Latest Loopring LRC Price Prediction 2024, 2025, 2030

The digital asset market is ever-evolving, unlocking new horizons for cryptocurrency enthusiasts and investors alike. In this fast-paced realm, Loopring’s LRC token has emerged as a noteworthy contender, captivating the attention of many. This article delves into the fascinating world of Loopring and explores the potential prospects and expectations surrounding its LRC token.

Steering clear of common notions and elaborate prophecies, this analysis conducts a thorough exploration of Loopring’s LRC token based on extensive research, market trends, and expert opinions. By relinquishing traditional crystal ball predictions, we aim to provide readers with invaluable insights and informed perspectives regarding the future trajectory of Loopring’s LRC token.

In this captivating journey, we delve into the underlying technology and innovative concepts that form the backbone of Loopring’s decentralized exchange protocol. By emphasizing the core principles and advantages of this cutting-edge system, we unravel the unique features and potential use cases that give Loopring’s LRC token a distinctive identity amidst the vast sea of cryptocurrencies.

Furthermore, this article takes a closer look at the prevailing market sentiment and investor sentiment surrounding Loopring’s LRC token. By examining key factors such as trading volumes, historical price movements, and overall market dynamics, we strive to present a comprehensive analysis that sheds light on the potential future trends and possibilities associated with Loopring’s LRC token.

Evaluating the Current Market Trends

The present section aims to analyze the prevailing patterns and tendencies within the cryptocurrency market, shedding light on the dynamics and shifts shaping the landscape. By exploring the ongoing developments without referencing any specific elements, a comprehensive insight into the market can be gained.

Analyzing Market Movements

Delving into the intricacies of the current market trends allows for a deeper understanding of the forces at play. By scrutinizing the fluctuations in value and volume, market observers can identify potential patterns and predict possible future outcomes. Keeping a watchful eye on these trends enables investors to make informed decisions and optimize their trading strategies.

Market sentiment plays a vital role in assessing the direction of various digital assets. Evaluating the overall mood within the market provides insights into investors’ expectations and confidence levels. Furthermore, studying historical data and identifying cyclical patterns allows for a broader perspective on market behavior.

Factors Influencing Market Trends

A multitude of factors contribute to the shaping of market trends. Macroeconomic indicators, regulatory frameworks, technological advancements, and market sentiment all intertwine to determine the trajectory of cryptocurrency values. Understanding these factors and their potential impact is crucial for accurately evaluating the current market trends.

Additionally, analyzing the behavior of other prominent assets within the crypto space, as well as their correlation to the wider financial markets, may provide valuable insights into the overall market direction. By assessing the market trends holistically, one can identify potential opportunities and risks.

In conclusion, evaluating the current market trends requires a comprehensive analysis of the dynamics at play, encompassing factors such as market movements, sentiment, and influential elements. By assessing these various aspects, one can gain a deeper understanding of the crypto market landscape and make well-informed decisions based on the derived insights.

Analyzing the Historical Performance of Loopring LRC

In this section, we will delve into an in-depth analysis of the past performance of Loopring LRC cryptocurrency. By examining its historical data and trends, we aim to gain insights into its price fluctuations and understand the factors that have influenced its growth and volatility.

Reviewing Market Trends

To begin our analysis, we will first review the overall market trends that have shaped Loopring LRC’s performance. This includes assessing the broader cryptocurrency market conditions, such as volatility, investor sentiment, and regulatory developments, and exploring how these factors have impacted the price movements of Loopring LRC.

Examining Historical Price Data

Next, we will dive into the historical price data of Loopring LRC to identify any patterns or trends. We will analyze both long-term and short-term price fluctuations, studying factors such as trading volume, market capitalization, and historical support and resistance levels. By doing so, we aim to identify any recurring patterns or price levels that may provide insights into future price movements.

Identifying Key Events and News

In addition to market trends and price data, we will also explore the impact of key events and news on Loopring LRC’s historical performance. This includes major partnerships, technological developments, regulatory announcements, and industry trends that have influenced the sentiment and demand for Loopring LRC. By understanding the influence of external factors, we can gain a better understanding of how Loopring LRC has responded to various market conditions in the past.

