What is Dex

Engaging with the dynamically evolving realm of cryptocurrency requires a deep exploration into the multifaceted nature of decentralized exchanges, commonly referred to as Dex. These platforms, which serve as vital conduits for peer-to-peer transactions, epitomize the spirit of innovation and democratization that defines the crypto landscape. By relinquishing central control and embracing a decentralized architecture, Dex empowers individuals to transact directly with each other, facilitating a seamless and secure exchange of digital assets.

A core tenet of Dex lies in its emphasis on decentralization, a paradigm shift that moves away from the traditional concept of intermediaries in financial transactions. Instead of relying on centralized entities like banks or financial institutions to facilitate trades, Dex harnesses the power of blockchain technology and smart contracts to create a trustless environment, where transactions are executed directly between users. This disintermediation not only eliminates the need for third-party involvement but also enhances security, ensuring that users have full control over their funds.

Furthermore, the inherent transparency of Dex is a distinguishing feature that contributes to its allure and reliability. Through the utilization of blockchain technology, every transaction carried out on these platforms is recorded on an immutable public ledger, visible to all participants. This transparency not only fosters trust among users but also facilitates efficient auditing and tracking of transactions. Additionally, the immutability of the blockchain ensures that records cannot be tampered with, providing an added layer of security and integrity to the exchange process.

Moreover, Dex enhances accessibility by obliterating geographical boundaries and eliminating the need for extensive documentation. Unlike traditional centralized exchanges, which often require extensive identity verification and compliance procedures, Dex platforms enable users to participate in transactions swiftly and without restriction. This inclusivity empowers individuals from different parts of the world, particularly those who may lack access to traditional financial services, to actively engage in the crypto space and reap its myriad benefits.

The Rise of Dex in the Cryptocurrency World

In this section, we will delve into the growing prominence of decentralized exchanges (Dex) within the realm of cryptocurrency. We will explore the increasing usage and influence of Dex platforms, highlighting their significant role in shaping the future of digital currencies. By delving into the key characteristics and advantages of Dex, we will gain a comprehensive understanding of why they have emerged as a powerful force in the world of cryptocurrencies.

Revolutionizing the Trading Landscape

The rise of Dex has ushered in a new era of decentralized trading, disrupting the traditional centralized exchange model. These platforms leverage advanced technologies to facilitate peer-to-peer transactions, eliminating the need for intermediaries and placing control directly in the hands of users. Dex platforms offer increased privacy, security, and transparency, providing a reliable alternative to centralized exchanges.

Empowering Individuals and Communities

Dex platforms have democratized access to trading and investing in cryptocurrencies, enabling individuals from all backgrounds to participate in the digital asset market. By eliminating centralized control and reducing barriers to entry, Dex platforms empower users to take control of their financial destiny. This inclusivity has resulted in strong communities forming around Dex platforms, fostering collaboration, knowledge-sharing, and innovation.

A look into the growing popularity and adoption of decentralized exchanges

In this section, we will delve deep into the increasing trend and acceptance of decentralized exchanges. These platforms have been gaining traction, and more and more users are turning to them as alternatives to traditional centralized exchanges. We will explore the reasons behind their popularity and how they function in the cryptocurrency ecosystem.

The Rise of Decentralized Exchanges

Decentralized exchanges, also known as DEXs, have emerged as a compelling alternative to their centralized counterparts. With the advent of blockchain technology, these platforms provide a peer-to-peer trading experience without relying on intermediaries. This approach offers several advantages, such as enhanced privacy, reduced counterparty risk, and increased trustlessness.

Factors Driving Adoption

The growing popularity of decentralized exchanges can be attributed to various factors. First and foremost, the increasing awareness of the importance of data privacy has prompted users to seek platforms that prioritize their security. DEXs, by design, offer greater privacy by eliminating the need for users to share personal information.

Additionally, the rise of decentralized finance (DeFi) has fueled the adoption of DEXs. DeFi applications leverage smart contracts and decentralized exchanges to enable a range of financial services, including lending, borrowing, and yield farming. As DeFi gains traction, so does the usage of decentralized exchanges.

