cap, and boost the visibility of new tokens in the crypto space.

What are decentralized applications (dApps) and how do they function on blockchains?

Decentralized applications (dApps) are software applications that run on blockchain networks, utilizing the blockchain’s decentralized nature to operate without a central authority. They are built on top of blockchains like Ethereum and Solana and can be used for various purposes, including financial services, gaming, and social networks. By leveraging smart contracts, dApps execute transactions and enforce rules automatically, ensuring transparency and security within the crypto space.

How does XRP fit into the broader crypto portfolio of blockchain technologies?

XRP is a digital asset created by Ripple Labs designed to facilitate fast and low-cost cross-border payments. Unlike many other cryptocurrencies that are primarily used for investment, XRP is aimed at improving the efficiency of international transactions. It is often included in a crypto portfolio alongside other blockchain technologies like Bitcoin and Ethereum, offering diversification and exposure to different aspects of the crypto market.

According to Solana, what advantages does the Solana network offer over other blockchain platforms?

According to Solana, the Solana network provides several advantages over other blockchain platforms, including high transaction speeds and low fees. Its unique consensus mechanism, which combines Proof of History (PoH) with Proof of Stake (PoS), allows it to process thousands of transactions per second. This scalability makes it a strong contender in the crypto space for applications that require high throughput, such as decentralized finance (DeFi) and non-fungible tokens (NFTs).

What is the role of Solana-based tokens and how do they integrate with existing crypto exchanges?

Solana-based tokens are digital assets built on the Solana blockchain, leveraging its high performance and low transaction costs. These tokens can be integrated with existing crypto exchanges for trading and liquidity purposes. Major exchanges like Coinbase often list Solana-based tokens, allowing users to buy, sell, and trade them. The integration of these tokens into crypto exchanges helps increase their visibility and adoption within the crypto market.

How do meme tokens and projects like Myro and Raydium impact the crypto space?

Meme tokens and projects such as Myro and Raydium often create buzz and attract attention due to their unique and sometimes humorous nature. These tokens can generate significant market interest and influence trends within the crypto space. Myro and Raydium, specifically, contribute to the ecosystem by offering innovative features or platforms for trading and liquidity, which can impact the overall market dynamics and investor sentiment.

What should one consider when researching new crypto assets and their potential in March 2024?

When researching new crypto assets in March 2024, it is crucial to consider factors such as the project’s underlying technology, use case, team credentials, and market potential. Evaluating how the asset fits into the broader blockchain ecosystem, its adoption by dApps and crypto exchanges, and any recent developments or updates is also important. Always do your own research to understand the risks and opportunities associated with the asset before making investment decisions.

How does the use of crypto exchanges like Coinbase affect the accessibility and liquidity of crypto assets?

Crypto exchanges like Coinbase play a significant role in enhancing the accessibility and liquidity of crypto assets. By providing a platform where users can easily buy, sell, and trade cryptocurrencies, exchanges help facilitate the flow of crypto assets between buyers and sellers. They also offer features such as portfolio management tools and market analysis, which can aid users in managing their crypto investments effectively.

What makes Solana coins a notable addition to a crypto portfolio compared to other digital assets?

Solana coins are a notable addition to a crypto portfolio due to their association with the high-performance Solana blockchain, which boasts fast transaction speeds and low fees. This makes Solana coins attractive for both developers and investors interested in blockchain projects requiring scalability and efficiency. Compared to other digital assets, Solana coins offer unique benefits such as lower transaction costs and the potential for integration with innovative dApps and DeFi platforms.

How has Shiba Inu’s market capitalization and total supply impacted its position in the cryptocurrency market?

Shiba Inu’s market capitalization has significantly increased due to its gained significant attention within the cryptocurrency space. Despite its vast total supply, which includes trillions of SHIB tokens, the coin has maintained a strong market presence, partly driven by its popularity and community support. The market capitalization reflects the total value of all Shiba Inu tokens in circulation, influenced by factors such as trading volume on platforms like Binance and broader market trends. Additionally, the concept of Bitcoin halving has sparked interest in other cryptocurrencies, including Shiba Inu, as investors seek potential opportunities in various crypto assets.