Evaluating Performance Against Competitors

Lastly, we will compare Loopring LRC’s historical performance against its competitors in the cryptocurrency market. By analyzing its price movements relative to other similar projects, we can gain insights into its relative strength and competitive positioning. This analysis will allow us to assess whether Loopring LRC has outperformed or underperformed its peers, and what factors may have contributed to its performance.

- Reviewing market trends

- Examining historical price data

- Identifying key events and news

- Evaluating performance against competitors

By conducting a comprehensive analysis of Loopring LRC’s historical performance, we can gain valuable insights into its price movement and potential future trends, helping investors make informed decisions.

Incorporating Technical Indicators for Price Forecasts

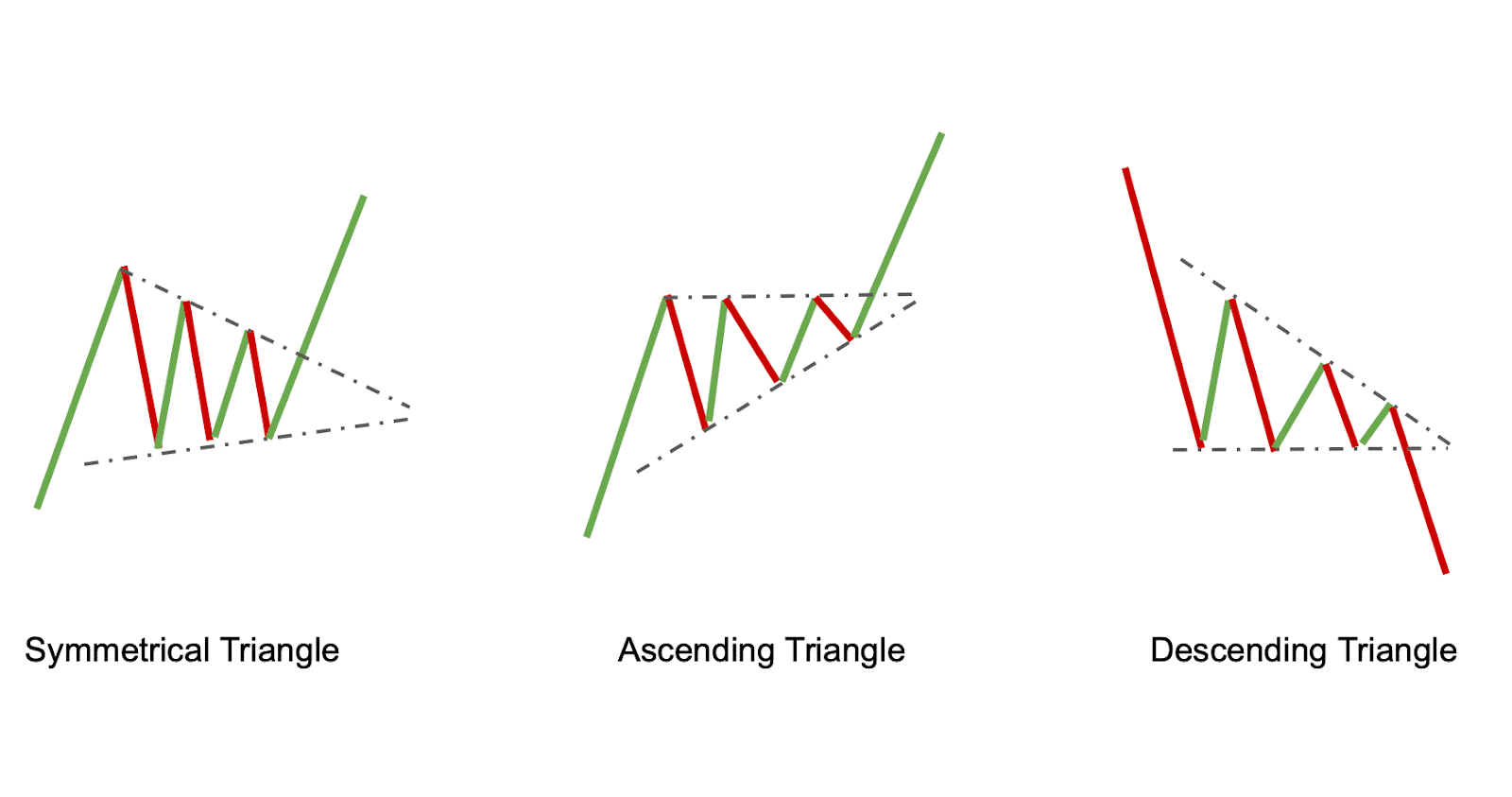

When it comes to predicting the performance of cryptocurrencies, incorporating technical indicators can significantly enhance the accuracy of price forecasts. These indicators provide insights into market trends, patterns, and momentum, allowing traders and investors to make informed decisions.