Furthermore, the decentralized nature of these exchanges aligns with the principles of blockchain technology, which emphasizes decentralization, transparency, and trustlessness. As more users understand and appreciate these principles, the demand for decentralized exchanges continues to grow.

In conclusion, the increasing popularity and adoption of decentralized exchanges are driven by a combination of factors, including privacy concerns, the rise of DeFi, and the alignment with blockchain principles. These platforms offer a unique and secure trading experience for cryptocurrency enthusiasts, providing more control over their assets and fostering a decentralized ecosystem.

Understanding the Concept of Decentralization in Dex

In this section, we will delve into the fundamental concept of decentralization within the realm of decentralized exchanges (Dex). We will explore the core principles and ideas that underpin the decentralization of Dex platforms, and how it distinguishes them from traditional centralized exchanges.

Decentralization, in the context of Dex, refers to the distribution of control and decision-making authority across various stakeholders. Unlike centralized exchanges, which are typically operated and managed by a single authority, Dex platforms aim to empower users by eliminating the need for a central governing entity. Instead, they leverage blockchain technology and smart contracts to enable trustless peer-to-peer transactions.

One crucial aspect of decentralization in Dex is the elimination of intermediaries. Traditional exchanges often rely on intermediaries such as brokers or custodians to facilitate transactions and hold users’ assets. Dex platforms, on the other hand, allow users to retain full control over their funds without the involvement of middlemen. This not only reduces the risk of fraud or censorship but also enhances the privacy and security of the transactions.

Moreover, decentralized exchanges operate on the basis of consensus mechanisms, enabling all participants to collectively validate and record transactions on the blockchain. This consensus-driven approach ensures transparency and immutability, as all transaction data is verifiable by anyone on the network. Additionally, it eliminates the possibility of manipulation or control by a single entity, promoting a more democratic and inclusive financial system.

Decentralization also brings forth the concept of user empowerment. With Dex platforms, any individual with access to the internet can participate in cryptocurrency trading, without the need for extensive identification or account setup processes. This accessibility fosters financial inclusion and enables individuals from all backgrounds to engage in the decentralized economy.

In summary, the concept of decentralization in Dex emphasizes the redistribution of power and control, the elimination of intermediaries, and the promotion of transparency and inclusivity. Through the application of blockchain technology, Dex platforms aim to revolutionize the traditional financial system by empowering individual users and creating a more equitable and resilient ecosystem.

Decentralized Exchanges vs. Traditional Centralized Exchanges: A Comparative Analysis

In this section, we will delve into the inherent differences between decentralized exchanges (DEX) and traditional centralized exchanges, highlighting their contrasting features and operational mechanisms. By understanding these distinctions, we can gain insights into the unique benefits and challenges offered by decentralized exchanges.

Operational Structure

One of the key disparities lies in the operational structure of decentralized and centralized exchanges. Traditional centralized exchanges are typically owned and operated by a single entity, which assumes primary control over the management, liquidity, and security of the platform. In contrast, decentralized exchanges function on a peer-to-peer network, where participants interact directly with each other through smart contracts. This decentralized nature eliminates the need for intermediaries and provides a greater level of censorship resistance.

Control and Security

Decentralized exchanges offer a higher degree of user control and security in comparison to their centralized counterparts. In centralized exchanges, users need to trust the platform with their funds, as they relinquish control by depositing their assets into the exchange’s wallets. On the other hand, decentralized exchanges leverage blockchain technology, enabling users to retain control of their funds throughout the trading process. This reduces the risk of hacks, theft, or mismanagement, as funds are held securely in users’ personal wallets until trades are executed.

Liquidity and Market Access

When it comes to liquidity and market access, centralized exchanges have traditionally dominated the cryptocurrency market. Centralized exchanges benefit from higher trading volumes, deep liquidity pools, and a wide range of available trading pairs. However, with the innovation of decentralized exchanges, liquidity is no longer solely dependent on one central entity. Decentralized exchanges leverage liquidity pooling mechanisms, allowing traders to access a broader market and transact directly with other participants, fostering a more inclusive and accessible trading environment.

Regulation and Compliance

Decentralized exchanges often present a challenge in terms of regulation and compliance. Traditional centralized exchanges are subject to regulatory oversight, depending on the jurisdiction in which they operate. They adhere to know-your-customer (KYC) and anti-money laundering (AML) regulations to ensure a certain level of security and accountability. Conversely, decentralized exchanges often provide users with greater anonymity, which can raise concerns regarding illegal activities and regulatory compliance. Balancing the advantages of privacy and security remains an ongoing challenge for decentralized exchanges.

| DECENTRALIZED EXCHANGES | TRADITIONAL CENTRALIZED EXCHANGES |

|---|---|

| Operate on a peer-to-peer network | Owned and operated by a single entity |

| Retain control of funds throughout the trading process | Require trust in the exchange to hold funds |

| Utilize liquidity pooling mechanisms | Benefit from established liquidity and trading pairs |

| Raise challenges in terms of regulation and compliance | Subject to regulatory oversight and compliance |

The Benefits and Advantages of Using Dex

In this section, we will delve into the multitude of benefits and advantages associated with utilizing a decentralized exchange (Dex) in the realm of cryptocurrency. Dex offers a range of advantages compared to traditional centralized exchanges, providing users with enhanced security, transparency, and control over their assets.

Enhanced Security

One of the key advantages of using Dex is the heightened level of security it offers. Unlike centralized exchanges, which store user funds in a centralized manner, Dex operates on a peer-to-peer network, eliminating the need for a central authority to control and safeguard user assets. This decentralized approach significantly reduces the risk of hacks and security breaches, as there is no single point of failure for hackers to exploit.

Increased Transparency

Dex provides increased transparency compared to centralized exchanges. Transactions on a Dex are recorded on a public blockchain, ensuring a transparent and auditable ledger that is visible to all participants. This transparency fosters trust within the cryptocurrency community and helps to build a more robust ecosystem. Additionally, users have access to real-time information about market orders and liquidity, enabling them to make informed decisions.

Flexibility and Control

Utilizing a Dex grants users a greater level of control over their assets. Unlike centralized exchanges that require users to deposit funds into their platform wallets, a Dex allows users to retain complete control over their private keys and funds. This ensures that users are not reliant on a third party to hold and safeguard their assets, reducing the risk of loss or theft. Moreover, Dex platforms often support a wider range of cryptocurrencies, providing users with greater flexibility in managing their portfolios.

Overall, the benefits and advantages of using Dex in the cryptocurrency space are numerous. From enhanced security and increased transparency to greater control and flexibility, Dex offers a compelling alternative to traditional centralized exchanges, empowering users to take ownership of their assets and participate in a more decentralized financial ecosystem.

Highlighting the key features and advantages of decentralized exchanges

In this section, we will delve into the essential characteristics and benefits of decentralized exchanges (DEXs). DEXs serve as an alternative to traditional centralized exchanges, offering a secure and transparent platform for cryptocurrency trading. By eliminating the need for intermediaries and central authorities, DEXs empower users to have full control over their funds and transactions.

One of the notable features of DEXs is their decentralized nature. Unlike centralized exchanges, which rely on a single entity to hold and manage user funds, DEXs utilize smart contracts and blockchain technology to enable peer-to-peer trading. This decentralized architecture ensures greater security, as it significantly reduces the risk of hacking and theft, which are prevalent in centralized exchanges.

Another advantage of DEXs is their transparency. Every transaction made on a DEX is recorded on a public blockchain, making it easily auditable. This transparency fosters trust among users, as they can verify the integrity and accuracy of transactions without relying on a centralized authority. Furthermore, the use of smart contracts in DEXs enables automated and immutable execution of trades, eliminating the possibility of fraud or manipulation.

DEXs also provide users with increased privacy. Unlike centralized exchanges that typically require users to provide personal information and undergo lengthy verification processes, DEXs allow for anonymous trading. Users can maintain their privacy while engaging in cryptocurrency transactions, enhancing the security and confidentiality of their financial activities.

Moreover, DEXs offer a diverse range of tradable assets. Unlike centralized exchanges that often have limitations on the cryptocurrencies they support, DEXs provide access to a wide array of tokens and coins. This broad availability allows users to explore and engage in trading various digital assets, contributing to a more inclusive and dynamic cryptocurrency ecosystem.