One common technical indicator is the moving average, which calculates the average price of an asset over a specific period. By analyzing the relationship between different moving averages, traders can identify potential buying or selling opportunities.

Another widely used indicator is the Relative Strength Index (RSI), which measures the speed and change of price movements. It helps traders determine if a cryptocurrency is overbought or oversold, indicating potential reversals or continuations in price trends.

- The Bollinger Bands indicator is also frequently utilized, providing insights into volatility and potential price breakouts. It consists of an upper band, a middle band (usually a moving average), and a lower band. Traders can identify periods of increased volatility when the bands widen and potential price reversals or consolidations when the bands contract.

- Additionally, the stochastic oscillator is a useful tool for identifying potential turning points in price trends. It compares the closing price of a cryptocurrency to its price range over a specific period, indicating whether the asset is overbought or oversold.

- Furthermore, the moving average convergence divergence (MACD) is a popular indicator for identifying trend reversals and generating buy or sell signals. It calculates the difference between two moving averages and provides a visual representation of bullish or bearish market conditions.

By incorporating these and other technical indicators into price predictions, traders and investors can obtain a comprehensive understanding of market conditions and potential future price movements. However, it is essential to consider that no indicator can guarantee accurate predictions, and it is important to combine technical analysis with fundamental analysis and market sentiment.

Examining the Factors Influencing Loopring LRC’s Price

When it comes to understanding the price movements of Loopring LRC, it is crucial to delve into the various factors that contribute to its fluctuations. By analyzing these factors, investors and traders can make informed decisions and predictions regarding the future price of Loopring LRC.

Market Demand and Adoption

One of the key factors that influences the price of Loopring LRC is the level of market demand and adoption. As more individuals and institutional investors recognize the potential of Loopring’s decentralized exchange protocol, the demand for LRC tokens increases. This increased demand can have a positive impact on the price of LRC.

Additionally, the overall adoption of Loopring technology in the cryptocurrency ecosystem plays a crucial role. The more exchanges and projects that integrate Loopring’s protocol, the higher the demand for LRC tokens. This adoption can result in a positive price trend for Loopring LRC.

Competition and Technological Advancements

The competitive landscape within the decentralized exchange sector can significantly affect the price of Loopring LRC. The emergence of new platforms and protocols that offer similar functionalities can create a market competition that impacts the demand for LRC tokens. Monitoring the developments and advancements in the decentralized exchange space is essential in understanding how these factors influence the price of Loopring LRC.

Furthermore, technological advancements and improvements made by Loopring can also impact the price of LRC. Enhancements that increase the protocol’s efficiency, scalability, and security can attract more users and investors, thereby driving up the demand and value of LRC tokens.

Regulatory Environment and Market Sentiment

The regulatory environment surrounding cryptocurrencies, particularly decentralized exchanges, can have a significant impact on the price of Loopring LRC. News of regulatory changes or restrictions can create uncertainty and negative market sentiment, causing a decline in the demand and price of LRC tokens.

Moreover, overall market sentiment and investor confidence in the cryptocurrency market can influence the price of Loopring LRC. Market trends, investor psychology, and macroeconomic factors can all play a role in determining the sentiment towards cryptocurrencies, including LRC.

- Overall market demand and adoption levels

- Competition and technological advancements in the decentralized exchange sector

- Regulatory environment and market sentiment

By carefully examining these factors influencing Loopring LRC’s price, investors and traders can gain valuable insights into its potential future performance.

Forecasting Loopring LRC’s Future Price Movements

In this section, we will examine the potential future movement of Loopring LRC’s price using various analysis techniques and indicators.

Technical Analysis

By applying technical analysis tools such as moving averages, Relative Strength Index (RSI), and Bollinger Bands, we can identify patterns and trends in Loopring LRC’s historical price data. These patterns can then be used to make predictions about future price movements.