In conclusion, decentralized exchanges possess key features and advantages that distinguish them from their centralized counterparts. Through their decentralized nature, transparency, privacy, and diverse asset availability, DEXs provide users with increased control, security, and flexibility in cryptocurrency trading.

Risks and Challenges in Dex Trading

Exploring the complexities and intricacies of decentralized exchange (Dex) trading unveils a multitude of risks and challenges that traders face in the cryptocurrency market. This section sheds light on the potential hurdles and uncertainties that Dex traders encounter, requiring careful consideration and strategic decision-making.

1. Market Volatility

The unpredictable nature of the cryptocurrency market introduces significant risks for Dex traders. Fluctuations in prices can be sudden and substantial, leading to potential losses or missed opportunities. Traders must constantly monitor market trends and employ effective risk management strategies to navigate the inherent volatility.

2. Lack of Liquidity

One of the key challenges faced by Dex traders is the limited liquidity pool compared to centralized exchanges. Due to the decentralized nature of Dex, the availability of trading pairs and order book depth can vary, potentially impacting trade execution and price stability. Traders must carefully assess liquidity conditions to ensure seamless trading experiences.

3. Security Concerns

The security of funds and personal information is a paramount concern within the Dex ecosystem. As Dex platforms operate without a central authority, the responsibility lies with individual traders to secure their wallets and private keys. The decentralized nature also makes Dex vulnerable to potential hacking attacks and smart contract vulnerabilities, necessitating the adoption of robust security measures.

4. User Experience Complexity

The user experience in Dex trading can be challenging for newcomers and less tech-savvy individuals. The decentralized nature often requires users to interact with complex interfaces, manage wallets, and understand the intricacies of smart contracts. Dex platforms must focus on enhancing user-friendly interfaces and providing comprehensive educational resources to bridge this gap.

5. Regulatory Uncertainty

Regulatory frameworks surrounding cryptocurrencies and decentralized exchanges are still evolving in many jurisdictions. This regulatory uncertainty adds an additional layer of risk for Dex traders, who must stay updated with changing regulations to ensure compliance and assess the potential impact on their trading activities.

- In summary, Dex trading comes with risks related to market volatility, liquidity, security, user experience complexity, and regulatory uncertainty.

An examination of the potential risks and challenges users may encounter in decentralized trading

In this section, we will delve into the various risks and challenges that users might face when engaging in decentralized trading. Decentralized trading refers to the act of buying and selling cryptocurrencies directly without the need for intermediaries or a centralized exchange.

One of the primary concerns in decentralized trading is the potential for security breaches and hacking. Since these transactions occur directly between users, there is an increased risk of unauthorized access to funds or theft. Users must be vigilant in safeguarding their private keys and ensuring the security of their wallets.

Another challenge is the lack of regulation and oversight in decentralized trading. Unlike centralized exchanges, there is no governing authority or regulatory framework in place to protect users from fraudulent activities or market manipulation. This can expose users to potential scams and schemes, making it crucial for individuals to conduct thorough research before participating in any decentralized trading platforms.

Additionally, liquidity can be a significant challenge in decentralized trading. Without a central order book, it can be more challenging to find counterparties willing to trade at desirable prices. This can result in increased transaction costs and slower execution times, especially for less popular cryptocurrencies or tokens.

Furthermore, the user experience in decentralized trading platforms can vary widely. Some platforms may have complex interfaces or limited functionalities, making it more challenging for beginners to navigate and execute trades. Additionally, the lack of customer support or dispute resolution mechanisms can further complicate the user experience.

Lastly, interoperability between different decentralized trading platforms can be a hurdle for users. Each platform may have its own unique protocols and standards, making it difficult for users to seamlessly transfer assets or trade across multiple platforms. This can limit the flexibility and convenience of decentralized trading.

In conclusion, while decentralized trading offers numerous advantages such as increased privacy and autonomy, users must be aware of the potential risks and challenges they may face. From security concerns to regulatory uncertainties and liquidity problems, it is vital for individuals to approach decentralized trading with caution and take necessary precautions to protect their assets.

Q&A: What is Dex

What role does Ethereum play in the operation of automated market makers (AMMs)?

Ethereum serves as the underlying blockchain network for many automated market makers (AMMs), providing the infrastructure for decentralized trading and liquidity provision.

How do automated market makers (AMMs) like Uniswap facilitate trading between buyers and sellers?

Automated market makers (AMMs) like Uniswap enable trading between buyers and sellers by using smart contracts to automatically execute trades based on predefined algorithms, without the need for traditional order books.

What is the function of a market maker in the context of AMMs?

A market maker in the context of AMMs provides liquidity to the platform by depositing assets into liquidity pools, enabling smooth and efficient trading for users.

Can you explain the concept of liquidity providers in the context of automated market makers (AMMs)?

Liquidity providers are individuals or entities that deposit assets into liquidity pools on AMMs, thereby enabling trading and earning fees based on the trading activity within those pools.

How do AMMs differ from centralized exchanges (CEXs) in terms of transaction fees and user experience?

AMMs typically have lower transaction fees compared to centralized exchanges (CEXs) and offer a decentralized trading experience where users can trade directly from their crypto wallets without the need for intermediary custody.

What are some of the advantages of using AMMs over traditional order book exchanges?

Some advantages of using AMMs over traditional order book exchanges include lower barriers to entry for liquidity providers, reduced risk of front-running and manipulation, and continuous liquidity provision.

How do AMMs leverage smart contracts on the Ethereum blockchain?

AMMs leverage smart contracts on the Ethereum blockchain to automate the execution of trades, manage liquidity pools, and facilitate the swapping of assets between users.

What role do blockchain networks like Ethereum play in enabling AMMs to function?

Blockchain networks like Ethereum provide the foundational infrastructure for AMMs, allowing for the secure and decentralized execution of trades and the management of liquidity pools.

How do AMMs contribute to the overall liquidity and efficiency of decentralized finance (DeFi) ecosystems?

AMMs contribute to the overall liquidity and efficiency of decentralized finance (DeFi) ecosystems by providing accessible and continuous liquidity for a wide range of assets, thereby enabling decentralized trading and financial services.

What impact have AMMs had on the democratization of access to financial markets and services?

AMMs have democratized access to financial markets and services by enabling anyone with an internet connection and a crypto wallet to participate in trading and liquidity provision, without the need for traditional financial intermediaries.

What is a DEX aggregator and how does it differ from a traditional crypto exchange?