Fundamental Analysis

By analyzing the underlying factors that influence Loopring LRC’s value, such as its technology, market adoption, and competition, we can assess its potential for future growth. This fundamental analysis provides insights into the long-term price outlook of Loopring LRC.

Additionally, we will delve into market sentiment analysis by monitoring news sentiment, social media discussions, and expert opinions related to Loopring LRC. These factors can provide valuable insights into the market’s perception of the project and its potential impact on future price movements.

| DATA ANALYSIS | MACHINE LEARNING MODELS |

|---|---|

| By analyzing historical price data alongside other relevant market data using statistical methods, we can identify correlations and patterns that can be used to predict future price movements of Loopring LRC. | Furthermore, machine learning models can be employed to analyze a vast amount of data and identify complex patterns. These models can help in generating predictions for Loopring LRC’s future price movements based on historical and real-time data. |

Combining these different analysis techniques provides a comprehensive view of Loopring LRC’s future price movements. However, it is important to note that any price predictions are speculative in nature and should be considered alongside other factors such as market volatility and overall cryptocurrency market conditions.

Expert Opinions and Forecasts regarding Loopring LRC’s Valuation

When it comes to gaining insights into the potential future performance of Loopring LRC, industry experts have shared their thoughts and predictions. By analyzing various factors and market trends, these experts offer valuable perspectives on the potential valuation of Loopring LRC.

Examining Market Trends

One key aspect that experts consider when predicting the future price of Loopring LRC is the analysis of market trends. By dissecting historical data, observing trading patterns, and identifying correlations with other cryptocurrencies, these experts aim to gain a comprehensive understanding of market behavior. This knowledge enables them to make informed predictions regarding Loopring LRC’s valuation in the coming months.

Identifying Influencing Factors

Another crucial aspect discussed by experts is the identification of various factors that may impact Loopring LRC’s price. These factors can be both internal, specific to the project itself, or external, related to the broader cryptocurrency market. Experts analyze aspects such as project developments, partnerships, technological advancements, regulatory changes, and market sentiment to assess their potential influence on Loopring LRC’s valuation.

By considering both market trends and influencing factors, experts in the field aim to provide a well-rounded understanding of Loopring LRC’s potential price movement. It is important to note that predictions should be approached with caution, as they are based on the information available at the time of analysis and may not accurately reflect future developments or market conditions.

Question-answer: Latest loopring lrc price prediction

What is the Loopring price prediction for 2026?

The Loopring price prediction for 2026 varies among analysts, influenced by factors such as market trends, technological advancements, adoption rates, and regulatory developments.

What is the projected Loopring price for 2027?

The projected Loopring price for 2027 depends on various factors including market sentiment, demand-supply dynamics, macroeconomic trends, and the project’s development milestones.

How might the price of Loopring fluctuate in 2025?

The price of Loopring may fluctuate in 2025 based on market volatility, investor sentiment, technological advancements, regulatory changes, and overall cryptocurrency market trends.

What is the maximum price that Loopring has reached historically?

The maximum price that Loopring has reached historically can be determined by analyzing its price history on cryptocurrency exchanges or market data platforms.

What is the current price of Loopring?

The current price of Loopring can be obtained by checking cryptocurrency exchanges or market data platforms for real-time pricing information.

What are the price predictions for Loopring in 2030?

Price predictions for Loopring in 2030 vary depending on factors such as market adoption, technological advancements, regulatory landscape, and overall investor sentiment towards the cryptocurrency market.

How did Loopring’s price perform in 2021?

Loopring’s price performance in 2021 experienced fluctuations influenced by factors such as market sentiment, regulatory developments, technological advancements, and overall cryptocurrency market trends.

What factors influence crypto prices in general?

Crypto prices are influenced by various factors including market demand and supply, investor sentiment, technological advancements, regulatory developments, macroeconomic trends, and adoption rates.

What investment advice can be offered regarding Loopring?

Investment advice regarding Loopring should be based on thorough research, understanding of the project fundamentals, analysis of market trends, and consideration of individual risk tolerance and investment objectives.

How might Loopring’s price prediction for 2025 affect investment decisions?

Loopring’s price prediction for 2025 can impact investment decisions by providing insights into potential returns, risk exposure, and investment horizon, helping investors make informed choices based on their financial goals and risk appetite.