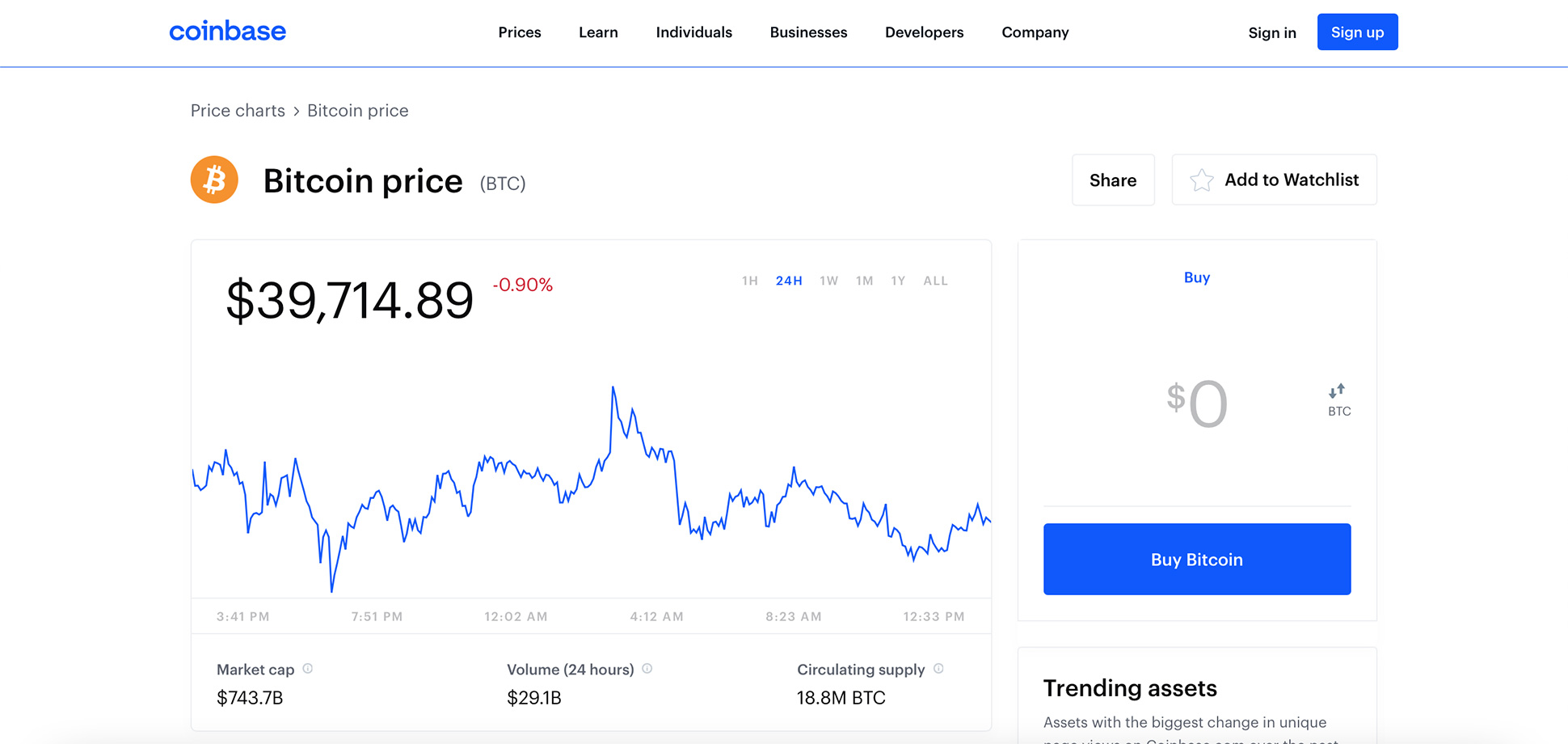

A DEX aggregator is a platform that allows users to trade cryptocurrencies across multiple decentralized exchanges (DEXs) simultaneously, offering better prices and liquidity compared to traditional exchanges like Coinbase.

How do DEX aggregators work to provide improved trading experiences for crypto traders?

DEX aggregators work by pooling liquidity from various decentralized exchanges, analyzing prices and order books in real-time, and executing trades at the best available rates for users.

What are some popular DEXs that a DEX aggregator might interact with?

Some popular DEXs that a DEX aggregator might interact with include Uniswap, SushiSwap, PancakeSwap, and Curve Finance, among others.

What role do smart contracts play in the operation of decentralized exchanges (DEXs)?

Smart contracts are utilized by decentralized exchanges (DEXs) to execute trades directly between users’ wallets, ensuring trustless and secure transactions without the need for intermediaries.

What are some risks associated with using decentralized exchanges (DEXs) compared to centralized exchanges?

Some risks associated with using decentralized exchanges (DEXs) include the potential for smart contract vulnerabilities, lack of regulatory oversight, and limited liquidity for certain trading pairs.

How do users interact with a DEX aggregator to trade cryptocurrencies?

Users interact with a DEX aggregator by connecting their crypto wallets to the platform, selecting the desired trading pairs, and specifying the amount they wish to trade. The aggregator then executes the trade across multiple DEXs on behalf of the user.

What advantages do DEX aggregators offer over individual decentralized exchanges?

DEX aggregators offer advantages such as improved liquidity, better prices, reduced slippage, and access to a wider range of trading pairs compared to individual decentralized exchanges.

Can you explain how transactions occur directly between crypto traders on decentralized exchanges?

Transactions on decentralized exchanges occur directly between crypto traders through the use of smart contracts, which facilitate the exchange of assets peer-to-peer without the need for a central authority.

How do DEXs use liquidity pools to facilitate trading?

DEXs use liquidity pools, which are pools of funds provided by users, to facilitate trading. These pools allow users to trade assets directly with each other by providing liquidity for various trading pairs.

What role do trading fees play in the operation of decentralized exchanges (DEXs)?

Trading fees on decentralized exchanges (DEXs) are used to incentivize liquidity providers and maintain the operation of the platform. These fees are typically lower than those on centralized exchanges and are distributed to liquidity providers as rewards.